This post was last updated on August 2nd, 2024 at 11:52 am.

Introduction For The Top 5 Features Of Church Software

Having a good software system is crucial in today’s times. Below we outline the top 5 features of church software that churches should always ensure are in one package.

Online Donations

Let’s get this out of the way. Your church must take online donations. Back in 2012, we wrote a blog post where online donations consisted of 10% of all giving. In 2019, that percentage has increased to 49% for people donating. This is a five-fold increase in about seven years. More than likely this number is higher in 2021. Another thing to think about with online donations is that churches accepting online donations record a 32% increase in donations over traditional donation methods such as passing the plate.

Is having a webpage for processing online donations enough, or is there more to it? In the past, there was something about the intimate nature of passing the plate around in the church. As we give, conscientiously we affirm how much we value our relationship to God. However, the donor’s spiritual connection is somewhat lost during the online donation process. Some reasons that online donations contribute to this lost connection are:

- the donations may not be given during the Sunday service when presumably, this is the time they are most connected to God.

- donors may setup recurring donations which keeps them from thinking about the act of giving week to week, each Sunday.

- it turns this once intimate interaction with God into just another day to day transactional experience, which can lead to a relational loss.

How does the church adapt?

While online donations increase overall, it’s important the donor stays connected to the church and more importantly, God. How does the church adapt to help keep that connection?

A feature that’s essential to the online donation module is the ability to communicate with the donor which preserves the connection with the church. While communicating to the donor is not included as one of the top 5 features in this blog, it’s not because it isn’t important. Communicating a ‘thank you’ or similar message after receiving a donation helps provide a similar feeling as the in-person plate offering.

Thank donors!

Fun Fact: Kivi Leroux Miller did an experiment sending donations to 10 different organizations for $20.00 each. She received 3 thank you messages, resulting in only a 30% response rate.

Thanking all donors after they donate is very important. Sending thank-you notes shouldn’t be based on the amount the person gave. In other words, a church only thanking donors that gave more than $250.00 because of the legal requirement, probably isn’t the right approach. Some say it’s a member’s obligation to give and they shouldn’t expect a thank-you note or email. There’s at least one flaw with that type of thinking. Leaders and organizations become great by appreciating the people that make up the organization. By not sending a thank-you note, the church risks losing donations because members don’t sense the appreciation.

One thing to look for in an online donation module, is an automatic follow-up thank-you email process. If you really want to impress (and increase donations), always follow up the automatic email with a personal note. In the follow-up email, the organization should include at least a summary of the goals the donations will accomplish. We understand some goals take a little while to accomplish, thus sending a second follow-up email later with updates on progress is fine. One thing to note with thanking donors for their donations — you can never overdo it!

I heard someone say one time “Thank before you bank”. It’s a good rule to remember when processing donations.

Church Accounting

Out of all the features in church software, accounting is the one that gets the church into legal trouble. Churches are quick to use what they know such as QuickBooks or spreadsheets. Both are mistakes. The accounting methodology required for churches is fund accounting. The only feasible way to ensure the church avoids legal issues is to ensure it uses a fund accounting system. Spreadsheets and QuickBooks don’t cut it, thus they fail the requirement.

What is fund accounting? Simply put it’s a double-entry system as any accounting system, but each entry also has a fund tagged to the typical disbursements to revenue, expenses, assets, and liabilities. The fund tagging is what makes church accounting different from the typical for-profit accounting system – QuickBooks. Applying a fund to every transaction allows the accounting system to follow the rules set by the IRS and FASB ( Financial Accounting Standard Board). Following IRS guidelines and other rules is the reason church accounting is included in the top 5 features of church software.

Why church accounting should be discussed first.

Accounting software should be one of the first considerations in the church software review process because of the possible legal ramifications. The fastest way to close the doors of any profit or nonprofit organization is to get in trouble with the government over legalities. Church leadership should ensure they are following the rule of law to safeguard themselves and the organization from making mistakes.

What does fund accounting give the church that the typical for-profit system can’t? It allows the church to run financial statements for each fund. The typical for-profit accounting system does not have the ability to break the entire chart of accounts down into separate financial statements. For example, a for-profit system can’t take an asset account such as a checkbook and report on a balance sheet for only one area of their operation. In other words, the for-profit balance sheet will always include the whole company with no ability to break it down.

Why isn’t church accounting discussed more in churches?

In most organizations, accounting is rarely discussed, until something goes wrong. It’s like the 800-pound elephant in the room that no one wants to talk about – at least until it’s too late.

One reason churches may not discuss accounting is that church leaders (ie church board) may only have one or two people that are familiar with accounting, thus the rest of the church board figures it’s taken care of. Even worse, some churches may have no one familiar with accounting. Let’s be honest, there is a huge difference between balancing a checkbook and actual accounting and it’s difficult to discuss topics we’re unfamiliar with.

If the church has one or two people that are familiar with accounting, they are typically for-profit company owners. There’s one glaring issue with this type of accounting background. While some of the skills learned in for-profit accounting do translate to a nonprofit organization, they are different in many ways. These differences do put a wrinkle into ensuring the church’s solution and processes follow accounting guidelines for fund accounting. These guidelines are sometimes harder for people that have previous accounting backgrounds to understand. It’s like the old adage- you can’t teach an old dog new tricks.

Successful organizations don’t ignore accounting. They learn about cash flow, investment strategies to increase financial standing, and how to budget effectively taking into account the current financial status. In other words, successful organizations utilize their accounting software to understand the complete picture.

Church Payroll

While church accounting is a topic people shy away from in churches, church payroll makes people run for the hills. 🙂 Typically, most churches have one person designated to do payroll because payroll does have a confidentiality facet to it. Why do people not like processing payroll? The short answer, payroll guidelines are complex and carry penalties when done wrong. What’s worse is that payroll mistakes allow the IRS to start a church audit.

Why is payroll so hard? No matter what kind of organization we are talking about, payroll is hard for multiple reasons. Some examples are filing W2’s and quarterly taxes with the government, figuring out how much to take out of a person’s paycheck, what taxes apply to ministers versus a regular staff employee, and so on. Having church software that can make these things easier and track all the information is a godsend- which is why it’s included in the top 5 features of church software.

What does the church payroll software have to track?

Church payroll has to track each employee’s and employer’s tax liabilities as well as overall gross wages. Tax liabilities which are typically paid quarterly to government entities, are then paid out by the software. Additionally, the church must cut checks every pay period to pay employees that list and track these deductions. The payroll software must send checks to health insurance, retirement, and other entities for employees. These deductions are also tracked for the employees so the annual reports can tally all of the deductions for W-2s and other forms. Payroll software must also file the annual reports on-time to the government. Using a dedicated payroll solution, like IconCMO, that incorporates the fund accounting concept is the only way to go.

As you can see there are many moving parts to any payroll system, but church payroll has at least one additional complex element that for-profits don’t – fund accounting. Church payroll must follow fund accounting principles just like other transactions in the system such as vendor checks, deposits, and journal entries. Church software that uses fund accounting principles, allow churches to set up salaries for various staff and tag their income to a particular fund. A good system, like IconCMO, can even tag an employee’s salary to come out of two different funds. For example, a musician that also works in children’s ministry could have two pay rates where each one uses a different accounting fund. In this case, the salary paid to the employee for the children’s ministry could come out of the Youth fund and the employee’s salary for musicians could come out of the General fund.

Membership

Any church software must have a membership module that tracks each family’s demographical information. In the past, churches used Rolodex cards for all their families who had limitations. However, sometimes it’s easier to think of church membership software as a glorified Rolodex that holds more information than names and addresses. It tracks information such as

- which groups each member is in,

- important milestones such as births, baptisms, confirmations, and marriages,

- contact information such as cell phones and email,

- attendance at church or at events,

- and so on.

Why would churches want to know all of this information about their members? For many reasons, but to name a few – wishing members happy birthday via phone call, inviting them to a Sunday picnic via text or email, sending out last-minute cancellations for Sunday service, knowing who was baptized (or reached other milestones), and so on. In the past, a lot of this information was either not tracked or was put in multiple places making it hard to locate or worse- churches lost their paper records to fires or other natural disasters.

Communication needs increases as society changes

Why is communication so important in today’s society versus past church communications? Why has communication increased in recent decades? Well, in recent decades, technology has made communication easier and church members have come to expect more from their churches. And people are much busier than before- or so they think. In reality, people across the world are working less per week because of time-saving devices and advancements. However, there are many caveats on why that is and it’s not straightforward.

Tony Crabbe had this to say:

We don’t need to be more productive; we need to do less, better.

https://www.personneltoday.com/

Tony Crabbe lists five reasons why people seem busier but may not be, on the website above. One reason was humans don’t like making tough choices that will benefit them. Another is that it’s a natural human reaction to avoid hard tasks. An ancillary thought is that picking easier and familiar tasks tends to keep people in the same daily grind.

As a church communication director, we have to remember that families need their personal communication in the quickest and most efficient way possible. What works for one individual may not work for another. Some families can’t wait for a mailed letter from the church. Other families may have a difficult time answering a phone call. This is why text messaging is so popular, but, that may not work for people who don’t text. For many churches, this is enough to pull their hair out, keeping track of each family’s individuals preferences.

Church Member Portal

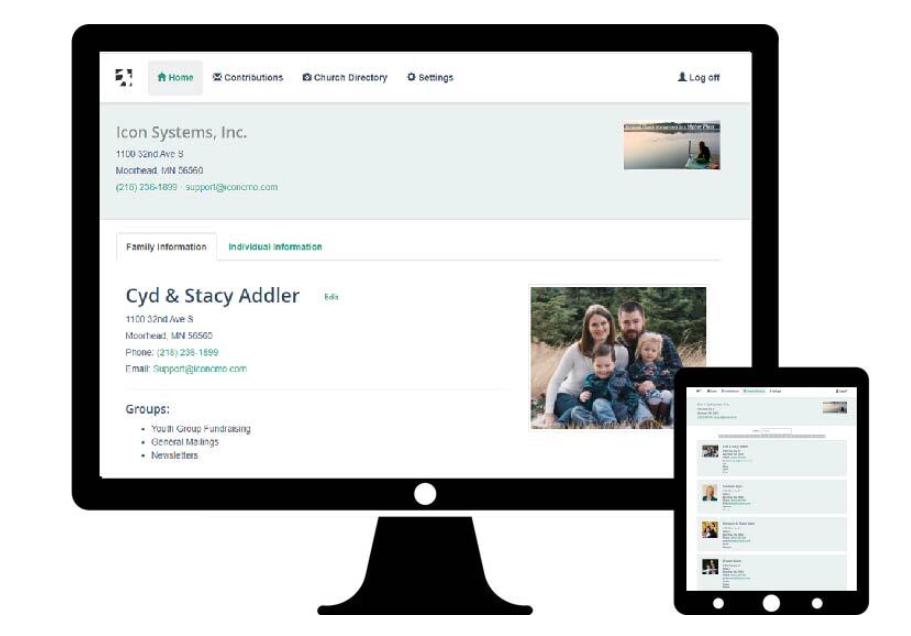

As we have noted earlier there are large amounts of data the church must stay on top of. Staying on top of this data would be easy if the church could hire as many people as they needed, but we know real life doesn’t work that way. Organizations don’t have unlimited resources and that includes staff resources. We could argue that churches have to do more with less but that argument only goes so far. So how do they accomplish staying on top of things and keep resources in ‘check’? They rely on volunteers and their church members to help. One way to do this is to allow church members to update their own family profiles. This removes at least one burden from the church secretary trying to keep everything updated for each family.

A church member portal allows church families to update their family profiles. It’s a must-have feature and why it’s one of the top 5 features of church software. Having church families updating their profiles spreads the work around. As the saying goes:

Many hands make light work.

From the literarily work of Sir Bevis of Hampton about 1300 AD.

Having a church member portal for families to update their information certainly helps in spreading around the work. Member portals can also help to give families their donation statements any time they need them for tax purposes. Church directories are another benefit for a family. This again saves time for the church secretary so that she doesn’t have to print them, prepare them and then mail them. The secretary also doesn’t get that occasional call asking for another family’s contact information.

Top 5 Features of Church Software Summary

As we can see with these top 5 features of church software, they keep the church on the straight and narrow as well as saves the church time and money. These features are the bare minimum a church should have in an all-in-one software package. Online donations not only save time for donation processing but offers convenience to church members. It also helps to increase donations to churches. The accounting and payroll features should be the first thing the church considers in its software. A good church accounting and payroll software will keep the organization out of legal trouble. QuickBooks doesn’t cut it when it comes to following IRS and FASB rules. Lastly, church membership and its member portal help keep the church on top of each family’s profiles while at the same time reducing time and cost for the church.

Just looking for information. I am new church council president (Faith Lutheran Church Miltona MN). We have your software ICONCMO. I want to ask if you have a chart of accounts, and a standard reports such as the P&L in QuickBooks but based on Fund Accounting, etc.

Hello David,

Congrats on your new position as the church council president! Yes IconCMO has a chart of accounts and can give reports such as P&L (commonly called the statement of financial activities in churches) and balance sheet (commonly called the statement of financial position in churches). The reports are fund based and follow the FASB guidelines that all churches follow. If you would like a 1 on 1 guided tour with us please sign up for a webinar. Click this link.