This post was last updated on February 23rd, 2024 at 09:30 am.

The following is an example of how a PPP loan could be received and processed by a church using IconCMO’s full-fund accounting system.

Sample: PPP Loan for $100,000. For this client, all transactions will still come out of the main checking account using the General Fund and qualifying expenses will be reimbursed with the PPP checking account.

If your church is not required to open a new checking account to manage the PPP loan, skip creating a new checking account and deposit the money into your bank account.

Step 1: Set up new accounts

Go to General Ledger: GL: Chart of Accounts and click on “Add New Account”

- Checking

- Asset

- Bank

- Checking

- Not a sub-account

- PPP Checking

- Liabilities

- Liabilities

- Long Term Liabilities

- Notes Payable

- Not a sub-account

- PPP Loan Liab

- Revenue

- Revenue

- Miscellaneous Revenue

- Not a sub-account

- PPP Revenue

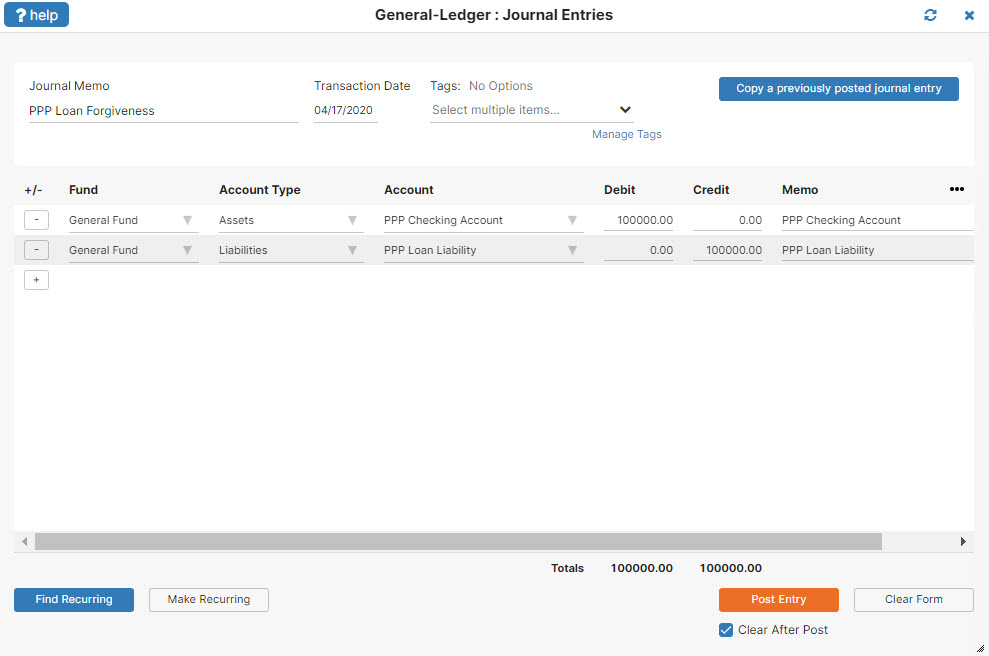

Step 2: Receive the money:

Debit PPP Checking for $100,000

Credit PPP Loan Liab for $100,000

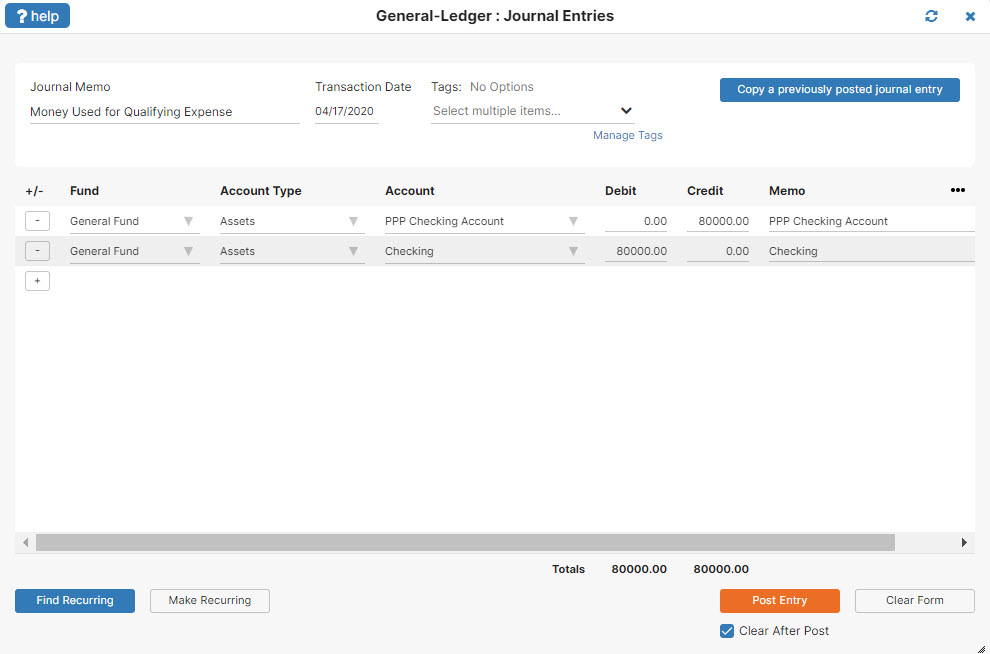

Step 3: Paying bills

Transaction 1: Record payroll and eligible expenses as you normally would.

Transaction 2: If eligible transactions total $80,000, transfer cash from PPP Checking to the Main Checking.

Debit Main Checking for $80,000

Credit PPP Checking for $80,000

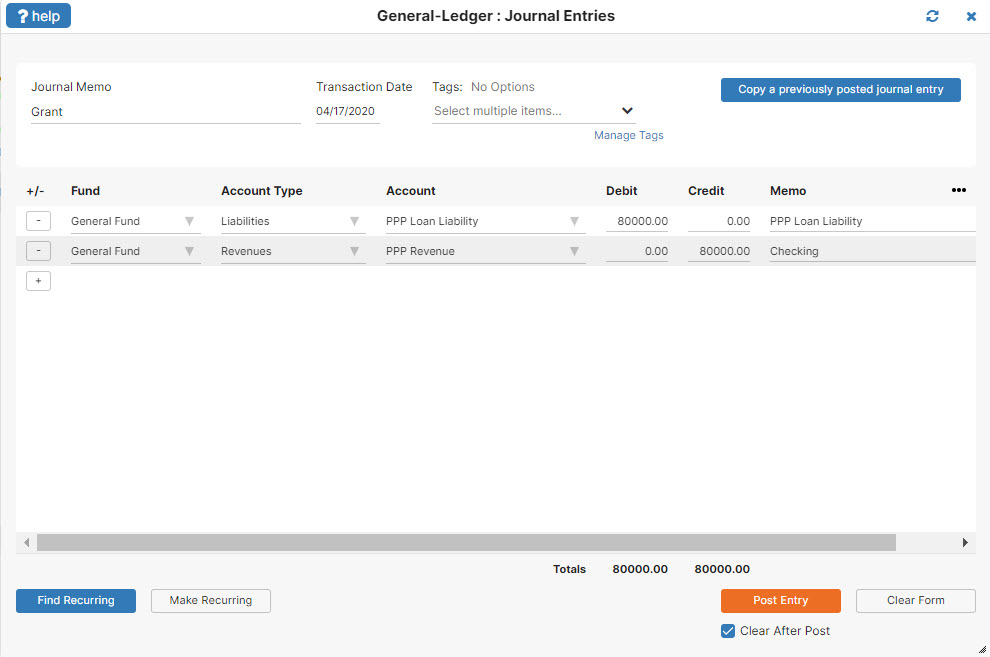

Step 4: Six-month loan review. $80,000 is turned into a grant. $20,000 stays as the loan.

Transaction 1: Recognize the $80K as revenue

Debit PPP Loan Liab for $80,000

Credit PPP Revenue for $80,000

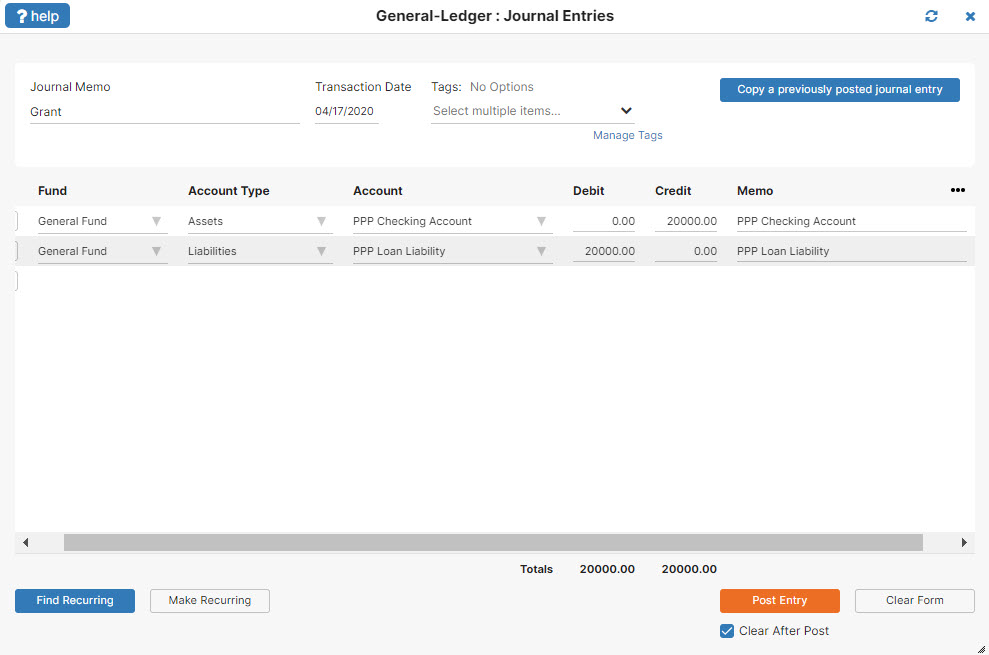

Transaction 2: Pay the remaining loan balance back.

Debit PPP Loan Liab for $20,000

Credit PPP Checking for $20,000

How do apply

Hello. You would apply through your bank or other local government entities. This post talks about the accounting transactions that have to happen after you apply and receive the money. Thanks for reading.

Does the loan then not get posted to the operating revenue until it converts into grant?

Correct- if all or a certain amount of the loan turns into a grant, then as in step 4, you would create a journal entry to debit your liability and credit your revenue for that amount.

Do an example where you set up a separate restricted fund and make qualifying expenses out of the restricted fund

Hello Robert,

In the post above you can use what ever fund you like. The credits and debits would not change in how you enter them into the system. Instead of using the General Fund that is illustrated you would choose the restricted fund that you have.

Thanks for the info

You’re very welcome Charles!

Thank you so much for this step by step example! Really appreciate all the work you do!!

Thanks Joy, we’re happy to help!