This post was last updated on July 8th, 2024 at 04:46 pm.

Linking donations to accounting is one of the unique features of IconCMO. This is part 1 of a four part series. See part 2, part 3, part 4.

Why is linking donations to accounting important?

Donors expect that churches will be faithful and responsible with their gifts.

One aspect of the trust relationship is that churches need to make sure they use the money donors give them for the stated purpose.

For example, if someone donates $100 for the youth group. They want to be sure that the money they gave is used only for the youth group.

That’s why it’s important for a church to have a good fund accounting system that

- tracks how much and for what purposes people donate, and

- tracks how the donated money is then used by the church.

Please see our posts on Easy Church Fund Accounting Part 1 and Part 2 for more information on fund accounting.

For this post, we’ll take a practical look at how IconCMO links donations to the accounting books. This link ensures that donations are recorded and designated right.

How the Donation to Accounting Link Works

Let’s use an example and we’ll do a pretty standard, straight-forward example. We can get into special situations later.

Let’s say Joe Smith, Mary Jones and the Ron and Becky Adams family all donate to the church on Sunday February 16.

- Joe Smith gives $50 to the General Fund – a designation for the money the church can use for it’s general operations.

- Mary Jones gives $20 to the same fund.

- Ron and Becky Adams give $30 for the church’s youth group.

The next day, February 17, the church makes a deposit into their Wonderful National Bank checking account for the full $100. Keep in mind that the church has an obligation to make sure they use Ron and Becky Adams’ $30 for the youth fund.

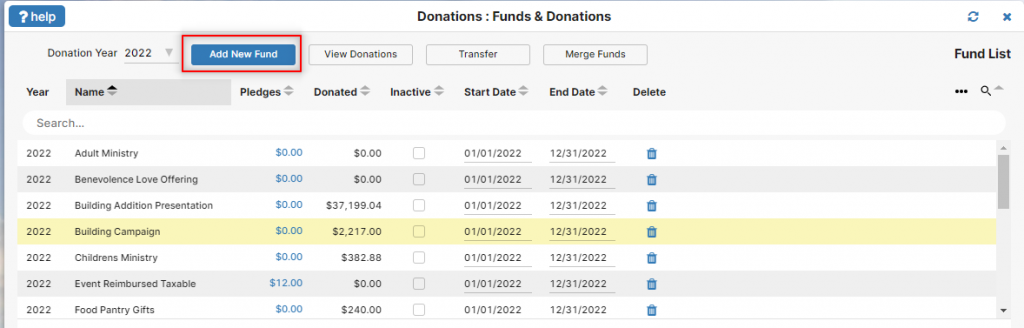

Donation Funds

First, we need donation funds.

(Actually, we first need to add the households/members and give them envelopes. However you can learn more about that in our setup guides under ‘!Getting Started’ in your IconCMO account.)

Donation Funds

- used to keep track of how much members donate for different church functions.

- are what show on the members’ donation statements to show what type of donation they gave.

- sometimes used not to describe the purpose of a certain type of gift but rather to separately identify the gifts for some other reason. So you could set up a donation fund called Christmas Service to identify donation made during the Christmas service.

- are not the same as the church’s accounting funds.

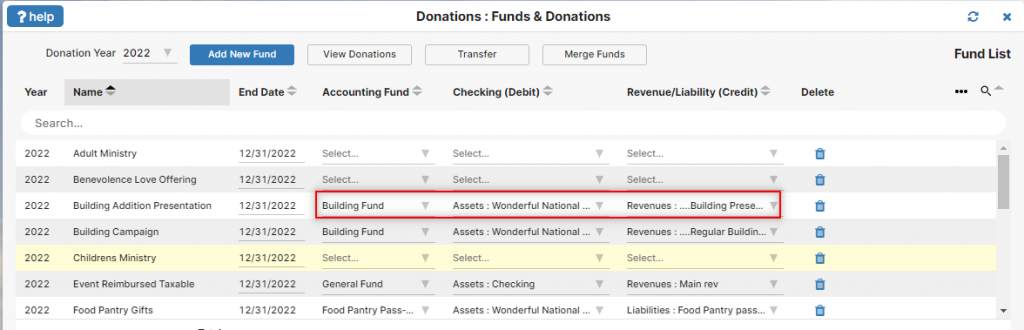

We’ll go in CMO to Donations: Funds & Donations and add our funds.

The Chart of Accounts

Now we need to let IconCMO know how these gifts should be handled on the accounting side. This is what we typically call the church’s books. It has assets, liabilities, revenues, and expenses. Unlike donation funds above which ONLY take in money.

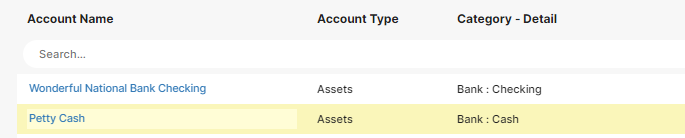

Setting up the Checkbook Account

On to the Chart of Accounts (COA) in General Ledger: Chart of Accounts.

Make sure you have your Wonderful National Bank checking account in the COA.

(For more information on adding or modifying accounts in your COA, check out those Setup Guides again, or click on the ‘?help’ in the upper left of the ‘Chart of Accounts’ window.)

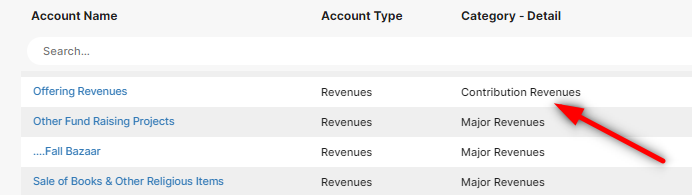

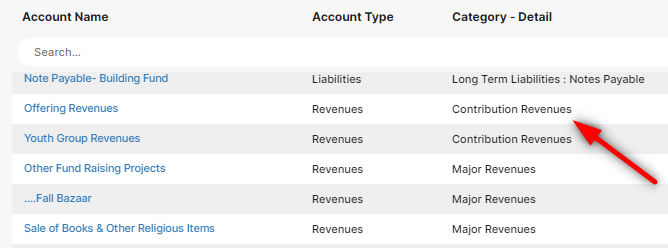

Setting up the Revenue Accounts

We’ll need at least one revenue account to record the type of revenue coming in. All we really need is an ‘Offering Revenues’ revenue account. We’re going to set things up so that IconCMO will record the revenues from the Adams’ gift in an accounting fund named Youth Group Fund. And the revenues from the other folks in the accounting fund named General Fund. So there’s no necessity to have separate revenue accounts for each type of gift. The ‘Offering Revenues’ revenue account shown below is all you really need.

But, you may want to create separate revenue accounts to distinguish general gifts from youth group gifts. Maybe you want to run a Statement of Activities (like a Profit/Loss report) for all funds at once. Running the all funds report, you want to be able to see different line items for each type of revenue. (I hope to get more into the results you’ll get on reports next time.)

To accommodate, I’m going to set up two separate revenue accounts as shown below.

So we have our bank account to debit for those gifts. And we have revenue accounts we can credit to record the two types of revenue. This gives two possible ways to set up the revenue accounts, depending on what is needed in the reporting.

Accounting Funds

Now we need accounting funds to apply the transactions to.

Accounting Funds

- are not donation funds

- are used to tag and set apart money and other resources that are to be used only for certain purposes (like the youth group).

- carry asset (e.g. bank) balances, carry liability balances, and are used to record revenues and expenses for a certain purpose (like the youth group).

- can be used with any of the accounts in your chart of accounts.

(Any fund that has balances in it as of your system’s beginning balance date needs to have beginning balances entered into the system in General Ledger: Accounting Funds. See your Fund Accounting Setup Guide under ‘!getting started’ for more information on how to do this.)

These funds are what we use in our accounting to make sure we keep good track of the Adams’ gift and use that money only for the youth group.

Think of Wonderful National Bank checking account as a pie cut in slices. One slice of the pie is going to be the checking balance for the General Fund that can be used for the church’s general operations. Another slice is going to be the Youth Group Fund – the money set aside for youth group purposes. Together, these and other funds (or slices) will make up the total balance of the checking account.

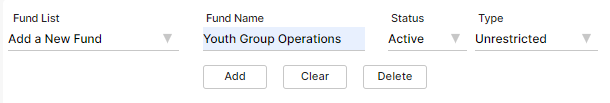

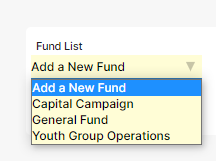

These funds are handled in General Ledger: Accounting Funds. The General Fund comes with the system by default. So I just need to add the Youth Group Fund. I’ll call it Youth Group Operations – just to let you know that it’s just a name and I can call it whatever I want.

Here’s my new fund list.

The Donation to Accounting Link

Now it’s time to link up the donation funds. Why? So that when we post money to them, IconCMO does exactly what we want on the accounting side. Money flows from the donation side from the donors, through the donation funds, and into the accounting side for the church’s accounting books.

So what’s supposed to happen on the accounting side?

Illustration When There is No Link.

Here’s the entry we want to happen looking at the church’s finances as a whole, not considering separate funds:

The Wonderful National Bank checking account increases (gets debited) $100, the General Offerings Revenues account increases (gets credited) $70, and the Youth Group Revenues account increases (gets credited) $30.

But we actually need to break this down into two entries to separately track the revenue and new checking balance in the Youth Group Operations accounting fund.

How a Donation to Accounting Link Helps

Here’s how the entry needs to break down into our two separate accounting funds.

Remember – every transaction in IconCMO will have

- an account (or accounts) to debit,

- an account (or accounts) to credit,

- and a fund (or funds) that it’s happening in.

That’s every transaction, whether it’s depositing donations, writing checks, recording a liability, interest, service charges, transfers – all of them.

We have to link the donation funds accordingly.

How to Setup The Link in IconCMO

Go to Donations: Funds & Donations.

For each fund you will need to select the values in the three drop down list to the right of the fund name. If you do not see the three columns labeled ‘Accounting Fund’, ‘Checking (Debit)’, ‘Revenue/Liability (Credit)’, then click on the three dots and show the columns by check marking them.

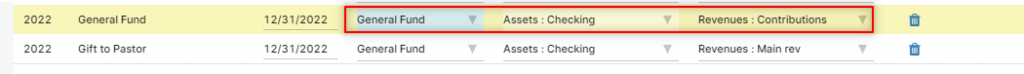

Set the accounting link so that deposits will be made a) using the General Fund accounting fund, b) debiting the Wonderful National Bank checking account, and c) crediting the General Offering Revenues revenue account.

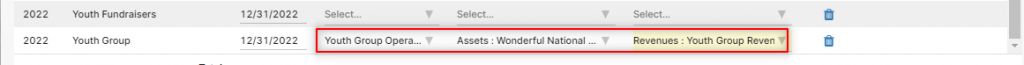

Click save and then follow the same process for the Youth Group donation fund. We want donations to the Youth Group donation fund to be deposited a) using the Youth Group Operations accounting fund, b) debiting the Wonderful National Bank checking account, and c) crediting the Youth Group Revenues revenue account.

The accounting link only has to be set once for each fund. It will stay that way, no matter how many donations you post to it, unless you go back to Donations: Funds & Donations and change it.

To be continued…

Next time in part 2, we’ll post our fictional donation batch and see how our statements, balances and reports turn out.

Photo by Possessed Photography on Unsplash

[…] is part 2 of a four part series. See part 1, part 3, or part […]