This post was last updated on February 16th, 2024 at 09:55 am.

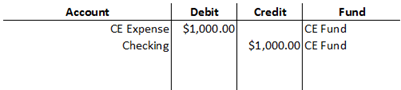

A while back, one of our customers presented us with a scenario involving a large credit card refund that we thought had the makings for some good discussion here on the blog. For purposes of anonymity, we’ll change some of the details while keeping the basic accounting concepts intact. The church’s pastor had been given the green light to attend an educational workshop out of town, and $1000 in trip expenses had been prepaid on the church’s credit card. The dollars were being allocated from the church’s “Continuing Education” fund. When the church received their monthly statement from the credit card company, they paid it in full. The portion of the payment to the credit card company that was for the pastor’s workshop looks something like this:

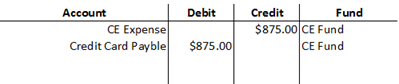

Unfortunately, at the last minute, a conflict came up and the pastor was not able to attend the workshop. The credit card company refunded $875 out of the $1000 that had been charged. However, the $875 refund was put back on the credit card, as opposed to cutting a check back to the church. The expense account that was previously debited can be credited for the $875, but the checking account cannot be debited because the refund went back on the credit card, not into the checking account. So what do you debit in a situation like this? The solution is to create a liability account for the credit card (if one does not exist already) and then debit the credit card liability account for $875 to complete the transaction.

The refund leaves the church with an unused $875 debit balance on their charge card which can be used to pay future credit card charges. There is one caveat, however. Can you guess what it is?

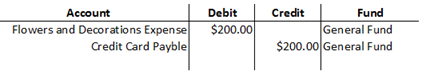

The $875 debit balance on the church’s credit card is allocated entirely to the CE Fund. What if the next charge to go on the card is $200 for flowers, but coming from the General Fund? The credit card company doesn’t care which of the church’s funds are affected. They will simply reduce the church’s $875 balance by $200, but the church needs to make proper fund allocations as that balance gets reduced. Let’s go ahead and assume the flowers get purchased with the credit card and that General Fund dollars are to be used. We’ll need to get $200 of the $875 debit balance on the card transferred from the CE Fund to the General Fund. There is a problem, however, in that we can’t execute a fund transfer on a liability account. The good news is there is a fairly simple solution. We can use a pair of journal entries that will:

- Put CE Fund dollars into the checking account

- Put General Fund dollars into the credit card account

The net effects of these entries are:

- The account balances for both the checking account and credit card remain the same.

- The $875 debit balance in the credit card account is now split between two funds, with an allocation of $200 to the General Fund and the remaining $675 allocated to the CE Fund.

The church can now pay for the flowers using the credit card and designating the General Fund without causing a negative General Fund balance in the credit card account.

Leave a Reply