This post was last updated on October 4th, 2022 at 03:39 pm.

This is our third and final post dealing with how your church can responsibly handle noncash donations from other organizations. People often call such donations gifts in kind or in-kind donations. (See a definition here.)

So far, in part 1 and part 2, we’ve only talked about donations of money.

But what if instead of money the other organization donates cans of food? Or water bottles, toys, lumber, tents, computers, paper, pens and pencils? What responsibilities do you have? How should you record the donation?

A hardware store donates lumber to your church

We’ll run through a scenario together. Let’s say a grocery store – All N Good Taste – donates 300 cans of soup to your church. And they’re donating these cans to help your efforts to feed hungry children.

First, what should you give All N Good Taste for this noncash donation?

You should give them a statement of what they gave and when. The statement should clearly describe the goods received. In this case, that’s 300 cans of soup (maybe even including the size and brand if it doesn’t get too complicated).

Also, including the purpose of the noncash donation will help you show good faith that your church plans to respect the donors’ wishes. After all, All N Good Taste probably doesn’t have the kids at the youth group retreat in mind when it donates cans to hungry children. Respecting donors’ wishes is serious business and can even lead to major lawsuits.

The statement should not include the worth of the goods. That’s not something a church is qualified to report on. If All N Good Taste claims their gift as a tax deductible donation, they’ll want the statement you provide, but they will need to include their own documentation or estimation of what the goods are worth for their noncash donations.

The same principle applies if an individual donates items to a church. They should receive a statement of exactly what was given and when, but not the estimated value of the items.

Next, how should this go on the church’s books?

The cans of soup should be recorded on the church’s accounting books as an asset. If you already have an asset called something like Food Donated to Hungry, you can use that, or create a new asset account for your in-kind donations.

Now, you’ll recall that you need to steer clear of reporting on the value of noncash donations in your statements to organization like All N Good Taste. However, you also need to determine and record the value of the donation in this asset account.

The account will be reduced or zeroed out once you finally distribute the cans.

For the offsetting entry, you need to record the value of the goods in a revenue account. This revenue account should be set up and named so that a report like the Statement of Activities will accurately show the income of the cans.

More on noncash donations

The rules and IRS regulations dealing with these noncash donations can get complicated. This blog post just covers a simple example, but to wade deeper into the waters of reporting on gifts in kind, refer to our ebook Recording and Increasing Church Donations.

Try our Church Management Software.

IconCMO and noncash donations (gifts in kind)

We’ve designed our IconCMO church management software to handle in-kind donations and statements.

In IconCMO, you can link these noncash donations to any special asset or revenue accounts you set up in the chart of accounts to account for these donations.

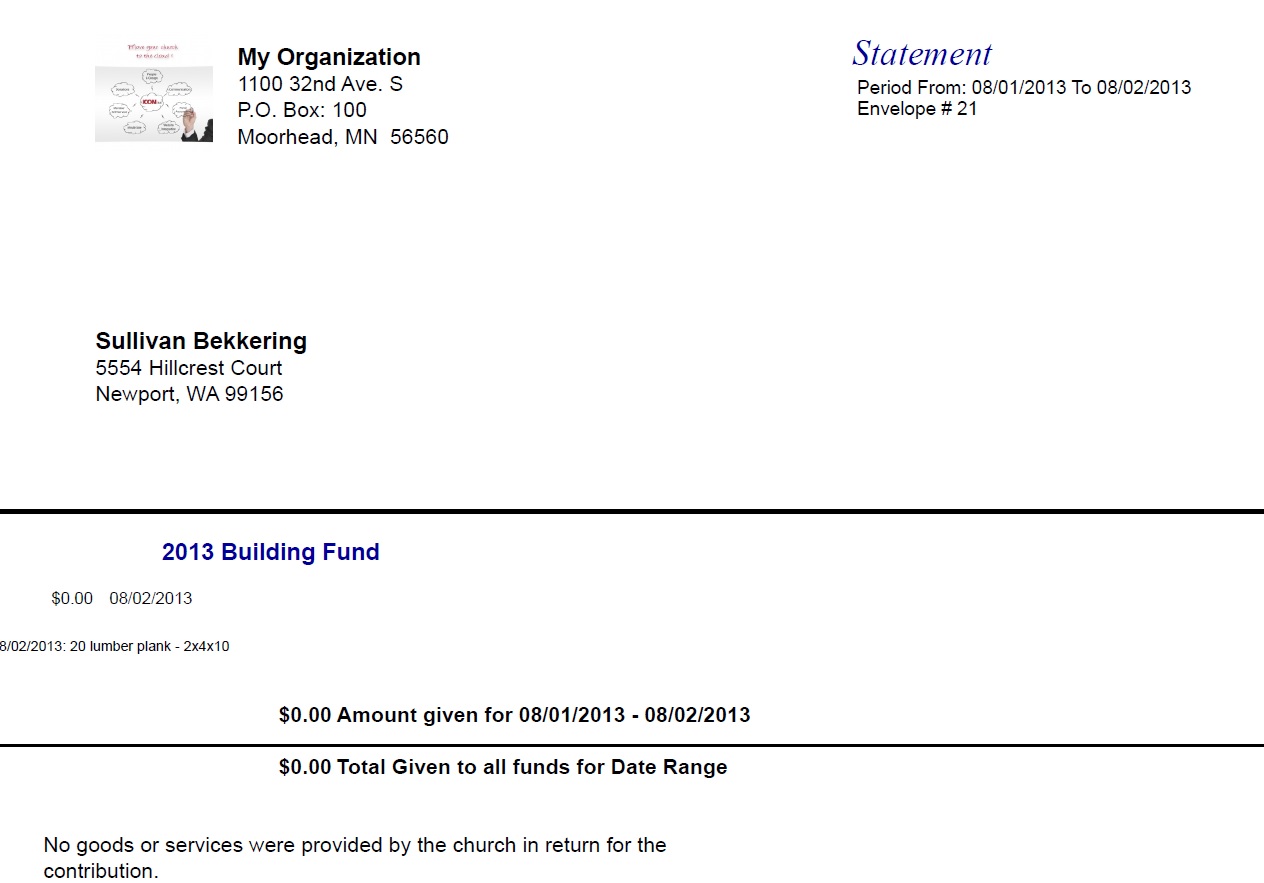

When you enter a noncash donation, there’s a box to enter a clear description of the goods received that shows up on statements back to the donors. Now, IconCMO follows Generally Accepted Accounting Principles (GAAP) for nonprofits. Thus, it requires you to fill in a description of the goods. Also, it does not allow you to enter in a dollar value (which a church is not qualified to report on).

With a few mouse clicks, you can use IconCMO’s donation module to send statements out specifically for these gifts in kind. Or you can send these statements together with the donors other cash/noncash donations.

You can handled this all the same way whether the donor is an organization or an individual.

Below is a sample statement for these kinds of noncash donations, with no dollar amount. Nevertheless, it shows a description of what was donated: twenty 2×4’s in this case.

Leave a Reply