This post was last updated on October 7th, 2022 at 02:37 pm.

Donations to a church don’t necessarily always come from members, or even outside donors.

They can also come from organizations – either nonprofit or for-profit.

The organizations may be donating to the church directly from their own funds, or they may be collecting donations on behalf of the church.

If the latter’s true, the original donors might write their checks out to the church, or they might write them out to the collecting organization, which will deposit the donations and send one lump sum to the church.

When it comes to reporting and giving statements, what are the church’s responsibilities in these scenarios?

This is the first of a series of blogs that will seek to shine some light so church’s know how to respond to such donations. This week, we’ll start with a particular situation:

- A nonprofit organization collects donations for the church for a specific purpose.

- The donors make their donations out to the nonprofit.

- The nonprofit deposits the donations in its own bank account and then makes a transaction to the church for the whole amount.

By extension, the examples in this series of posts should lend some clarity to what your church’s responsibilities are when it donates to other organizations.

A nonprofit collects donations for your church’s specific cause

Let’s say your church is starting a program to provide assistance with home and auto repairs for needy families in the community. We’ll call it Handiwork. A local nonprofit organization called United 2 Serve likes your cause and decides to host a fund raiser to donate to the program.

United 2 Serve’s constituents make various donations to United 2 Serve, which deposits the money in one of it’s bank accounts. United 2 Serve then gives a check to your church for the total amount of all the donations it collected.

Your church’s responsibilities

First, let’s look at what’s not your responsibility – statements to the original donors. The donors made their donations out to United 2 Serve. United 2 Serve should send the donors donation statements, which the donors can count as tax deductions because they were sent to a nonprofit.

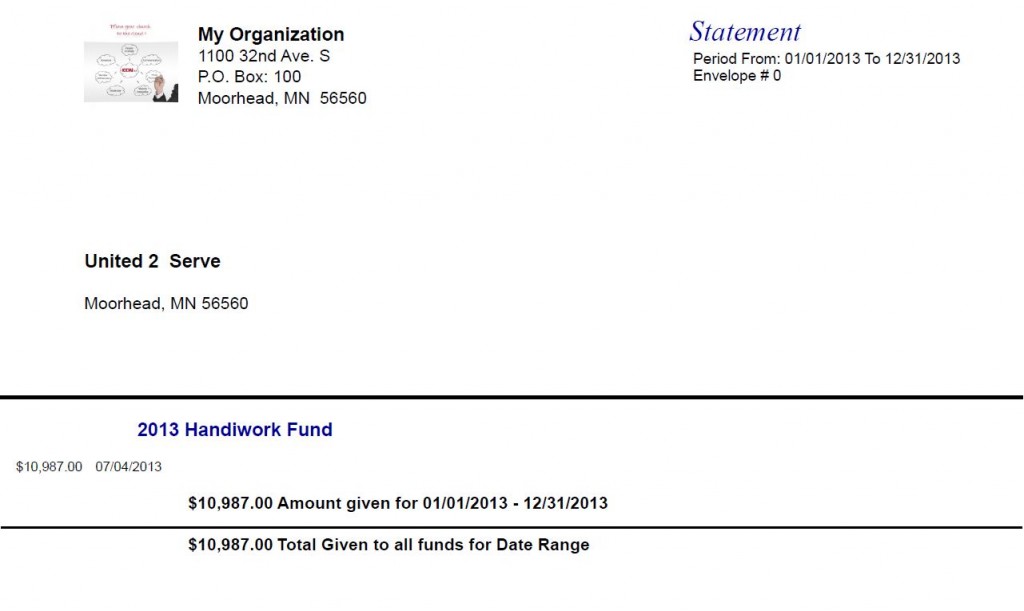

Your church should send a statement to the nonprofit organization (preferably with a nice, thoughtful letter). The statement should have the date and amount of the donation, as well as the purpose the money was donated for.

The church should put the money in a fund dedicated to that purpose, maybe the Handiwork Fund. This fund needs to be separated in the church’s records from other assets; that’s an important (and legally required) part of honoring the wishes United 2 Serve has for the money it donated. Traditionally, churches have often done this by opening a bank account specifically for the fund, but that’s not necessary with a good accounting software.

Since United 2 Serve has made such a big donation to your cause, it would also be good if you could report to United 2 Serve on the health of the fund and how the money’s being used.

Help from IconCMO

IconCMO, our web-based church management and accounting software, gives you powerful tools to handle these responsibilities in an organized, efficient way.

- You can enter the organization’s name -United 2 Serve – and address as you would for any of the church’s families. IconCMO allows you to assign statuses to households, as well as create them, so you can create a status called “organizations” and use it to distinguish organizations from your regular membership.

- Assign a donor number to United 2 Serve. You can assign the donor number number zero to organizations or other donors that don’t have numbered offering envelopes.

- Set up a donation fund called Handiwork Fund. This fund is for recording all dontation donated to the church for the purpose of funding the Handiwork project.

- Now let’s look at the accounting and general ledger side of the procedure. You can set up an accounting fund called Handiwork Fund. If you think of your checking account as a pie, this fund is a slice of the pie, designating the portion of your bank account dedicated to Handiwork. All your transactions in the Handiwork project will be recorded with this fund.

- You can create a revenue account in the Chart of Accounts with the name of the organization – maybe Unite 2 Serve Revenues. This account let’s the church track yearly revenues from the organization in its reports. You can create revenue accounts for other organizations as well.

- Now you can go to your donation fund called Handiwork Fund and create an accounting link. Set up your link so that the donation you record from United 2 Serve is recorded and placed in your checking account, recorded in the Unite 2 Serve Revenues and placed in the accounting fund called Handiwork Fund. Note that if other organizations (or just regular donors) donate to Handiwork, you can change the revenue account in the accounting link.

Further, you can create reports for United 2 Serve or any other interested parties (balance sheets, budget reports, statements of activities) that are specific to Handiwork Acct Fund. That way you can give donors a focused, transparent look at this specific area of interest in your church’s finances.

This is just one way in IconCMO that donation and accounting situations like this one can be handled.

What interactions has your church had with other nonprofits? Please share your experiences and any insights or questions you have about them.

Leave a Reply