This post was last updated on March 26th, 2021 at 09:17 am.

Fund Accounting Definition

The official definition of fund accounting is described as

“(1) an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law. (2) It emphasizes accountability, rather than profitability, and is used by Nonprofit organizations and by governments. In this method, (3) a fund consists of a self-balancing set of accounts and (4) each are reported as either unrestricted or permanently restricted.”

Citation: Wikipedia definition for fund accounting

At first glance this fund accounting definition is about clear as mud. We’ll have to break it down further, so it makes sense to the other 99% of us. The next several sections go over this definition. We numbered the parts of the definition above which corresponds to each section that discusses that specific part.

If you have any questions on how fund accounting can help your organization please contact us.

Contact Us for a 1-on-1 Guided Tour!

Thanks for scheduling a time with us!

Looking forward to talking with you,

Carrie at Icon Systems, Inc.

1. ‘Resources Limited by the’ Fill in the Blank ______

Let’s start with this part of the definition “an accounting system for recording resources whose use has been limited by the donor, grant authority….by law”. Majority of churches work with at least one fund that has donor restrictions. A common one is a building fund where all the money donated must be “set aside” for the building. The church can’t use the money for the utilities, traveling, salaries, or anything else. The entities that can impose these restrictions are the

- donor

- grant authority

- governing agency

- other individuals or organizations or

- law

Essentially there are entities such as a grant authority or donor, that tells the not for profit how to spend the money. We will get into restricted vs unrestricted funds later on, but suffice to say, when an entity imposes any kinda of restriction, then the fund becomes a restricted fund. Fund accounting is the system that tracks this separation of resources — ie assets, revenue, and so on.

2. Accountability, Not Profitability in Fund Accounting

The next phrase in the definition is “It emphasizes accountability, rather than profitability…” which will take a little explaining. Let’s start with profitability as that is the easier of the two.

Businesses work on a profitability model for their stakeholders. In other words, their financial reporting looks at the “bottom line”. In business, expenses deducted from revenue gives the left over profit. If the profit is positive, the the business is in the black. If its negative, the business is in the red, which is bad. The “bottom line”, as people call it, is the left over amount.

In a not for profit it’s not so clear cut. Why? Well because they are a not for profit, thus they shouldn’t see a profit from their operations. The accounting is more involved with not for profits because of the accountability piece. It boils down to the following premise — donors want to ensure you are spending money the way its intended.

In a not for profit it’s not so clear cut. Why? Well because they are a not for profit, thus they should not see a profit from their operations. The accounting is more involved with not for profits because of the accountability piece. It boils down to the following premise — donors want to ensure you are spending money the way its intended.

Conversely, in a for profit business this restriction is non-existent. They can spend the money any way they wish to the point of bankruptcy. We could say it wouldn’t be smart to go bankrupt but the accountability rule is not present. So how is accountability measured? That is described in the next part of the definition below.

3. Measuring Accountability Using Fund Accounting

Now we will tackle this part of the definition — “In this method, a fund consists of a self-balancing set of accounts“. Measuring accountability all comes down to using fund accounting. Fund accounting allows an organization to use a set of self balancing accounts. In a for-profit system there is only one set of balancing accounts.

For example, it has asset, liabilities, revenues, expenditures, and owner equity. In other words, the organization does not have a separation of monies. But in not for profit accounting each fund has its own set of balancing accounts. So each fund has a set of assets, liabilities, revenues, expenditures, and net assets. What would this look like?

Budget envelope system from the old days

A very simplistic example is your grandmas envelope system back in the day. Let’s take a trip down memory lane. Families would cash their checks and bring majority of the cash home. Then they would place a portion of their cash into various envelopes. These envelopes would have labels such as gas, food, household expenses, and discretionary.

The money in the envelopes were only used for the purpose labeled on its envelope. This system would keep you from using gas money for food. This proven method of household budgeting is very similar to fund accounting. Why?

Because it keeps the money for gas separate from food. Additionally, at any time you can look into the envelope for gas, and see you have “X” dollars left for gas for the month. You can do the same for the food envelope. In a similar manner if you recorded each time money left the envelope, and for what, you have a list of paid expenses that you can see “where” your money went.

The money in the envelopes were only used for the purpose labeled on its envelope. This system would keep you from using gas money for the house mortgage. This proven method of household budgeting is very similar to fund accounting. Why?

Because it keeps the money for gas separate from the mortgage as we see in the above picture. Additionally, at any time you can look into the envelope for gas, and see you have “X” dollars left for gas for the month. You can do the same for the house mortgage envelope. In a similar manner if you recorded each time money left the envelope, and for what, you have a list of paid expenses that you can see “where” your money went.

Now let’s move onto something a little more complex using the picture below and the background of the older household envelope system.

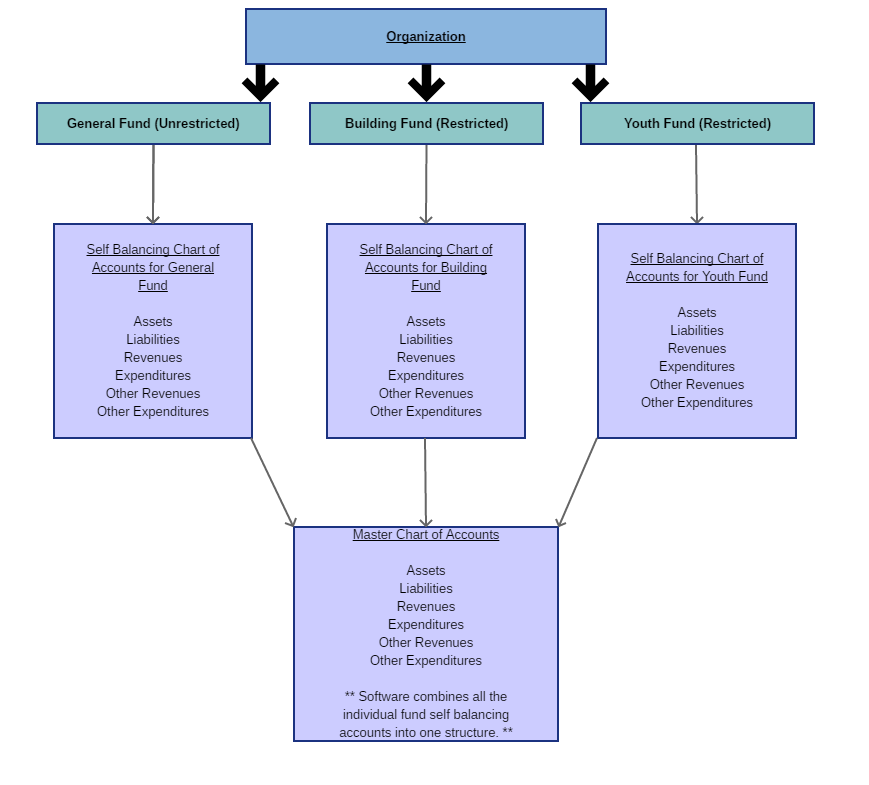

Explanation of self balancing accounts using a picture

As you can see from this picture representation, each fund and its accounts are isolated. The General fund’s assets do not commingle with the Building fund’s assets. Keep in mind this is a picture representation to simplify the explanation. You first have the three funds annotated in the top three boxes under the Organization box. The next three boxes noted “Self Balancing Chart of Accounts…” is where these self balancing accounts isolate themselves. Then these self balancing accounts roll up into the “Master Chart of Accounts” seen in the bottom box. We know that’s a lot of information but let’s break this out a little to understand the self balancing part of the definition.

Defining a self balancing set of accounts

First, we need to understand what a “self balancing set of accounts” means. It means when entering a transaction, there’s a debit, credit, and a fund. Remember in the for profit system you only needed a debit and credit. In a not for profit an added fund attribute defines the set of self balancing accounts used. However, the debit and credit are still used. This fund attribute allows us to only look at that fund’s self balancing accounts. For example, if the fund attribute is the General fund, then we only look at the self balancing accounts for the General fund.

Self balancing accounts example

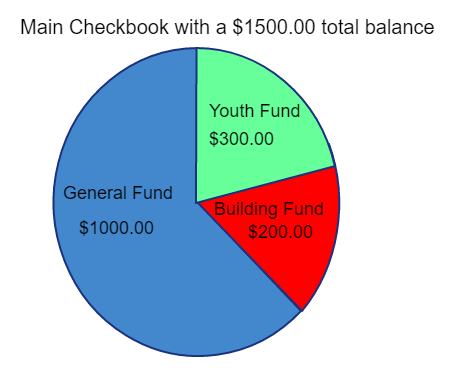

We have a food expense for $60.00. Entering the debit and credit should be the easy part. We credit ($60.00) on the main checking account, and debit ($60.00) on the expense called “Food”. So what is our new balance in the “total” checkbook? It is $1440.00. This would be what you see on any for profit system. It wouldn’t tell you who owns the $1440.00. There is no breakdown in a for profit system.

Looking at a not for profit system we will start with the same $1500.00, but break it out among three funds, pictured below. We would still use the same credit and debit as before but we would ‘tag’ a fund with those credits and debits. Since this food was for the youth camp we would use the Youth fund. That’s the big difference in for-profit accounting and not for profit accounting, is the ‘tagging’ attribute.

Deciphering the numbers in the funds

We need to know the balance remaining for the Youth fund since they paid for the food. Churches require this breakdown for their funds. So how do you get the fund balance if you don’t attach a fund attribute to the debit and credit? It’s impossible.

But given the right software this fund attribute attaches to every entered transaction. So to get the fund balance we look into the main checkbook using the pie chart above. We see the Youth fund has $300.00 balance and doesn’t “own” the full $1500.00. To get the Youth fund balance we start with the $300.00 balance from the pie chart and minus $60.00, which gives a $240.00. Thus the Youth fund balance is $240.00. Keep in mind we still have $1000.00 for the General fund and $200.00 for Building fund balances. Why? These our outside of the purview of the Youth fund, so the balances do not change. This is how self balancing accounts work. They ONLY affect the portion of the accounts tagged with the fund. This is why the $300.00 amount was reduced but the others were not.

Tryout IconCMO to ensure fund accounting is used in your organization.

4. Unrestricted or Permanently Restricted Funds

The last piece of the definition is “each are reported as either unrestricted or permanently restricted“. This is the easiest part of the definition. Most of the time when a fund is first created, it is set to restricted or unrestricted. At that point, reports break each type out and the user does not have to do anything else, aside from recording transactions correctly. So we will concentrate on examples of each so you have the funds set right. The best example of an unrestricted fund is the General fund. It means that the church can spend the money any way they wish to further their mission. They do have to stay within the guidance they outline in their organizational bylaws but it is typically very broad.

Restricted funds

The restricted fund type is a little harder to explain so we will use a few examples. Essentially the church needs to understand any imposed restrictions for all donations. Courts routinely view disobedience of donor restrictions as a “breach of contract”. Failing to fully understand and execute the obligation(s) you stand to lose the donation. Worst yet the church goes to court and is made to pay punitive damages if a breach happens. Let’s look a court case with Garth Brooks, the famous singer.

Garth Brooks wins lawsuit against not for profit

Garth Brooks gave a $500,000 donation to a not for profit hospital. The understanding was they were to build a women’s center honoring his late mother. This donation was later returned via a court judgement. The judge ruled in Garth Brooks’ favor and awarded 1 million dollars, doubling the original donation amount. Why? Because the hospital wanted to use the money for other building projects. The court saw this as a “breach of contract” and it held the not for profit responsible. The jury awarded the extra $500,000 as a punitive measure. That is what we call a hard lesson. The church has to understand donor imposed restrictions or not take them. It could cost your church dearly, to the point of closing your doors when fund accounting principles are ignored.

Fund accounting helps to avoid this unfortunate real life example. It emphasizes why not for profits must be very concise and clear to their donors on how they are using donations, then record them appropriately.

In the case of a grant or government authority the monies will always be restricted. They will tell you how the organization should use the money. There is very little wiggle room in spending money outside the stated purpose.

Donor imposed restrictions

A donor imposed restriction is one where the person states an intention for the donation. The not for profit has two choices — fulfill the obligation(s) or refuse to accept the donation. Those obligations can be any number of things. For example, they may give you donation(s) with the intent of building a Gym for the youth. What if the church decides to build a bigger worship area instead? Because the intent was for a Gym they are in a breach of contract. They could go back to the donor and see if they would allow a change to the “intent”. If so the church should request this in writing.

Fund Accounting Definition Summary

We have reviewed the unrestricted vs the restricted versions, and how not following donor imposed restrictions could lead to a court case. We have also seen how not for profits look at accountability instead of profitability. Also important to have is using sets of self balancing accounts and how this helps keep every thing straight. This was discussed in point #3.

Now that we know the definition of fund accounting in detail, we can move onto understanding the intricacies of fund accounting. Things like why use fund accounting? Other questions like, how fund accounting helps the organization? Who should use fund accounting? We’ll go over some examples of fund accounting.

Why Use Fund Accounting?

Aside from the IRS and FASB (Financial Accounting Standards Board) stating that all not for profits must use fund accounting, for churches, it comes down to a moral issue. They should want to do “right” by their donors. Churches should welcome transparency on their missions’ progress to share with their donors. Transparency is one way of building trust with donors. It also helps donors rationalize giving to churches. Let’s face it, its hard for most people to “give up” anything, and money probably tops the list. Churches should try to leverage resources as far as possible towards the mission(s) that the donor(s) believe in. Without believing in the mission donors don’t give money in the first place.

How Does Fund Accounting Help?

To this end, fund accounting helps in multiple ways. It helps the church to budget for each ministry’s purpose. The not for profits can budget for their revenues and expenses for each ministry. It helps by giving financial statements to see how healthy the organization is over all. How? By combing all ministries financials into a consolidated financial statement.

Additionally, fund accounting can break out each ministry’s financial statement. This shows the ministry how they are spending their resources. These funds are often seen as little mini companies within the larger organization. Each mini company has their own self balancing set of accounts, thus can provide a full set of financials at its own level.

Who Should Use Fund Accounting?

Fund accounting is the standard for almost all not for profits, including churches. Government entities also use a form of fund accounting as well. It is the only method of accounting that answers all questions for the not for profits for each of their mission areas. Simply put, for profit accounting comes up short.

If you are church or nonprofit, check out IconCMO for your organization to ensure the organization can stay within FASB and IRS guidelines.

Fund Accounting Examples

We go over a few different examples. Each example will use its own set up of numbers. Thus you won’t have to remember the numbers from one example to another. We believe these examples show how fund accounting will help them.

Accounting for a Grant and Other Mission Purposes

Let’s say the church has a General fund that has $10,000.00 in it. Aside from this checkbook the church has a few CD’s and one savings account. A donor decides to give the church a scholarship grant. The grant to helps underprivileged children attend school. The scholarship grant is a million dollar investment that pays annual dividends of $50,000. The donor left strict instructions that the million dollars isn’t touched, in perpetuity. The annual dividends are used for the educating the underprivileged, via tuition.

There are multiple restrictions on this money thus it would be set up as a restricted fund. It would not co-mingle the Scholarship Grant’s money with the General fund’s money. In this example we can assume a few things.

Assumptions on the scholarship grant’s money

- The million dollars is in its own asset account as its an investment which is held by a brokerage firm. It would not be in the same asset account that the organizations uses for their main checkbook.

- When receiving dividends the money goes to a revenue. The revenue account could be one created for this scholarship grant only. Or, it could be a generic dividend account.

- The $50,000 must be used for educating the underprivileged children, via tuition. What this does not say is that you must use all $50,000 or part of it. In other words putting the remaining amount back into the brokerage account would be okay. Building a new school would not be okay.

- How will we track the money spent on tuition? We would need a few expense accounts for this as well. These expense accounts, more than likely, are only used for tracking the scholarship grant’s expenses.

Create the accounting plan for the scholarship grant

Given these points above we can map out how to handle the grant in the accounting system. We would need two assets accounts. One for the main checkbook. And one for the brokerage investment account. We’ll use one dividend revenue account for the entire organization in this example. Why? Since there’s not much dividend activity, it makes the most sense for the organization. It also keeps the chart of accounts (COA) less cluttered. There would be at least one expense account to track money paying for tuition. And lastly, the scholarship fund is restricted. The General fund is unrestricted.

What questions can be answered using fund accounting?

What questions would the granting authority ask during an audit? They may want to know the following:

- How much did the church receive in dividend income from the scholarship grant and/or other investments?

- How was the annual dividend spent?

- Was there any left over and if so where did it go?

- What is the amount currently held in the investment account?

As you can see these questions would be pretty hard to answer in a for profit system that also had $10,000 of “other” money. In fund accounting we use a combination of funds and accounts to help with separating resources.

Deciphering the revenue account question #1

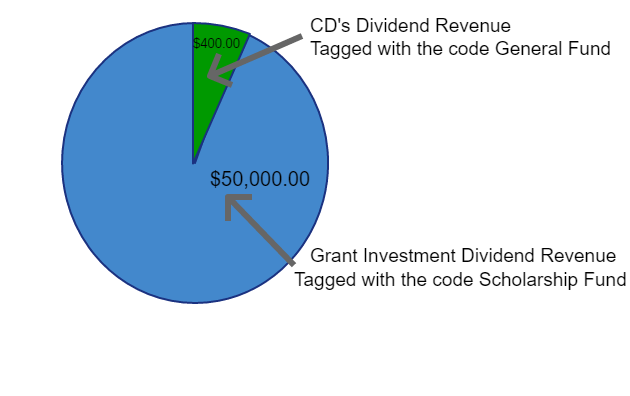

Let’s first look at the revenue account and how the money came in. Remember we are using one revenue for all dividend income called Dividend Revenue. Let’s say the CD’s also brought in $400.00 of dividend income for the year. The grand total for the dividend revenue account is $50,400.00. But having this one number on a financial statement tells you little about the origins of the income. It only shows the total amount. Which part is restricted? Unrestricted?

In a for profit system this total is all you would know. You would not have the ability to see that $400.00 came in from the CD’s dividend. And the $50,000.00 came in from investment dividends. Using a fund, which essentially tags each transaction with a code, we can break the revenue account into parts. Here’s a picture representation of what it would look like.

Summary of Question #1

A fund accounting system can can breakout the dividend revenue account via reports. For example the chart above shows the revenue account. A proper accounting system can print a Statement of Activities (P&L) for the Scholarship fund. This report would only show the $50,000 for the dividend revenue account and the Scholarship fund. The picture representation above shows this piece in blue. What happened to the $400.00, colored green above? This is tagged with the General fund so it would not appear on the Scholarship fund report. There are no restrictions on the $400.00. Whereas there are restrictions on the $50,000. The ability to break this one revenue account between two funds, is why fund accounting works for churches.

To solve this question check out IconCMO!

Deciphering the expenditure account question #2

How was the annual dividend spent? This one is a little easier. Remember the Scholarship fund had its own expenditure accounts set up. As such we should not see other expense transactions commingled. Let’s use an example of where we paid tuition for two children, at $25,000/year. These expenses are recorded using the expense account called 7000-tuition.

Summary of Question #2

On a Statement of Activities (P&L), the expense would show up only on the Scholarship fund report. When the same report is ran for the General fund, the 7000-tuition expense should not be seen. In fact if the “7000-tuition” expense does come up on the General fund report you know something was coded wrong. Why? Because this particular expense account is only for the Scholarship fund. It would be a red flag to see this expense on any Statement of Activities other than the Scholarship fund report. Likewise if we saw an expense for utilities, typically paid for by the General Fund, on the Scholarship fund report that would be a red flag.

To solve this question check out IconCMO!

Deciphering the “left over” amount question #3 and #4

Whenever the question asks something like what is left over, what is remaining, or we need to know the balance remaining, it means you need to look at the Statement of Financial Position. This report is better known as the balance sheet. Why would you not look at revenues minus expenses? Because revenues and expenses do not carry balances. They do not roll over from one year to the next. In other words they are only accumulators. The only accounts that are “balance” type accounts are assets and liabilities. Thus to know how much is left over, you look at the “balance sheet”, or in the church world Statement of Financial Position.

Another reason is that the balance has to look at any outstanding liabilities. Just because the fund might show $600.00 in the checkbook does not mean it has $600.00 to spend. If there is a current liability of $100.00, then the fund can spend only $500.00. This is why looking at revenues and expenses only does not work when a “balance is needed.

In regards to the investment account, it is very similar. It’s asking for a balance of this account. And since the Scholarship fund owns this, it would show up as another line item on the statement of financial position. Majority of the time it would follow the regular checking and saving accounts as it is less liquid.

Summary of Question #3 and #4

This “left over or balance” question is a fundamental question that any FASB compliant software should provide. It is a foundational block to understanding the not for profit’s financial health. Knowing the balance of any fund on the system, as well as the organization balances as a whole, is paramount. How else would you know if the church is fulfilling their mission? Financial statements explain how revenue is coming in, what those resources are spent on, and the remaining balance left for the mission. All of this to say, is if you need to know balances, the method of fund accounting solves this problem. Not only does it solve a myriad of issues for churches, it is required for not for profits.

To solve these two question check out IconCMO!

Summary For Fund Accounting

As we look at the various parts of the fund accounting definition, it shows that fund accounting has the following attributes.

- Multiple sets of self balancing accounts.

- Restricted vs. unrestricted resources.

- Emphasizes accountability instead of profitability.

- Who could impose restrictions on resources.

Having all these attributes creates a method of accounting that helps not for profits understand how to best serve their communities and greater causes. It gives them the ability to redirect resources when needed, and at the same time keep restricted resources from being spent, incorrectly. When fund accounting is properly set up and executed, it is an awesome experience. As the examples show, we can break down any account — checkbooks, revenues, liabilities, and expenses into the various funds giving the organization a detail view of the fund’s resources.

Let us guide you through fund accounting. Get in touch with us.

Contact Us for a 1-on-1 Guided Tour!

Thanks for scheduling a time with us!

Looking forward to talking with you,

Carrie at Icon Systems, Inc.