This post was last updated on October 5th, 2022 at 08:51 am.

Fund accounting is a type of accounting for not for profits. In this post we are gonna go over multiple facets of fund accounting.

We’ll first discuss the governmental regulations on why churches must use fund accounting. Next we will go over how using fund accounting creates a bond of trust with your donors, and how this can increases donations in the future. Then we are going to take a deep dive into the basic principles of all accounting. In other words no matter what type of system you are on, fund accounting, for profit accounting, or governmental accounting, these principles apply. Next we will go over the definition of fund accounting, and review the most important piece of the definition — “self balancing funds”. Then who, like the church board, pastor and so on, should be keenly aware of fund accounting and how it works. And lastly we will discuss the difference between accounting funds and donation funds. And yes they are different!

FASB Requires Churches To Use Fund Accounting

The Financial Accounting Standards Board (FASB) says not for profits must use fund accounting. There are no exceptions to this for smaller churches. FASB is the governing body that oversees the accounting practices for all organizations, for profit or not for profit. FASB creates the Generally Accepted Accounting Principles(GAAP) guidelines. When accounting is incorrectly handled, a possible ramification is that the church could lose their tax exemption status. Fund accounting is the only appropriate and correct method to handle a not for profits’ ledgers.

Church loses tax exemption status example

For example, if the church has Unrelated Business Income Tax (UBIT) over a certain amount, and didn’t report it on the form 990-T or 990-W to the IRS (publication 1828), this is a sure fire way to get audited. How would you know what the UBIT is, when the church isn’t using a fund based accounting system? Any audit can open the door for losing tax exemption status. The best way to avoid losing tax exemption status, is to not give a reason for an audit in the first place. Once an audit is started, the scope of it is almost limitless. The breadth of records that can be audited/examined are below.

…the types of required records frequently include organizing documents (charter, constitution, articles of incorporation) and bylaws, minute books, property records, general ledgers, receipts and disbursements journals, payroll records, banking records and invoices. The extent of the records necessary generally varies according to the type, size and complexity of the organization’s activities.

From the IRS Publication 1828 – Tax Guide For Churches and Religious Organizations.

Getting audited should not be taken lightly. As you can see based on the size and complexity of the organization, the requested records can vary substantially. Some questions to think about are:

- how would you show the general ledgers and payroll records without an accounting system?

- how will you show donations vs. UBIT, or other income for the organization?

- how will you show expenses for restricted vs unrestricted accounting funds?

- will the IRS be satisfied with a bunch of Excel documents showing the accounting records?

- would the IRS prefer accounting records generated by a true fund based accounting system?

Now that we have proverbial red tape out the way, let’s move on.

Fund Accounting Builds Trust With Donors

Fund accounting allows the organization to convey to their donors how well they did with the latest fund drive. Or how well they did with last week’s donations. Fund accounting allows the church to show donors how they spent the money entrusted to the church for each mission’s function. They can show a break down of the Youth mission versus the Community Outreach mission.

Donation transparency helps to show donors that their donations are going to worthy causes. As trust builds, between donors and the church, the donations increase — year over year. When an organization betrays donor’s trust, donations drop fast if not stop altogether. It is unlikely that the organization would recover after an incident like this. It takes a long time to build trust, but that same trust can be destroyed in moments.

Restricted monies — does fund accounting help build trust?

Fund accounting also helps in the area of restricted monies from donors. Many churches take in restricted monies that are only spent for one purpose. Fund accounting keeps these pots of money separate at all times, as required by FASB. Most donors that give to a restricted fund want to ensure their donation is spent wisely and for the designated purpose. They expect a higher standard of care in this area. And fund accounting delivers on the church’s promise of good stewardship!

If all the money went into one pot without a fund annotation — how will the church assure the donors, that their money went for the new building project and not some thing else? Using a fund based accounting system is the only way you can show them a financial statement for the Building fund and what its expenses and revenues were, separate from everything else. Additionally, fund accounting is the only way to show the church a consolidated financial statement for all funds. This type of report shows how the organization is doing financially overall.

Accountability builds trust – types of accounting methods

Churches aren’t interested in profitability, but accountability. The for profit accounting method is only interested in profitability. Thus, businesses use the for profit accounting method, which emphasizes profitability.

Churches on the other hand are interested in accountability to their donors, members, and so on. The accountability is achieved through the fund accounting method and builds trust with donors. When fund accounting is used, gradually the trust builds between the church and donors when the donors see how the money is spent for each mission in the church.

Another method you may have heard of is governmental accounting, which is closely related to fund accounting, but used by government entities like cities.

A Deep Dive Into Accounting’s General Principles

Let’s look at what accounting is before we dive into fund accounting. Do you know you use accounting everyday in real life? In fact, accounting principles mimic real life processes of how money comes in and out of your pockets. Another way to look at it, is that accounting is a story of how money came in (income), how much you own (assets), how much is owed by you (liabilities), how much has left your possession (expenses) and how much stayed with you (net worth). In this section we are gonna go over the five main areas of accounting, normal balances, and accounts in the chart of accounts.

Five main areas of accounting

Accounting boils down to the five areas seen below on the left. We provided what they’re known as (aka) in the accounting world on the right side of the table.

| PLAIN ENGLISH | ACCOUNTING VERBIAGE |

| Money You Own | aka ==> Assets |

| Money You Owe | aka ==> Liabilities |

| Money You Receive | aka ==> Revenue |

| Money You Spend | aka ==> Expenses |

| Your Worth | aka ==> Net Worth |

Looking on the left side of the table above I bet you can figure out pretty easily in your head how much “your worth” is personally, based on the other four items. For example, most people know how much they have in their checking accounts, retirement accounts, and so on. They also know about how much they owe various people like banks and car loans. Additionally, they also know how much they receive each month in income, aka your paycheck — 🙂 . They also know how much they spend each month for expenses. When you take all these numbers together you get “Your Worth” at any given time.

People love complexity

So why all the fancy names like assets, liabilities, revenues, expenses, and net worth in the table above? Unfortunately, humans have to make things difficult, and give them “proper accounting” names. We love complexity.

The importance of understanding these key areas — ie assets, revenues, liabilities and so on, can’t be stressed enough. To not understand them thoroughly, is akin to trying to do mathematical division when you haven’t learned addition, subtraction, and multiplication. It’s a futile exercise that will end in failure.

Accounting’s normal balances

The next principle to understand is what a normal balance of an account is. The normal balance is the expectation that an account, depending on its classification (ie asset, liabilities, etc.) within the chart of accounts, will have a credit or debit balance. In other words it is the side (debit or credit) of the account that is positive. For example all assets accounts will have a normal balance on the debit side. Whereas, liabilities have the normal balance on the credit side.

Below is the table to show the normal balances. The ‘Yes” indicates where the normal balance is kept.

| Account Type | Normal Debit Balance | Normal Credit Balance |

| Asset | Yes | |

| Liability | Yes | |

| Revenue | Yes | |

| Expense | Yes | |

| Equity | Yes |

Note: While the normal balance doesn’t hold true in all circumstances, the exceptions should be in the minority of cases.

Note: For simplicity we will not get into contra accounts in this blog post, but beware they contain a normal balance that is the reverse of the natural balance of that account classification.

Accounts in the chart of accounts

Within each of the five main areas of accounting there are specific accounts. For example, in assets you could have checking, saving, or money market accounts. In liabilities you could have a car loan or a mortgage. Revenues and expenses would of course have accounts under them as well.

The money moves in an out of these accounts, and recorded for later review. In fact, the definition for accounting is “the system of recording and summarizing business and financial transactions and analyzing, verifying, and reporting the results”.

Aren’t accounts and funds the same thing?

No they are not the same! This one concept trips up 90% of the not for profits that use fund based accounting systems. Accounts and accounting funds are not interchangeable. They have completely two different purposes. Using them interchangeably is like saying soda and milk are the same thing. Silly example but it is meant to illustrate how different the two are.

You have a checkbook which is an account. However, that checkbook is not the General fund This is still true even if the checking account only contains General fund monies. Multiple funds can be in any account. To illustrate how funds work inside general ledger accounts check out this example using a pizza pie. For example, in a checkbook, you can have one, two, or more funds that make up the whole checkbook. This process might look familiar to anyone that has used the envelope budget method at home, where you separate money into various categories — envelopes.

Example using the envelope budget method

Here’s a quick example using the envelope budget method. In envelope budgeting, you would have multiple envelopes with sums of money for various purposes in your household. For example you would have one envelope for utilities, groceries, gas, mortgage, and so on.

To understand how this works, let’s look at just one envelope. We’ll use the envelope called utilities where we deposit “X” amount per month to pay the monthly housing utilities. From this envelope (fund) you would pay the garbage, electricity, water, and so on. Each of these expenses have their own line item in your home accounting system. The utility envelope is the fund that pays for garbage, but the amount paid is recorded against the garbage expense account. Likewise, the amount paid for the electricity bill is recorded against the electricity expense account.

All the money to pay for both of these came out of the same utility envelope (fund), but the amounts were recorded against different accounts — ie electricity and garbage. See the difference? The fund owns the money but the accounts record the money coming out of it.

The expense accounts can’t tell you how much is remaining in the utility envelope or any other envelope like gas, groceries, and so on. Expense accounts can only tell you how much went through them, and they reset each year. Information in accounts is limited. For example the garbage expense can’t tell you what the electricity expense spent and vice versa. But looking into the utility envelope (fund) can tell you how much you have left, and how much you spent on everything that left the envelope for all utilities.

How do funds affect other accounts like revenues?

In a similar manner, a revenue account, can have deposits come through and each of them are annotated with a fund. It could be multiple funds or one fund. This gives the ability to look at one donation revenue account and see a breakdown of General, Mission, and Youth fund monies that came into each of the funds, via the one revenue account.

Summary for accounts

Liabilities, revenues, expenses, and asset accounts can all have various fund allocations for any transaction that hits them. The reason for this is because on a fund based accounting system, there’s a credit, a debit, and a fund tied to every transaction. By annotating a fund to both the credit and debit, allows us to have the self balancing accounts within that fund’s set of CoA.

What Is Fund Accounting?

is a method of accounting. It uses self balancing funds which gives accountability to their donors (or grant authority, or governing agency). These donors have placed restricted or unrestricted limitations on their donations.

Icon Systems refined definition

We wanted to emphasize the ‘self balancing funds‘ piece. This is why we reworded the definition above to emphasizes this unique difference. Here’s the full unchanged definition for fund accounting.

Self balancing funds — why are they needed?

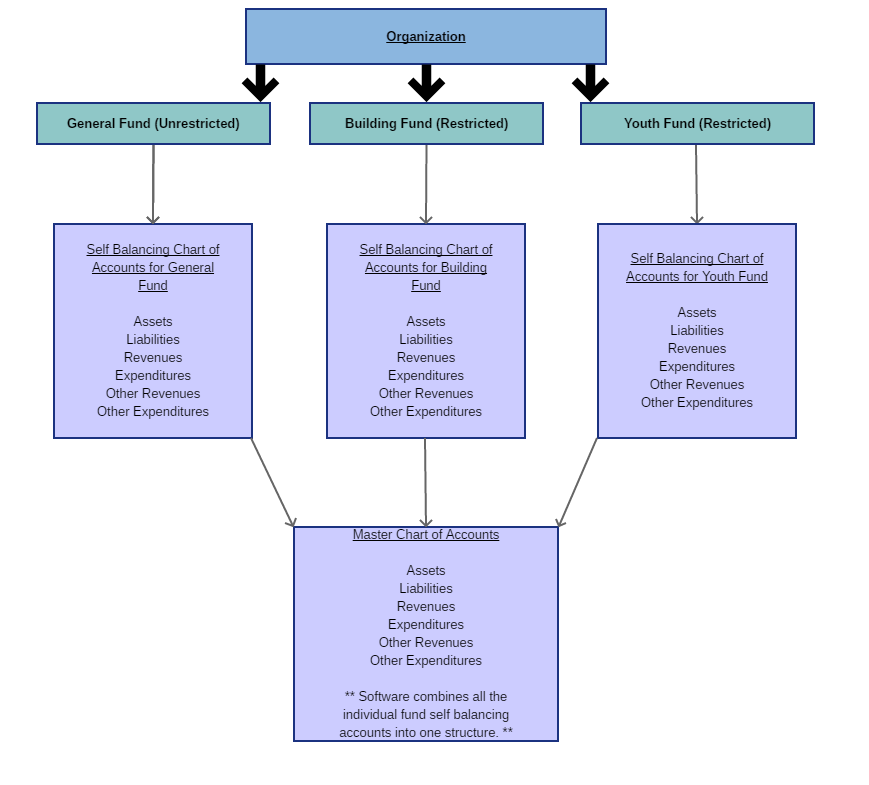

While all parts of the definition are important, the “self balancing” piece is the most significant fundamental difference between for profit and not for profit accounting. In other words, on the transactions in the accounting system, the self balancing aspect is what makes a for profit system work differently than a not for profit system. This difference affects everything from entering transactions to the generated reports. Unlike for profit systems, the self balancing ability allows the required comprehensive not for profit reporting. Below is a picture representation of self balancing funds and their relation to the Chart of Accounts (CoA).

The self balancing structure keeps the resources for the General fund separate from the Building fund. This separation is not found in a for profit system, thus they can’t report separately on various areas of their business. With churches they can report specifically on how certain missions, community outreach, and so on are doing by using funds. In the above picture representation the Youth, Building, and General fund would all have their own reports.

This is the accountability piece that the for profit world misses. For profit systems, for the most part, have one money pot where money comes in and out. Not for profits have numerous pots (ie. General, Youth, and Building) of money, each with a fund designation, that allows money to come in and out of just that pot (fund).

Who Should Use Fund Accounting?

The simple answer is all not for profits. However we are gonna go in a different direction. Let’s discuss the people that should use it within the not for profit. People like the church board, financial secretary, pastor, and donors. We will go over why each of these would need to understand fund accounting. We’ll also cover why they might have different purposes in their queries about the financial health of the organization.

Church board and fund accounting

The church board typically meets monthly to go over the financial health of the organization. They are responsible for the majority of the decisions. Things like putting on a new roof, repaving the parking lot, putting new carpet in a room, and so on. They create the vision, manage high level conflicts, develop strategic plans for the organisation, and so on.

The financial health of the organization is very important to this group of people. Two reports they need to know and understand are the Statement of Financial Position (balance sheet) and Statement of Activities (P&L). There are other reports like Cash Flow and Change in Net Assets that they should review during their monthly meetings.

The church board will also review the budget numbers to the actual for the month and year to date. While this is important we will note that budgets are not financial statements. A lot of times church boards spend too much time reviewing the budget and not enough time on the financial reports that are important. This is a mistake!

Why using budgets instead of financial statements is a mistake

This may come as a surprise, but many church boards spend more time creating their church budget, than learning how to read and understanding financial reports. And that’s a mistake! While church budgets are important “tools”, they are just that — tools. Budgets don’t measure your organization’s financial health. The majority of your auditors aren’t going to ask for budget reports during an audit either. Likewise if you need a loan, bankers don’t care about budgets. They want financial statements with real numbers on them, not promises or your best educated guess.

So what is wrong with using budget reports vs financial statements? A lot of things. First a budget does not guarantee you received the income as stated. Second it does not guarantee that your expenses will come in as you speculated. What happens when the income does not come in as you expected? Or expenses are unusually high? Do you wait to see if the revenue is received in a few months and hope you make up the difference? Ironically this is what a lot of not for profits do! Common dismissive statements go something like this — the summer is always slow for donation because people are at the lakes. Or it’s winter so a lot of people are down south, thus why the income is low. Sounds familiar?

Budgets don’t tell the whole story…

Another issue is, budgets do not tell the whole story. Budgets are entered on revenues and expenses only, and are educated guesses at best. You don’t budget on liability or assets. These two main areas are ignored completely in the budget. Yet the assets is where your money is at, and liabilities is what you owe. In regard to loans budgets can’t handle the principal payments for mortgage payments. Principal payments, unlike mortgage interest expenses, goes against a liability account for the loan. Because liability accounts are never in a budget — how do you budget on them?

Another issue is a budget’s proposed numbers aren’t backed up by any real transactions. The real transactions happen later as you are chugging along through out the year. So the church proposes the budget in say November for the up coming year. The earliest you see any numbers that are “real” is after the month of January is finished. Because budgets are created using proposed numbers the organization has to wait till after they start spending and receiving money in the new year. Then they can compare the actual to the proposed numbers.

Evaluating financial reports

By using fund accounting, the church board can dissect, for each mission area, how well the resources are used. Each mission area would have their own set of financial reports. This is one of the primary objectives that fund accounting helps. How? It helps the church board filter out the noise from other mission areas in the reports. For example, if they are reviewing the Youth fund, the reports would remove all details of what the General fund spent or received. Only transactions that affect the Youth fund would show. Effectively, each fund is like reviewing an independent company’s financial records.

Church treasurer and fund accounting

The church treasurer is typically the person responsible for either entering the transactions into the system or overseeing the data entry. The church treasurer typically serves on the board in an ex officio position. The treasurer works closely with the financial secretary who inputs the donations and ensures all monies are deposited. To this end, the treasurer’s understanding of fund accounting, is more on the technical and advisory side. They need to understand the ramifications of entering transactions and how it will affect the generated reports. The old adage “garbage in garbage out” (GIGO) applies.

A GIGO example is, if they enter a transaction for an expense and code it to the Youth fund instead of the General fund, then the reports for both funds would be incorrect. The Youth fund report would show less money than it should in the checkbook. And the General fund report would show more money than it should in the checkbook.

However, if they ran a report for the entire organization which includes the General and Youth fund, it would show the checking account to be right. We call this an all funds report. Treasurers prepare the accounting reports for the church board, and at times answers the church board’s questions.

Pastors and fund accounting

Pastors (IE — fathers, priest, deacons, bishops, and so on) are the face of the church, so to speak. They need to instill confidence, trustworthiness, honesty, and above approach for the organization and how resources are handled. To do this, at very least, they should know the on going projects, expenses, lump sum revenues (not names of who donated), and so on of the church’s finances. They should know which missions are struggling and the ones that aren’t and the ability to discuss them intelligently.

Some times the pastors are on the church board so they can get a first hand look at what is happening, financially. Some times they are not, but that doesn’t dismiss them from knowing what is going on financially, at a high level. Pastors get asked many times in passing conversations, how certain projects and missions are going. So it is important that they are tuned in to the organization’s finances, and not turn a blind eye to it because someone “else” takes care of it.

Church members and fund accounting

A church member doesn’t get off easy on this one. While they may not be at the monthly meetings, church members certainly should be receiving the annual financial report. These reports typically come from the accounting reports. Because church members give donations, they have a vested interest in knowing how the church is using the donations. This isn’t to say you agree with every penny that was spent, but in general you get an idea of how the church is doing overall. And are they going in a generally good direction?

The other items to note is how the money was spent for any restricted monies given. For example if the church took up donations to buy a piano — do you see that money in a separate fund? Were there any disbursements from the piano fund that wasn’t for the piano on the financial statements? And finally when purchasing the piano, were the piano fund monies used instead of another fund? Once the obligation is fulfilled, then the church should take appropriate steps to take care of any left over monies, in accordance to church bylaws and other FASB regulations.

Donation Funds VS Accounting Funds

Church management software that includes an accounting and donation management systems will have accounting funds and donation funds. These are two separate things. In fact if you don’t have two separate sets of funds, you may want to look elsewhere for appropriate software. Unfortunately past terminology has not help alleviate confusion by using the word fund for both of areas.

Churches have two sets of books

Essentially the church has two sets of books. Not to make light of the situation — but an organization having two sets of books would typically get you in trouble with the IRS and several other government entities. But with churches one set is a set of accounting books. The other is the donor’s set of books that have the donations recorded. Let’s explain these two sets of books in more detail.

There are major differences between these two sets of books.

Donation and accounting funds – what happens at the end of the year?

Accounting funds do not start over at the end of the year. Their balance moves forward as an equity account. Donation funds start at zero at the beginning of the year. The reason for this is so the stewardship committees can compare funds from one year to previous years. For example the church may want to know how the giving for the General fund has increased or decreased over the last five years.

Many believe you could get a report by a date range for the entire year (ie 01/01/2019 through 12/31/2019) to compare this year to the previous five year’s donations, for the similar date ranges (ie 01/01/2018 through 12/31/2018). If this could be done than the funds would not have to go to zero. Not so fast… You can’t go by date ranges for this type of report. Why? One example is for prepaid pledges. Another is postpaid pledges. Let’s look at a prepaid example.

Let’s first define what a prepaid donation is. It is when a donor gives the money in one year, but ask the church to apply it to next year’s fund. In other words they are paying ahead on their pledge for that fund. The donor makes a prepaid donation for the 2020 General fund, but the giving date is Dec 29th, 2019. They are paying ahead. For the report situation, the donation would be added to the 2019 fund based on the date it was given. For the report it should be added to the 2020 General fund total, and not the 2019 General fund total.

Donation and accounting funds – which ones hold the donations?

Donation funds only hold money from donors’ donations. They should not have monies entered for things like room rentals, wedding fees, or other income producing activities that aren’t pure donations. Accounting funds on the other hand can receive money from donations, and all other income producing activities. For example, when recording room rental fees, money received should bypass the donation funds completely. It should only be deposited into the church’s accounting books. This increases the church’s checkbook, but gives no credit to donors because room rental fees aren’t donations.

Donation and accounting funds – reporting differences…

The two types of funds give the ability to answer various questions. For example, on the donation funds, the finance stewards like to compare a specific funds. For example, they want to see how much they brought in for the General fund for the last five years.

Conversely, on the accounting General fund they might want to know how much they spent in the last three years, how much is remaining, and the total revenue for a period of time. The total revenue that came into the General fund is not always the exact amount that came in for donations. For example, the church could have other income like weddings where that money by passes the donation fund and goes directly into the church’s accounting books for the General fund.

Donation and accounting funds – day to day processes…

The church inputs donations for each donor which applies to their pledge. These donations go into the donation fund. But isn’t that the same fund as the church uses to write out checks and pay bills. No it is not. Think about it this way. When you write out checks, what happens to the accounting fund balance? It goes down, right? The accounting fund has less money in it because money left the organization. The opposite is true when the accounting fund receives money.

If this balance goes up and down, how would you know the total amount of donations that came in for the year, by fund? The balance changes as you write checks or receive money. The difference between the two types of funds, donation and accounting funds, is that donation funds do not go up and down. They only receive money, thus their total only goes up. Accounting funds on the other hand go up and down giving you a balance based on transactions.

Why can’t you look at the revenue account for the accounting fund to see how much was received for donations? Because that revenue account is also accounting for other revenues that aren’t donations. Things like room rentals and wedding fees. This type of income is irrelevant to the stewardship committee that handles donations and soliciting donors.

Fund Accounting Summary

Fund accounting is a unique system that helps not for profits answers the questions important to them, like the following:

- How are their missions helping the community?

- What can be do to better use our resources?

- How can we expand our reach with the same resources?

- How much do we have on hand to use, and how much have we spent in x, y, z missions?

Fund accounting answers a lot more than just these questions. Most will say that fund accounting is harder to use, but it really is just a different way of thinking. It’s no different than a for profit system where you need to know the credit and debit to code the transaction right. The only addition is to pick a fund for the transaction. Think of the fund as a category that encapsulates the transaction which keeps that transaction from affecting any other category (fund).

[…] is really important is that IconCMO accounting package is fund-based which is compliant for churches according to the FASB 958. Quickbooks, including Quickbooks for […]