This post was last updated on October 15th, 2024 at 12:00 pm.

Donation receipt requirements are an important consideration when looking for church software or auditing the current solution to ensure it has all that’s needed. Having the appropriate donation receipt allows your donors to ensure they can take their full tax deduction. While the tax deduction that the donor receipt facilitates isn’t the only reason to give — it does help to keep your donors donating toward your cause.

The worst thing to happen is the deduction isn’t allowed and they get a hefty tax bill because of the church’s mistake. A lot of churches will say that could never happen to us. Well, it has happened in the past to donors who donated to churches. One IRS case was Durden v. Commissioner (T.C. Memo 2012-140 (May 17, 2012). The result was an increase to their tax bill to over $9,000.00 including fines. They donated over $22,000.00 to a church and instead of getting a deduction, they received a fine.

This IRS penalty was levied because of missing verbiage on the original donation receipt. The IRS started a legal action and won the case. What verbiage was missing on the donation statement that could have cost the taxpayer over $9,000.00? The eleven simple words below were missing.

no goods or services were provided in exchange for this donation

This missing statement was the only thing wrong. The taxpayers made their donations on time, taxes were filed on time, and so on. It was an expensive mistake that wasn’t even their fault. Donors assumed the church knew what should be on the donation statement. Do you think these donors or others will be so fast to keep donating to the same organization when mistakes like this are made? What do you think would happen to the church’s reputation?

What Are The Donation Receipt Requirements?

There are several donation receipt requirements for donation statements. While the church provides the statement, it’s up to the taxpayer to ensure its right. Churches can greatly relieve these problems for their donors if they ensure their software can provide an IRS-compliant statement. The following are the essential requirements.

Name of the organization

The name of the charity must be on the statement. Some donation statements will have the charity’s address and EIN although it’s not required. However, the taxpayer should know the address of the charity in case of an audit or have it in their records.

Amount of donations(s)

The donation statement should have the donation amounts along with the dates that they were given. So if there were weekly donations of $100.00, the annual statement would have 52 records on it. A subset of the entries may look like these where there is a date and an amount for each.

| Date | Amount | Date | Amount |

| 01/05/2020 | $100.00 | 01/12/2020 | $100.00 |

| 01/19/2020 | $100.00 | 01/26/2020 | $100.00 |

Having a date and amount also helps in case of an audit. Many times the IRS wants to see your bank statements or canceled checks to prove you donated the money. By having the donation receipt you can easily locate the correct bank statements or cancelled checks.

Non-cash donation

When there are non-cash donations like office supplies, cars, land, and so on there needs to be a description but not the value on the statement. Why isn’t the value listed for the non-cash donation? Because the church isn’t an appraiser. The donor and their CPA must come up with the value that they believe is a true representation of the donated goods. When the church acts as an appraiser, it opens itself up to liability from the IRS.

For new things like office supplies the donor can simply provide the receipt for those goods. The church should not keep these receipts — ever. It is the donor’s record to provide to the IRS. For other items like a used car, they may use the NADA (blue book) value of the car. For land, they may use the assessed value from tax records. The best advice for the taxpayer is to consult with a CPA as they do this all the time. The advice for churches — stay out of the appraising business.

An example of this might look like this on a statement. The first two are non-cash donations with a detailed description and no value assigned. The last one is a regular cash donation which shows value. The $50.00 cash donation below doesn’t need a description.

| Date | Amount | Description |

| 05/20/2020 | $0.00 | A non-cash donation for 1 box of paper. |

| 05/30/2020 | $0.00 | Donated a 1986 Buick Skylark |

| 06/20/2020 | $50.00 |

Required text on statements

Multiple verbiage phrases can be placed on donation statements. The church must first decide if the statement needs the basic verbiage or does it fall under the Quid Pro Quo type of statement where the church must give the fair market value of an item or service they provided directly to the donor.

The basic donation verbiage

For the basic donation statements where the donor doesn’t receive anything in return for their donation the following text or something similar is used.

We acknowledge by this report that the church did not provide any goods or services to you in exchange for the above gifts, or their value consisted entirely of religious benefits.

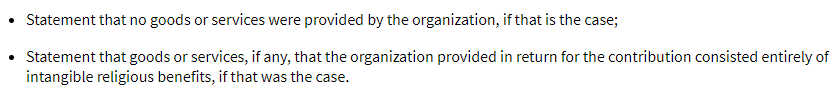

There are two parts to this statement that the IRS sees as important and should not be changed. By combining both into the statement the church covers both scenarios.

- did not provide any goods or services

- value consisted entirely of religious benefits

The IRS isn’t clear in its documentation as to why these two statements are treated separately instead of just giving one requirement. Below is a screen capture from their website showing the two requirements. You will note that they have a disclaimer of ‘if that was the case’ after each one.

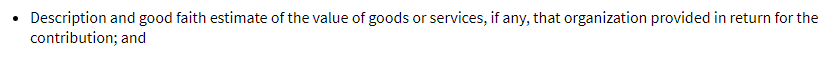

Quid Pro Quo donation verbiage – the other scenario

A Quid Pro Quo donation is when a donation is partly a good or service and partly a donation. The total donation must be over $75.00 before a statement is required. The Quid Pro Quo statements do differ in the way the regular statements work as far as verbiage.

The most common example is a fundraiser where the dinner ticket’s total cost takes into account the actual dinner cost and the rest is a donation. For example, say the dinner ticket is $125.00 but the actual meal only costs $25.00. The church must include a description of the good faith estimate of the fair market value of the meal. In this case $25.00 for the meal and provide a donation statement of $100.00. Here’s an example of what the verbiage might look like.

| Description | Date | Total Donations | Fair Market Value of Goods Provided to You | Deductible Donation |

| Dinner Ticket | 05/01/2020 | $125.00 | $25.00 | $100.00 |

Below is the IRS policy from publication 1771 — Charitable Donations – Substantiation and Disclosure Requirements.

The $250.00 Rule For Donation Receipts

The $250.00 donation rule simply states that for donations up to $250.00, the donor can simply use a canceled check, bank statement, or other documentation for proof of the donation. They would also have to track which charity they gave to on their own. This is the case even when the accumulated donations for the year are over $250.00 such as 52 donations at $10.00 each. The donors don’t need a written acknowledgment from the charity.

However, when any donation is $250.00 or over, it requires a written acknowledgment from the charity. Donors are not off the hook with written acknowledgments from the charity. The donor should also have a bank statement, canceled checks, or other proof that coincides with the written acknowledgment in case of an audit. Non-cash donations always need a donor receipt from the charity regardless of the value.

It’s beneficial for any nonprofit to supply a written acknowledgment even when they aren’t required by the $250.00 threshold. This ensures an open line of communication between you and your donors, helps them during a stressful time — tax season, and shows good faith on your part with the received donations.

IRS Penalties

IRS penalties and fines can be substantial for a church or any organization that operates on a tight yearly budget. Any organization will want to consult a nonprofit CPA or tax attorney. Another option is an enrolled agent (EA) which specializes in tax law. More on Enrolled Agents later. Each of these professionals can practice in front of the IRS at all levels.

For Quid Pro Quo donations, there is a $10.00 penalty for each failure to provide the required written statement to the donor. So if there were say 200 donors at an event and the church failed to send them a proper written acknowledgement it would be a $2,000.00 fine. The maximum penalty is $5,000.00 per fundraising event, which adds up when hosting multiple events each year.

Note on Enrolled Agents: The EAs are the only ones that spend their entire career in US taxation. They are licensed by the federal government after taking the taxation exam whereas CPAs and attorneys are licensed by the states in which they practice. An EA’s knowledge of tax law is vast and deep whereas CPA’s and tax attorney’s daily work varies. Many times CPAs and tax attorneys don’t know how a not-for-profit differs in the tax code from a for-profit business. EAs, on the other hand, are tested relentlessly in this area.

What About Donation Receipt Requirements For Canadian Churches?

Canadian churches have numerous more donation receipt requirements for their donation receipts according to the CRA — The Canadian Revenue Agency. We’ve outlined those requirements in another blog post. What is important to know is that IconCMO does have the ability to do the Canadian style receipts and they are compliant with the CRA.

Why Provide Statements At All

These donation receipt requirements are a lot to take in, especially for churches where they rely a lot on volunteers for data entry. The main reason to provide these statements is to ensure your donors can take their tax deduction. By giving these statements, the church shows appreciation to the donor, and that donor will keep donating to the organization.

Donation Receipt Summary

As noted in this post having the right requirements on donation statements is imperative to ensure donors can take the tax deduction at the end of the year. We also outlined the differences in verbiage that are used based on the type of donation statements — the Quid Pro Quo or a regular donation statement. The statements also change when a non-cash donation is received and the church doesn’t assign a value to it.

And lastly, we saw that the IRS penalties for failing to have a proper statement can be devastating for the church and its donors. Not only are the IRS penalties extreme for both, but the fallout afterward will be equally devastating. The donors will stop donating. When donors stop donating, it lowers the revenue for the church to operate.

Nice knowledge-gaining blog. This post is the best on this valuable topic. I like your explanation of the topic and your ability to do work. I found your post very interesting