This post was last updated on March 24th, 2022 at 11:40 am.

Renting Space At Churches — Many Questions Arise

For many churches renting space helps pay the bills and possibly put a little more in the coffers for church projects, ministry outreach, and so on. Renting space is no easy task for the church finance team. When churches decide to open their doors for renting space, many considerations will arise, such as:

- figuring out a room rental fee schedule.

- legal ramifications and insurance coverage.

- drafting up long and short-term rental agreements.

- cleaning up after scheduled events.

The Purpose Of This Church Finance Guide

This guide will help the church finance stewards to crunch the numbers and make some sense out of them for the fee schedule. It will also answer the following questions, plus much more.

- How should a fair fee schedule be drafted?

- Should the charged fees be tied to the church’s operational cost? Short answer – Yes.

- Can figuring these fees out the right way help with budgeting for the church’s own programs? Short answer – Yes.

- Can the fees illustrate how much it cost for the church’s own program, the community outreach events they host, and so on for a more accurate representation of how they spent donations? Short answer – Yes.

The church could take guesses on rental fees using multiple methods listed below, however, at best, these are guesses.

- Seeing what’s offered around the local area.

- Historical rental cost.

- Asking the church down the road.

- Input from a real estate agent or local event rental companies.

These guesses tend to be more of a gut-feel answer and not based on facts, most of the time. So, is there a way to figure a fee schedule based on facts like square footage and operating cost, and answer the initial four questions? Yes, there’s a way to figure out how much the church should charge by the square foot per hour of use and tie this to the overall cost of operation.

Basic Data For Church Building

We are going to use the cost calculator from Berkeley College and adapt it to the church’s needs. To do this right, the church will need information such as expenses for the year from your accounting system, your building’s depreciation schedule (typically 30 years), total square feet of the building, replacement value per square foot, and so on. The church finance team will want to keep this information in a table like you see below.

| Ownership Cost | Amount | Unit | Data Type | Data Source |

|---|---|---|---|---|

| Building Square Footage Total | 25,000 | GSF* | Actual | Church (blueprints) |

| Replacement Cost | $ 200.00 | $/GSF | Estimated | General Contractors |

| Building Depreciation Schedule | 30 | Years | Policy | IRS and Church |

| Total Usable Hours** | 2500 | Hours | Policy | Church |

| Core Space Factor | 30% | Percentage | Estimated | Church (blueprints) |

Notes:

We will be referring to this table for key pieces of information throughout this blog post and our example.

*GSF in this table is gross square footage, which means all square feet that include hallways, bathrooms, and other common areas.

** The total usable hours are how many hours per year the building can be used. This will vary depending on the church. For this example, we will use 2500, which is the product of 5 days per week, 10 hours per day, for 50 weeks (5 * 10 * 50 = 2500). The church will not rent the building on Sundays and Mondays.

Now we move into using the operating, administration, and capital costs to help determine what we should charge for renting certain parts of our facility out. Many times churches don’t keep all of these in mind — especially capital cost.

Church Finance — Operating Cost

Operating costs are things like utilities, repairs, custodial services, security, etc. The church finance team needs to gather the annual cost of these which you should have in an accounting system like IconCMO. In a spreadsheet, enter each expense on its own line, and in the next column enter the annual cost. In the third column, enter the result from dividing each expense cost (ie utilities – $65,000.00) by the building’s square footage (25,000) referenced in the Basic Data Section table (above.)

| Operating Cost Description | Annualized Cost | Annual Cost / Square Footage (ie 25,000) |

|---|---|---|

| Utilities | $ 65,000.00 | $ 2.60 |

| Repairs & Maintenance | $ 85,000.00 | $ 3.40 |

| Add other costs – one per line. | —— | —– |

| Total Facilities Operating Cost | $ 150,000 | $ 6.00 |

Note:

We only put two expenses in the table above but there should be a lot more building expenses than these. The church finance team will want all of them entered into the table.

Church Finance — Administration Cost

The administration cost area is where the church must decide how much each employees’ salary is dedicated to building operations. For example, a pastor’s annual salary would have a very small percentage of their salary, if any, going towards the building operation. In comparison, the facilities manager would have the majority of their salary dedicated to the building’s operation.

This table would be similar to the one above, but there are two extra columns called “% Dedicated to Building” and “Annualized Cost For Building”. The first calculation is taking the “Annualized Cost” and multiplying it by the percentage found in the column “% Dedicated to Building”. Thus, $100,000.00 multiplied by .30 equals $30,000.00.

To get the final figure “Annual Cost/Square Footage”, take the $30,000 and divide it by the building’s square footage of 25,000, which equals the $1.20, as seen in the Office Staff Salaries line.

| Admin Related Expenses | Annualized Cost | % Dedicated to Building | Annualized Cost for Building | Annual Cost/Square Footage |

|---|---|---|---|---|

| Office Staff Salaries (multiple people) | $ 100,000.00 | 30% | $ 30,000.00 | $ 1.20 |

| Pastor Salary | $ 90,000.00 | 5% | $ 4,500.00 | $ .18 |

| Other costs tied directly to building operations | —- | —- | —– | —– |

| Total Admin Cost | $ 190,000.00 | $ 34,500.00 | $ 1.38 |

How To Figure Out The Percentage For Each Staff Member

There is really no right or wrong answer for the percentages found in the “% Dedicated to Building” column. It’s your best estimate of how much time that person spends on building operations. Additionally, it’s quite common for certain people to contribute no time towards building operations, thus they don’t belong on the table or simply use a zero percent. The church must keep in mind as it adds employees to payroll- like another building maintenance technician- their salary must be added to the table. In other words, the data in the tables should be reviewed annually or at a bare minimum every two years.

Confidentiality Note:

When it comes to salaries, the church finance team should be very careful about disclosing salaries to people that may not need to know any of that information. Each church is different in this and the church finance team should follow the proper church protocol, whatever that may be.

Church Finance — Capital Cost

Capital cost takes things like long-term debt service (ie building loans) into account and replacement cost. So how would you know the replacement cost? There are a couple of ways the church finance team can determine the building replacement costs.

You could have the building assessed by a private company. You could use the typical square footage construction cost for your area. For example, builders typically will charge something like $200.00 per square foot. Then you would just multiply this by the square footage of the property. In this example, it would be $200.00 multiplied by 25,000 ft2, which equals 5 million dollars for the replacement value.

We then take the 5 million and divide it by the deprecation years (30 in this case) which comes from our basic data input table. This gives $166,667.00 for the ‘Annualized Cost for Building’. We take this figure and divide it by the 25,000 ft2 to get the $6.67 figure. The ‘Long Term Debt’ is easier since the church should know what their annual mortgage payment is. You simply divide the annual mortgage payment by the 25,000 ft2.

| Capital Cost | Total Cost | Annualized Cost for Building | Annual Cost per square foot |

|---|---|---|---|

| Replacement Cost | 5 million | $ 166,667.00 (5 million / 30 years) | $ 6.67 (rounded) |

| Long Term Debt | No Value | $ 286,449.12 (loan payment per year) | $ 11.46 (rounded) |

| Total Capital Cost | $ 453,116.12 | $ 18.13 |

Why Is Captial Cost Overlooked?

Capital costs are often overlooked, especially when the building is new. The church leadership’s mentality is ‘we just built this building and it should last for a long time.’ While that’s true, large expenses do happen and buildings do wear out and need upgrades. Waiting until the last minute without properly allocating resources leads to a detrimental outcome. When churches wait until the last minute, this is when church members see the hastily thrown together capital campaign drive to raise large sums of money to fix the roof or some other big expense. As the saying goes:

Prior Planning Prevents Poor Performance!

James Baker, Former Secretary of State.

Adding Up All The Costs For The Annualized Cost

Now we need to add up all the annualized costs from the previous three tables.

| Cost Type | Annualized Amount |

|---|---|

| Operating Cost | $ 150,000 |

| Administration Cost | $ 190,000 |

| Capital Cost | $ 453,116.12 |

| Total Cost | $ 793,116.12 |

Once we have these annualized costs we can figure two things out.

- Square foot annualized cost — Simply take the cost of $793,116.12 and divide it by 25,000 square footage which is $31.72 (rounded). The $31.72 number is used later.

- Cost of ownership by square foot per hour — Simply take the $31.72 and divide it by the 2500. This gives a result of .013 (rounded).

Why do we need the ‘Cost of ownership by square foot per hour?’ Because people rent facilities by the hour most of the time. It also ensures fairness across all activities. For example, someone that rents it for five hours should be charged more than the one that rents it for one hour. It allocates the rent proportionally to what is used by each person, group, etc. In addition, it also equally adjusts the cost per hour by square foot based on the operating hours. Some buildings may only be opened for 500 hours per year and they would require more to operate in most cases because they don’t have as many hours as this example of 2500 hours.

Assigning Cost To Each Room

The initial set of figures above only tells the church finance team the preliminary information on how much we should charge per square foot of space, by the hour. But buildings have various different size rooms, common areas, types of rooms, etc. For example, the sanctuary will be quite a bit larger than say a classroom. We need to use the cost per square foot above and figure out how much per hour should each room rent for, including common areas.

Our example building is 25,000 square feet and has a sanctuary that is 10,000 square feet, 2 classrooms at 2,100 square feet each, and a kitchen at 4,200 square feet. These figures don’t include common areas such as hallways, bathrooms, and so on. However, we still need to account for these common areas as they need maintenance, repairs, cleaning, etc. just like anything else. This is where the ‘core space factor’ comes in. Most buildings have this multiplier to accommodate the common areas. It’s a percentage of square feet added onto the room’s net square footage.

Difference between net and gross square footage

In the example, you will see the net square footage for the rooms is only 18,400 instead of the 25,000 that we’ve been using. That’s because the 25,000 is for the entire building which includes the common areas like bathrooms.

To figure out the ‘Total Gross Square Footage’ we add 30% to each ‘Net Room Square Footage’. This properly allocates common areas based on the size of the room rented. A sanctuary common areas usage would be an additional 3,000 square feet versus a classroom of 900 square feet. In other words, the larger the room that’s rented, the more common area is included for the fee.

| Type of Space | Net Room Square Footage | Core Space Factor | Total Gross Square Footage | Annual Cost of Ownership per Space |

|---|---|---|---|---|

| Sanctuary | 10,000 | 30% | 13,000 | $ 412,360 |

| Classroom #1 | 2,100 | 30% | 3,000 | $ 95,160 |

| Kitchen | 4,200 | 30% | 6,000 | $ 190,320 |

| Classroom #2 | 2,100 | 30% | 3,000 | $ 95,160 |

| Totals | 18,400 | 25,000 | $ 793,000 |

Next, we take the ‘Total Gross Square Footage’ and multiply it by $31.72, which is the ‘Square foot annualized cost’ found earlier. For example, 13,000 ‘Total Gross Square Footage’ multiplied by $31.72, which gives you the ‘Annual Cost of Ownership per Space’ — the $412,360 in the above table.

The Final Rental Fee Schedule By Room

The next table will take the ‘Annual Cost of Ownership per Space’ and give an hourly cost per type of room. We divide the Annual Cost of Ownership per Space by 2500.

| Type of Space | Annual Cost | Per Hour Cost (divide Annual Cost by 2500) |

|---|---|---|

| Sanctuary | $ 412,360 | $ 165.00 (rounded) |

| Classroom #1 | $ 95,160 | $ 38.00 (rounded) |

| Kitchen | $ 190,320 | $ 76.00 (rounded) |

| Classroom #2 | $ 95,160 | $ 38.00 (rounded) |

This would conclude figuring out a fee schedule as you see in the above table. The fee schedule is directly tied to the church’s operation instead of a gut feeling. Now we will move on to explaining how these room usage fees help show donors how their donations were spent.

Using Room Usage Fees To Accurately Depict Donations Spent

What else can a fee schedule help with? It can help the church draft the true cost of their missions such as children’s ministry and accurately reflect them in annual reports.

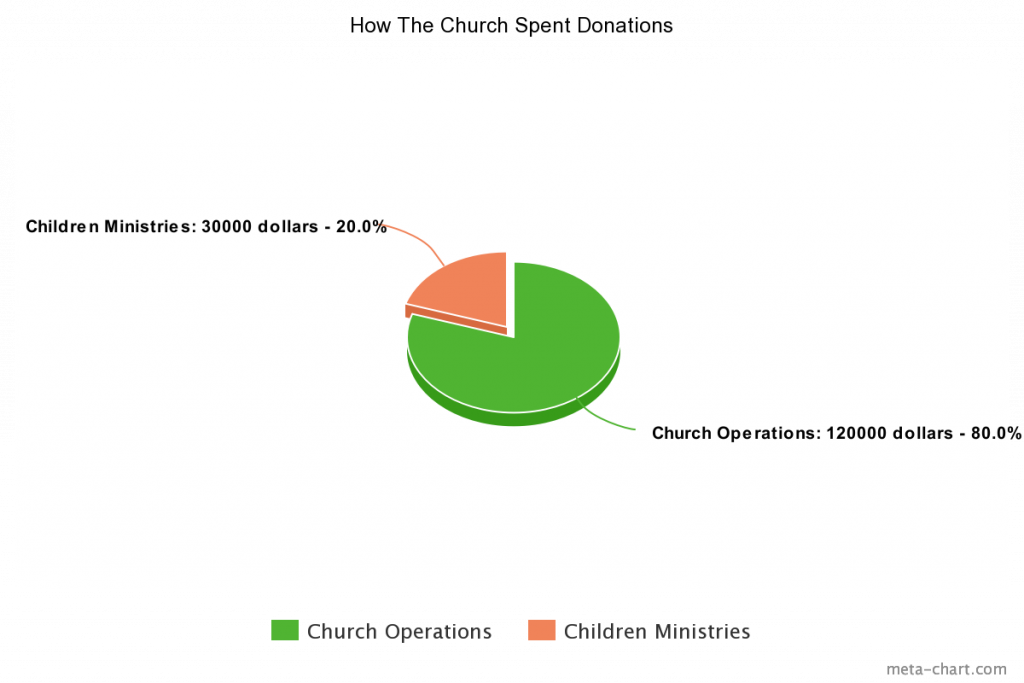

Churches, so many times, show money spent on the biggest expense of the church which is operations and salaries. Unfortunately, this doesn’t paint the church in the best light when operations and salaries make up +75% of the donated monies as seen in the first pie chart below. While operations and salaries are important, if it’s not correctly illustrated they can be misleading. In other words, a fee schedule based on facts will paint a more honest picture.

So how can the fee schedule help with the true cost?

By knowing the true cost we can fairly and accurately represent what the church building contributes to the children’s program or other ministry work when they use the building. Let’s say the church initially represented in their annual report that they spent $30,000 on the children’s ministry and $120,000 on church operations. This is before determining the fee schedule. It would look like the graph below, where church operations take up 80% of the pie.

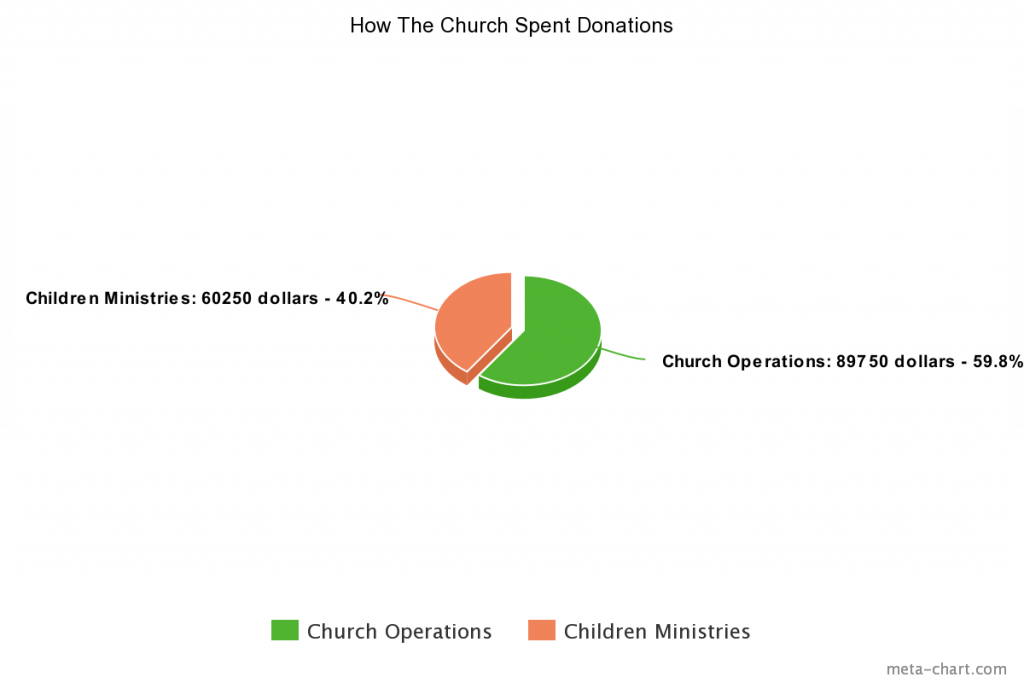

Now let’s apply the fee schedule to show the true cost of each ministry. It will show an entirely different story of how the ministries’ resources are used.

Room usage fee example

The children’s ministry meets on Wednesdays and Fridays and they use both classrooms plus the sanctuary for 2.5 hours/night — ie five hours total per week for 50 weeks a year. Let’s review some of the basic calculations using the hours and number of weeks.

- Annual hours — 5 * 50 = 250 annual hours.

- Total rent per hour — 165.00 + 38.00 + 38.00 = 241.00 for room rent.

- Annual rental fees — 250 total hours * 241.00 room rent per hour = $60,250.00 Annual rental income.

So instead of showing $120,000.00 for church operations, it should show $89,750.00 for church operations and $60,250.00 for children’s ministry. Do you see the difference in how this is represented in the table below or in the following graph?

| Ministry or Functional Area | Old Representation | New Representation |

|---|---|---|

| Church Operations | $ 120,000.00 | $ 83,850.00 |

| Children’s Ministry | $ 30,000.00 | $ 66, 150.00 |

Room usage fee pie chart

To visualize this better, let’s see it on a pie chart. This pie chart below shows the updated values where there is less green (church operations) and more orange (children’s ministry). After looking at the two pie charts, which one shows the church in a truer way using facts?

Answer: The one below shows a truer representation of the church’s resources.

Some may say ‘…but the church is not receiving money from the children’s ministry for the building’s usage’ or ‘we don’t charge our own ministries to use the facilities’. Yes, that is probably all true, but the church, donors, leadership, and many others need to know what the true cost is to put those activities on. If you didn’t have the building and needed to rent space, there would be a rental fee assessed in that scenario, right? Why treat the two scenarios differently when reporting them in an annual ministry report? Additionally, it helps to show that the church is not spending 80% on church operations only.

Renting Church Space Summary

Now that the church finance team has successfully calculated room rates tied to the church’s building operational cost, it can better assess its usage, overall maintenance needs, and even the annual financial report on their ministries. Tying rental fees to building costs ensures the church is charging a fair rate but still maintains the building. Basing fees on facts, instead of gut feelings is well worth it, even if it takes a bit to go through.

Adjusting rental fees as cost goes up and down is important. For example, the church would adjust the capital cost used in the fee schedule when the church pays off a building loan. Why? Because the church isn’t servicing that particular debt anymore, it should lower the room cost provided everything else was the same. This would make the church more competitive in the local space rental market. By the same token, if building repairs go up substantially or you take out a new loan for a large renovation, then naturally the fees would go up. Churches should review fee schedules at least every two years.

Leave a Reply