This post was last updated on November 23rd, 2021 at 01:22 pm.

Church Chart of Accounts Introduction

The church’s chart of accounts (CoA) is the building block for your entire church accounting system. In a proper church accounting system, the CoA works in conjunction with funds, to create a robust church fund accounting system that answers the question of accountability. Funds working with the CoA, provide a multiple tier reporting structure that gives a deep dive view into the organization’s spending.

Here are the other parts of this series.

- The second part goes over the chart of accounts order- its numbering, how the order of accounts translates to reports, some do’s and don’ts, and finally the two main methods of accounting.

- The third part explains the reason equity accounts are pulled out of the chart of accounts, then goes over examples of how profit and loss reports are created using revenues and expenses.

Normal Balances

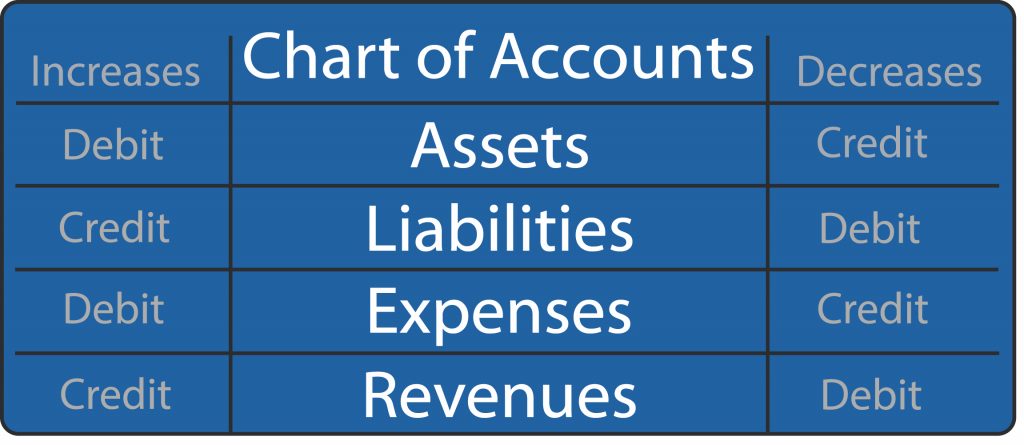

First, we need to understand what a normal balance is in accounting. A normal balance is a double entry accounting term that describes how an account is increased or decreased. Debits increase asset and expense accounts while credits increase liability and revenue accounts. These normal balances in the table below are very important to know and are the first thing an Accounting 101 course will teach. In other words, a debit doesn’t always decrease an account and a credit doesn’t always increase an account.

Church Chart of Accounts Sections

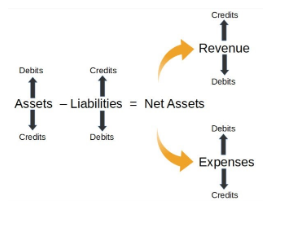

There are five common areas in the church’s chart of accounts in any organization. The five sections are assets, liabilities, owner’s equity (net assets), income, and expenses. See the illustration below. It shows how the debits and credits move the account depending on which account you use. In other words, if your entry is a credit to revenue, then the revenue account increases. Or if it’s a debit to a liability, the account will decrease.

We need to take a look at the net assets because this is typically called owner’s equity in most accounting software. This is a major difference between nonprofit and for-profit accounting software. Churches aren’t owned whereas for-profit companies are. That is the reason for the verbiage change. The net assets are actually the funds that we will get to later. It’s the funds which own the resources in a nonprofit, just as the owner’s equity owns the resources in the for-profit companies.

Now let’s go over each of these account types — assets, liabilities, expenses, and revenues.

Assets

The assets in the church’s chart of accounts contain balances for accounts like checking, savings, CDs, and investments (i.e. stocks). Other assets that may be listed are buildings, land, and accounts receivables.

Here’s a more definitive definition:

Asset accounts represent the different types of economic resources owned or controlled by the entity.

Wikipedia.org

While we are defining assets, we need to straighten out another misconception on checking accounts in regards to how the debits and credits work. A debit transaction into a checkbook actually increases the balance of the checkbooks. What!?! Debits are suppose to decrease the balance — right? Let’s explain this in more detail as to why there’s some confusion.

Your checking account is an asset to you; however, it’s a liability to the bank. When you deposit money, it’s increasing the amount of money the banks owes you. When you use your debit card or withdraw money, you’re lowering the amount of money the bank owes you. In other words, you are lowering the liability in the bank’s accounting books via a debit transaction. Liabilities only lower with a debit transaction, thus why the bank gives you a debit card for checking accounts.

Coincidently, the reason credit cards are called credit cards, is because they increase the liability you owe the bank. Credit and debit cards work in the opposite direction of each other. Long story short — credit and debit cards were aptly named from the bank’s perspective not their account holder’s. If you’re still confused, we go into great detail about this verbiage switcheroo in this blog post.

Liabilities

Liability accounts list things like current liabilities and long-term liabilities. The big difference between these two sections is that current liabilities are anything the organization will pay in less than a year. Some examples are payroll, accounts payable, and credit cards. Long term liabilities are obligations that are paid over a year or more. Some examples are mortgages and vehicle loans.

Let’s look at a more definitive definition of liabilities:

Liabilities accounts represent the different types of economic obligations of an entity, such as accounts payable, bank loans, bonds payable, and accrued expenses.

Wikipedia.org

Liabilities are used extensively when an organization is using accrual based accounting. The other method of accounting is cash based accounting. We discuss these two methods in the third part of this series as one method greatly affects the liabilities and the other doesn’t.

Note: Churches should review their bylaws to see what method of accounting they should use. If the church uses a different method than prescribed in the bylaws, more than likely the church would fail an audit.

Revenues

Revenues are where all the organization’s income enter into the organization’s accounting system.

The official definition is:

Revenue is the income generated from normal business operations and includes discounts and deductions for returned merchandise.

Investopedia.com

Every organization’s revenue accounts will be setup slightly different depending on the organization’s focus. For example, an organization may be product focused so they may want their revenue accounts focused on the products to determine which business segment is doing well and which ones aren’t. A product focused chart of accounts would look like this:

- Revenue

- Tires

- Windshields

- Wheels

- Seats

The next for-profit organization is a service based instead of product based. Let’s look at what that might look like:

- Revenue

- Oil Changes

- Tire Rotation

- Tire Balancing

- Gas Filter Changes

Looks simple right? The above set up is what you see in a for-profit organization but a church has to deal with funds when setting revenues up. In churches, when multiple funds are used, you want to stay very generic in the naming of revenue accounts. So you shouldn’t have a revenue account name ‘General Fund Donation Revenue’ or ‘Mission Fund Donation Revenue’

Expenses

Expenses are where the money leaves the organization.

The official definition is:

An expense is the cost of operations that a company incurs to generate revenue.

Investopedia.com

Most of the church’s expenses happen in the the operating expenses area. This is where salaries, utilities, and the day to day operations are accounted for. The operating expense section handles 98% of the expenditure transactions in the church’s books. One thing to keep in mind with expenses is to not get too granular with expenses. We go over this in more detail in part two of this series.

Expenses in a church are pretty similar to a for-profit organization. For example, nonprofits have utility and salary expense just like a for-profit organization. What may be different in the expense area is that the church might have a section where they give money to other not-for profits. So they may have an expense account called the ‘Local Community Food Shelf Expense’ that is used to write checks out to the local community food shelf organization.

Chart of Accounts Part 1 Summary

The first part in this three part series goes over what normal balances are. We also gave an introduction to the four main sections of the chart of accounts. As you read through this series you want to keep in mind the following objectives:

- The church must be compliant with IRS and FASB.

- Church leadership must understand how to read reports across each ministry.

- The church leadership needs to understand what ministries are bringing in enough donations to cover the expenses that it incurs.

Your 30-day free trial of IconCMO is ready!

For future reference, an email with your log in credentials is on its way to your inbox. If you do not receive an email or have any other questions, please contact our sales department at 1-800-596-4266 or sales@iconcmo.com using the following account number: .

An email with your free trial is on its way to your inbox. In the meantime:

If you do not receive an email or have any other questions, please contact our sales department at 1-800-596-4266 or sales@iconcmo.com using the following account number: .

Incredible post. Very much an informational one. this article is very much useful for my trading broker’s business.