This post was last updated on May 26th, 2022 at 10:19 am.

Church Accounting Introduction

There are major differences between not-for-profit accounting and for-profit accounting. We break this down in several areas in this post. First, we’ll go over an example of for-profit accounting to get our feet wet. Next, we will move on to the not-for-profit, more specifically church accounting. In each section, we will review what questions each accounting method answers. Next, we will find out what additional questions a not-for-profit accounting system can answer. Additionally, we will discuss how funds play a role in the schema for the not-for-profit systems. Finally, we walk through several step-by-step not-for-profit examples. These examples show what happens to fund balances, revenue, checkbooks, and expenses as transactions take place.

Before jumping into the for-profit example below, you may want to read the other part of this series called “church accounting software — is it important”. It goes over why funds are important. Additionally, it explains various differences between not-for-profit and for-profit organizations and their reporting. And finally the FASB accounting standards and why they are important. In regards to church accounting software and its selection, you may be interested in this guide — church management systems. The guide goes over other requirement considerations.

For-Profit Introduction

Let’s start with “For-Profit Accounting” as it is easier to understand. The for-profit businesses have what they call a single set of self-balancing accounts. This single set of self-balancing accounts is a general ledger or COA (chart of accounts). So for the “for-profit” organizations, all the accounts balance against each other, commonly called double-entry accounting. This balancing happens in one set of ledgers, the COA, by using the double-entry method. This is vastly different from church accounting software that uses funds. In church accounting, one fund represents one set of ledgers. Thus there are multiple sets of self-balancing ledgers within one organization. Let’s use an example to illustrate a for-profit transaction, first. Then we can dive into a not-for-profit example.

For-profit accounting example

To use a simple for-profit transaction, what happens when you pay the monthly executive food bill of $75.00. And the checking account has a balance of $500.00? You would enter the transaction into the accounting system similar to the following.

| Account | Credit | Debit |

| Food Expense | $75.00 | |

| Checking | $75.00 |

Sounds straightforward forward right? It should take you back to college accounting 101. From this transaction, a couple of questions can be answered for the for-profit company, such as:

- How much did we spend on food expenses for the year? Answer — $75.00

- How much remains in my checkbook after this expense? Answer — $425.00

Not-for-Profit Church Accounting Introduction

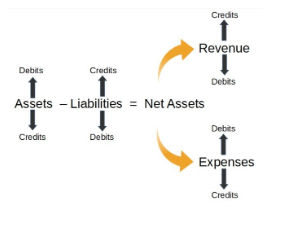

In the for-profit area, the above two questions are important. But in the not-for-profit world, it gets much more complicated. This is why church accounting software was created. This software helps to detangle the mess and provide reports that make sense. Remember in the for-profit world the age-old equation of Assets minus Liabilities equals Owner’s Equity is followed. However, in not-for-profit, the equation is Assets minus Liabilities equals Net Assets. This change is more than a verbiage difference, as explained here in the church accounting software. Here is an illustration of the not-for-profit equation.

What other questions should church accounting software answer?

Church accounting software is required to answer the previous for-profit questions plus a lot more. Some of those questions include,

- When it comes to the General fund, how much does it have left in the checkbook separate from all other funds?

- How are you going to record the expense transaction separate from other expenses that aren’t in the General fund?

- How much is remaining in every fund on the system?

- When revenue is received, how are you going to record it so the church leadership knows that it is for the General fund and not the Youth fund?

- How much is owed by each fund (ministry function/purpose)?

So how can we answer these additional questions? The answer is, you guessed it — Funds!

Funds to the Rescue!

Funds have one primary goal. It’s to create little mini organizations within the larger not-for-profit. What this means is they have their own set of assets, liabilities, income, expenses, and net assets. So essentially they create multiple self-balancing books within one organization. If you remember from the for-profit section, it only has one set of self-balancing books. This is not true in fund accounting, thus complication ensues.

Multiple ledgers in one using funds

We can’t stress how important the ability is to have many ledgers that self-balance. Each of these smaller ledgers then rolls up into one organizational ledger. And just as important, at each level, the church accounting system has to produce the reports needed — ie at the fund level and the entire organization. This gives the organization the ability to see one set of books for say the Youth ministry. This Youth Ministry is viewed alone from all other ministries. It also allows the organization to see all the ledgers rolled up into one set of reports. For example, you can see the General, Youth, and Mission funds and have their numbers combined to see how the overall organization is financially.

Tagging Transactions with Funds in Church Accounting

So how does a transaction look in a fund-based church accounting software? If you remember, in a for-profit we had credits and debits when the organization paid for the food. In a not-for-profit, we would do the same credit and debit, but we would “tag” it with the fund. It’s this tagging that helps create the reports and keeps everything in balance. The “tag” acts like an extra piece of information that we can programmatically filter on. During the filter process, we pull out only transactions that have the fund we are seeking. In this case, it is the General fund. So what does this look like using the same example as before for the monthly executive food bill of $75.00? And the checking account has a balance of $500.00.

| Account | Fund | Credit | Debit |

| Checking | General Fund | $75.00 | |

| Food Expense | General Fund | $75.00 |

Please note that we now have a column showing the affected fund. This is not present in a for-profit accounting system example. It is this extra piece of information that makes everything come together. Not-for-profit bookkeepers should know the fund before entering it into any church accounting system. In fact, CPAs and anyone who deals with accounting will tell you if you don’t know the fund, debit, and credit, you have no business inputting the transaction. I know some will say, “I only put the transactions in based on what I am told”. If this is the case, then the church’s process needs to change at the leadership level. Not knowing the fund for the transaction, is akin to, not knowing which bank your money is at. We are pretty sure you know where the church’s money is, even if you hide it in coffee cans in the church’s backyard!

Initial Resource Allocation by Fund into the Checkbook

Before we go any further with more examples, we need to do one important thing. The checkbook has $500.00 in it. But yet, we do not know which fund(s) own that $500.00. Does the General fund own all of it? Are there other funds that own part of it? Let’s do that now. As of 12/31, you have $500.00 split among three funds as seen below. This is what is called the “beginning balance”. Once these beginning balances are set, it is never touched again. More importantly, it’s not zeroed out at the end of each year or moved. In a not-for-profit the money stays in the fund and rolls over automatically, so don’t get creative with transferring money at year-end.

| Fund | Amount Allocated to Checkbook (Beginning Balances) |

| General Fund | $300.00 |

| Youth Fund | $125.00 |

| Mission Fund | $75.00 |

| Total in Checkbook | $500.00 |

Fund Accounting Answers Church Leaders’ Questions

So, can we answer the questions in this example that church leaders will ask? How about the questions from church oversight, government, and other interested parties that want answers? Yes, we can!

- How much did we spend on food expenses for the year? Answer — $75.00

- How much remains in my checkbook (as a whole) after this expense? Answer — $425.00

- For the General fund, how much does it have left in the checkbook separate from all other funds? It is $300.00 minus $75.00. Answer — $225.00.

- Note this is different than the overall checkbook balance of $425.00.

- How much is remaining in every fund on the system? Answer — The General fund has $225.00 remaining, the Youth fund has $125.00 remaining, and the Mission fund has $75.00 remaining.

- Note the Youth and Mission fund balance did not change. Only the General fund because the transaction was tagged General fund.

More In-depth Examples Using Fund Accounting

Now let’s get into some more in-depth examples. For this, we will reset the checkbook to $500.00 and use the same resource allocation mentioned above. If you remember, the General fund had $300.00, the Youth fund has $125.00, and the Mission fund had $75.00 which totals to $500.00. Let’s say we have the following transactions to enter into the accounting system.

- The youth spent $26.00 on their skiing trip.

- The missions received $52.00 in income.

- The utilities of $110.00 were paid.

- The staff traveled and spent $74.00.

Let’s record these transactions using fund tagging in each of the walk-thru examples below. Then let’s include the standard credit and debit notation. Also, note that the for-profit scenario did not do fund tagging. The extra input for tagging funds is important for not-for-profits. This advantage will be seen shortly. Before entering one number in a not-for-profit accounting system you need three pieces of information — the fund, debit, and credit. Just as important is the date, amount, and the person you are paying. These items are without a doubt the most important data you need for entering transactions.

Walk thru utility bill example

| Fund | Account | Credit | Debit |

| General Fund | Checking | $110.00 | |

| General Fund | 9000-Utilities | $110.00 | |

| End of Transaction |

Let’s walk through each transaction and see how each one affects the fund balances. More importantly, why does a church need this church accounting structure? Paying the utilities was tagged with the General fund. Remember the General fund had $300.00, so we will subtract $110.00 for a new fund balance of $190.00. It does not subtract it from the total checkbook balance of $500.00. Church accounting software, and more specifically fund accounting, keeps this straight.

Another way to look at it is, that there are two balances happening, simultaneously. One balance is for the entire checkbook which is $500.00 and one balance is for the General fund which is $300.00. The General fund has $300.00 and pays the utility bill. Thus the expense, tagged with the General fund, lowers the General fund balance. Also, the entire checkbook total lowers as a side effect. This is all completed behind the scenes for you.

Important to note is on any transaction(s), the fund can’t be blank. Thus an uncategorized transactions should never exist. If they do, then the church accounting software isn’t suited for a not-for-profit. There are many systems that allow incomplete transactions entered. In other words, some transactions and their disbursements, are missing key information in regards to the fund assigned to the credit and debit.

Walk thru mission income example

| Fund | Account | Credit | Debit |

| Mission Fund | Checking | $52.00 | |

| Mission Fund | 1000-Revenue | $52.00 | |

| End of Transaction |

Let’s work through the revenue that was received for missions. The current balance for the Mission fund is $75.00. We received $52.00 in income for the missions. Keep in mind the checkbook total balance is $390.00 for all funds. The church accounting software would start with the current balance in the checkbook for the Missions fund, which is $75.00. Then, it would add the $52.00 to the Mission fund balance for the checkbook account. This makes a new balance of $127.00 for the Mission fund. But, a side effect of this, is that the checkbook total balance increases to $442.00.

Again, this is all done behind the scenes within the church accounting software. There’s no need for separate checkbooks, subaccounts of checkbooks, projects, liabilities, or classes. We call these workarounds creative accounting. Many systems deploy these workarounds like Quickbooks. The IRS does not like creative accounting. Thus, if we were to review the fund balances within the checkbook after the one expense and revenue transaction, we would have the following.

| Fund | New Fund Balance | Old Fund Balance |

| General Fund | $190.00 (expense charged) | $300.00 |

| Youth Fund | $125.00 (no change) | $125.00 |

| Mission Fund | $127.00 (revenue received) | $75.00 |

| Total | $442.00 |

Walk thru travel expense example

This example is different in that it uses the same expense account for two different causes. The youth went on a skiing trip and the staff had training out of state. Both expenses were entered in under the generic expense account called “8000-Travel”. But, the transactions are from different ministries in the not-for-profit, thus different funds. This is another area where church accounting software shines. It can break apart the expenses at the fund level instead of the account level. Thus simplifying your chart of accounts. Here are both transactions together.

| Fund | Account | Credit | Debit |

| General Fund | Checking | $74.00 | |

| General Fund | 8000-Travel | $74.00 | |

| End of Transaction | |||

| Youth Fund | Checking | $26.00 | |

| Youth Fund | 8000-Travel | $26.00 | |

| End of Transaction |

In the past churches would have two expenses for these two transactions. They would call them something like “8001-Youth Travel” and “8002-Staff Travel”. This workaround was created because funds weren’t used. The church had to separate it via the expense accounts instead. If you had to use expenses in this manner, your chart of accounts will become unmanageable. And without a lot of manual calculations, an individual ministry’s balance is still unknown. By using the same expense account but tagging a fund, you can now separate every transaction within one account. To clarify, the expense account can show you which expenses happen under each fund, using the Statement of Activities.

Walking thru the travel calculations

Now we will review the calculation for these two expenses and their funds. The youth’s skiing trip, paid by the Youth fund, has a balance of $125.00. This one expense is $26.00, we would subtract it from the $125.00 which equals $99.00 in the Youth fund. Then this reduces the grand total for all funds in the checkbook to $416.00.

Moving on to the last remaining transaction for the staff’s travel. This expense, paid by the General fund, used the same expense account as before. The General fund currently has $190.00 in the checkbook. The staff travel expense was $74.00, thus $190.00 minus $74.00 is $116.00 for the General fund’s balance. Just like before the checking account (including all funds) lowers to a grand total of $342.00. The General fund only has $116.00 in it. Don’t confuse this amount with the $342.00 checkbook total.

| Fund | New Fund Balance | Old Fund Balance |

| General Fund | $116.00 (expense charged) | $190.00 |

| Youth Fund | $99.00 (expense charged) | $125.00 |

| Mission Fund | $127.00 | $127.00 (no change) |

| Total | $342.00 |

How much did you spend on travel expenses?

What’s interesting about this example, is that one expense account is shared between two different ministries. A proper church accounting software can break that expense account into those ministries. Keep in mind ministries are often represented by funds. So if you want to know how much travel the staff did, you would view a report using the General fund. Thus, you run a one fund report and choose the General fund. In this case, the report would show $74.00 for the staff’s travel. Now moving on to the youth travel and how much they spent. Again, we would use a one fund report but choose the Youth fund instead. This report would show $26.00 for that same expense account. This is the area where the majority of for-profit systems fail. It is also where many so-called not-for-profit systems also fail.

Now, what if we need to know how much travel was paid for across the entire organization. Then you would run an “all funds” report which would look at every fund, and that expense account and add them up. In this case, the total travel expenses for the organization is $100.00. It would add $74.00 and $26.00 together. Pretty awesome!

Summary of Not For Profit vs For-Profit Accounting

Now that we have walked through a few examples let’s summarize the key points.

- For-profit accounting only uses debits and credits. Not-for-profit accounting uses credit, debits, and funds.

- For-profit accounting has one set of self-balancing accounts, whereas not-for-profit has many, depending on how many funds are set up.

- Accounting funds come to the rescue for the not-for-profits. The accounting fund’s primary goal is to create little mini organizations within the larger organization.

- We learned that by tagging transactions and their disbursements, we can answer all the questions from the church leadership. A for-profit system simply fails in this respect. We also learned that many retro-fitted for-profit systems that are sold as not-for-profit systems, can’t answer the required questions.

- And finally, we walked through four examples to get a feel for how the fund’s balances change independently within the checkbook’s total balance. And discussed how the funds keep all the transactions separate.

Check out some more examples of fund accounting.

[…] can get the churches into trouble. We discuss what makes a software fund based extensively in this church accounting blog. […]