This post was last updated on July 14th, 2021 at 08:18 am.

Chart of Accounts for Churches Introduction

This is the second of a three-part series. In this blog we’re going to review the order of the chart of accounts, account numbering, how the order of accounts translates to reports, some do’s and don’ts, and finally the two main methods of accounting – accrual and cash-based. In the third article, we’ll review why equity accounts are removed from the chart of accounts, as well as, how profit and loss reports are created using revenues and expenses.

Here’s the other parts of this series.

- In this first part we will cover what normal balances are and the various sections of the chart of accounts.

- The third part explains the reason equity accounts are pulled out of the chart of accounts, then goes over examples of how profit and loss reports are created using revenues and expenses.

The Chart of Accounts Sections

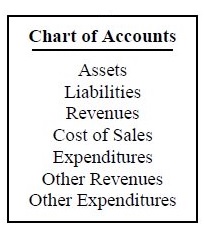

It is important to understand the order of accounts within the chart of accounts. We will go over the major sections — Assets, Liabilities, Revenues, and Expenses.

Listed above are the major sections in the CoA (chart of accounts) for churches. We will review assets, liabilities, revenues, and expenses. Keep in mind ‘revenues’ and ‘other revenues’ work the same way, as do ‘expenditures’ and ‘other expenditures’. Churches don’t typically use cost of sales, so we will skip that section.

What happened to the equity section of the chart of accounts?

We will go over this in more detail but for now, just know this is one of the major differences in nonprofit versus for-profit accounting.

Assets

The first set of accounts are asset accounts. The accounts within the asset section are listed in the order of liquidity. In other words, how fast can you exchange the asset for cash. For example, a stock can be converted to cash within a few days but a fixed asset such as a building or land could take weeks, if not months, to convert to cash. The order of liquidity for assets is seen below. This order is for a for-profit company but nonprofits follow a similar outline.

- Cash

- Marketable Securities

- Accounts Receivables

- Inventory

- Fixed Assets

- Goodwill

Churches (nonprofits) may not have all of these like assets such as Inventory or Goodwill. However, churches do have some accounts that may replace these, such as interfund receivables or notes receivables. Fund transfers are unique to church accounting and are done more often than you may think. For example, the General Fund may give money to the Youth Fund for an upcoming trip to help the Youth group. The interfund transfer accounts help to decrease one fund (General) and increase another fund (Youth).

Liabilities

Liabilities are less complex. There are typically two main categories that you’ll see below.

- Current Liabilities

- Noncurrent or Long-term Liabilities

The following categories break down Current Liabilities.

- Short-term Notes Payables

- Accounts Payable

- Payroll Related Liabilities

- Other Tax Payables (ie sales taxes)

Current Liabilities are not listed in any particular order. In other words, it’s less restrictive.

Revenues

There are typically two major types of revenue – Operating and Non-operating Revenue. Most church revenue is received through the Operating Revenue accounts. Non-operating Revenue or “Other Revenue” tracks interest from CD’s and saving accounts or records dividends from stocks.

Operating Revenue

The type of organization you have will dictate the revenue accounts that are listed first. For example, if you sell products, the product revenue accounts will be listed first under Operating Revenue. In the case of churches, they get the majority of their revenue through donations so donation revenue accounts appear first. Below is a list of Operating Revenue.

- Donation Revenues

- Product Revenues

- Service Revenues

- Miscellaneous Revenues

One note on revenue accounts. These should not include bank interest like dividends, or CD and saving account interest. This interest is recorded in the Non-operating Revenue section or “Other Revenue”.

Expenses

There are three major expense categories – Cost of Sales, Operating, and Non-operating Expenses. Churches rarely use Cost of Sales but it is still listed in the chart of accounts. The majority of church expenses fall under “Operating”. We’ll review both Operating and Non-operating Expenses. The order of expenses should appear the way a church wants them listed on reports.

Operating Expenses

The following is a list of the expense account headings you might see in a church’s chart of accounts. These could have sub-accounts under them.

- Charity Expenses

- Church/Ground Maintenance Expenses

- Depreciation Expenses

- Education Expenses

- Office Expenses

- Professional Expenses

- Staff Benefit Expenses

- Staff Salary Expenses

- Travel Expenses

- Utility Expenses

- Worship Expenses

- etc….(you get the idea) 🙂

Non-operating Expenses

The following is a list of expenses that aren’t related to the church’s operations.

- Penalties & Fines

- Loss on Sales

- Taxes

- Interest

- Service & Processor Charges

As you can see, the expenses for a nonprofit and for-profit are very similar. Remember you can always add more accounts when needed.

The Standard Numbering of the CoA

Using numbers allows the church to organize the chart of accounts. IconCMO provides flexibility so a church can organize numerically or alphabetically. Typical numbering will begin with 1000 for the assets, 2000 for liabilities, 4000 for revenues, 5000 expenses, and so on. Note how we skipped over the equity accounts- the 3000 accounts found in for-profit organizations. In Nonprofit organizations, the “equity” is held within the fund balances.

How the CoA Order Translates to Reports

In the end, it’s the reports that follow the chart of accounts structure, so the reports should be the end goal when creating the chart of accounts. In other words, when creating the church’s CoA you have to think backward by asking yourself, “how do we want the accounts and their numbers shown on the reports?”

There is some standardization in reporting that all accounting systems must follow. For example, revenue accounts do not show up on balance sheet reports or what we in nonprofit accounting call the Statement of Financial Position. Likewise, checking accounts wouldn’t be on a profit and loss report or what we call the Statement of Financial Activities in the nonprofit world.

Do’s and Don’ts When Setting up the Church Chart of Accounts

There are some biggies for setting up the church chart of accounts.

Setting Up too Many Accounts

It’s important to keep the chart of accounts workable. If the chart of accounts grows extremely large it becomes unmanageable. Let’s review a quick- but true example, that came across my desk a few years ago. For expenses, let’s say you have ‘building supplies’ as a main account with multiple subaccounts.

It could look like this (the right way):

- Building Supplies

- Cleaning Supplies

- Paper Products

- Tool Repairs

- New Tools

Or it could look like the one below (the wrong way):

- Building Supplies

- Cleaning Supplies

- Clorox

- Hand Soap

- Toilet Cleaners

- Paper Products

- Toilet Paper

- Paper Towels

- Xerox Paper

- Tool Repair

- Vacuum Parts

- Mops

- etc…

- Cleaning Supplies

It’s pretty clear with these two examples, the second one is a poor way to set up a chart of accounts. When church leadership inquires how much money was spent on Clorox vs hand soap, a saying comes to mind – “penny wise, pound foolish.” Organizations shouldn’t be accounting for toilet paper separate from paper towels. The second one is the one that came across my desk which we aptly helped reorganize.

Ability To Expand the Church’s Chart of Accounts When Needed

Most accounting systems have the ability to expand the chart of accounts. Many times when setting up the chart of accounts an organization simply can’t account for everything. After all, humans aren’t fortune tellers, although that would be an awesome superpower to have! If we aren’t fortune tellers, then we need the ability to add, merge, reorganize, and delete accounts within the chart of accounts. However, it’s important to know how the accounting system handles deleted or merged accounts after transactions have posted to them.

How about adding accounts? Any special considerations?

When adding accounts there is one account that should never have sub-accounts. This is the checking account. Some churches try to break the checking account (or saving account) into sub-accounts to keep money separate. This is the purpose of fund accounting. The funds are responsible for breaking up each account such as assets, liabilities, revenues, and expenses. Some software, like Quickbooks allow sub-accounts because they are not a true fund-based accounting systems. The rule here is one account for each physical account you have at the bank.

Setup The Chart of Accounts Based on Relevancy

Does your church need reporting on certain ministries? Or does the church report only on one fund and break out revenues and expenses at the account level? It could be a combination of both where the General fund handles 95% of everything and the remaining 5% is handled by a few ministry (mission) funds.

If the organization uses one fund, then the organizational structure of the accounts becomes much more important. For example, the expense accounts that are used most often might be towards the top of the expense section. This would be the same for the revenue section.

On the flip side, the organization becomes less important when the church uses multiple funds to categorize expenses. The reason is that the funds allow the church to have a top-level category, and only the accounts used by that fund, show up on that fund’s report. In other words, accounts with no activity for a fund will not show up on that fund’s reports.

Accrual vs Cash Based Accounting

One last thing to keep in mind when setting up the chart of accounts, is the method of accounting your organization will use.

The primary difference between accrual and cash-based accounting is the timing of when revenues and expenses are recognized. In addition, it’s much easier to make corrections on cash-based transactions than on accrual-based transactions.

Accrual based accounting

How does the accrual method work? The bookkeeper completes an accounting entry when a bill is received. This entry hits the appropriate expense account and the accounts payable account. There is no checkbook involved in this first stage. The expense is realized with the appropriate date and moved to accounts payable. However, the money doesn’t leave the checkbook at this time. The entry is made in the accounts payable module using a credit to liabilities. The opposing disbursement is a debit to an expense account.

How does the bill get paid since we didn’t write out a check? When the time comes to pay the bill, the bookkeeper does an entry to cut the check. They credit the checkbook and debit the accounts payable (not the expense account). This is when the cash leaves the organization. Essentially, the dates of the expense and when the cash leaves the organization can be in two different months.

As you can see there are two separate entries happening to pay a bill via the accounts payable, and numerous accounts are involved. This example used the expense account, the liability account (AP) two times, and the checkbook. This is why when a mistake is made, it takes more effort and time to fix it.

Cash based accounting

Cash-based accounting happens with one transaction and is much easier to use. In cash-based accounting, the entry is a debit to an expense and a credit to the checkbook. In this instance, the expense is recognized immediately and the cash leaves the organization the moment the entry is completed. When a mistake is made, the bookkeeper simply has to make a correction to the expense and checkbook.

Most churches are cash-based, but if you are wondering what method you should be using, check the church’s bylaws. Typically they will have documented if the church is required to do accrual-based or cash-based accounting.

Chart of Accounts Summary

In this series, so far, we’ve defined what makes up the chart of accounts, how its organized, how it affects reports, the various methods of accounting such as cash and accrual-based, some do’s and don’ts, and what normal balances are for each type of account. We also defined equity as fund balances, different than for-profit accounting and owner’s equity. Understanding this concept is very important because it drives the whole underlying structure of a nonprofit.

There are many more reasons churches need to have fund accounting implemented in their accounting books. Anything less is unacceptable when it comes to the church’s accounting and transparency.

Your 30-day free trial of IconCMO is ready!

For future reference, an email with your log in credentials is on its way to your inbox. If you do not receive an email or have any other questions, please contact our sales department at 1-800-596-4266 or sales@iconcmo.com using the following account number: .

An email with your free trial is on its way to your inbox. In the meantime:

If you do not receive an email or have any other questions, please contact our sales department at 1-800-596-4266 or sales@iconcmo.com using the following account number: .

Leave a Reply