This post was last updated on November 22nd, 2021 at 01:02 pm.

In case you missed the other parts here they are.

- In this first part we will cover what normal balances are and the various sections of the chart of accounts.

- The second part goes over the chart of accounts order- its numbering, how the order of accounts translates to reports, some do’s and don’ts, and finally the two main methods of accounting.

Church Chart of Accounts Introduction

In this third part of our introduction, we’ll go over the reason equity accounts are equivalent to the funds in a nonprofit accounting system. Additionally, we will discuss the importance of having these equity accounts outside the chart of accounts and what extra functionality it gives the church in its reporting. For churches, it’s paramount that the funds and the chart of accounts work together to provide FASB, GAAP, and IRS compliant reporting.

Why Equity Accounts Aren’t In The Chart Of Accounts

We need to address why owner’s equity accounts are not listed in the chart of accounts for churches. Mainly, there are no owners of churches, thus using the verbiage ‘owner’s equity’ would not be an accurate statement. Below we’ll discuss why equity accounts are excluded from the chart of accounts for nonprofit organizations.

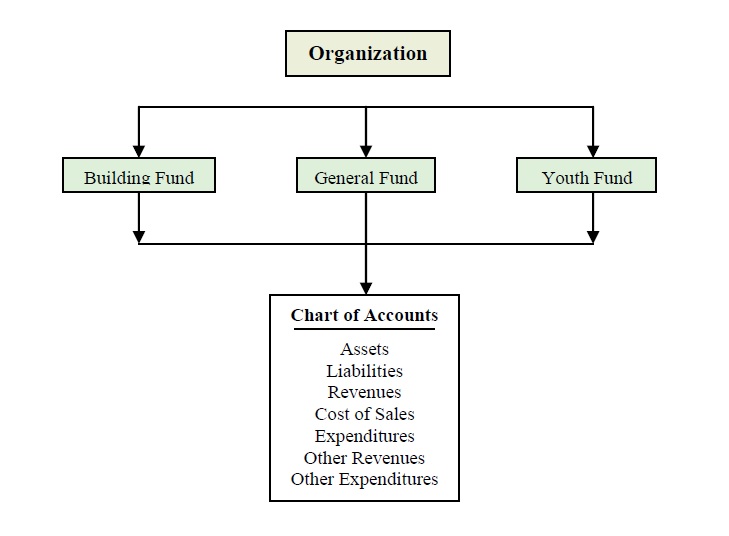

Churches use fund accounting which eliminates the need for equity accounts. In other words, the funds are the equity accounts. Fund accounting allows the church to report on the equity for each separate entity. For simplicity, we will call these separate entities, “mini” organizations. When these mini organizations are combined, they make up the entire church. These mini organizations would be something like General Fund, Youth Fund, Missionary Fund, and so on. Let’s see how this might look in the image below- where the funds are pulled out and sit above the accounts in the chart of accounts.

These mini organizations are the equity accounts which hold the balance of the chart of accounts. Having these mini organizations outside the chart of accounts gives the church more flexibility with reporting. Balance sheets or P&L financial reports can be run for the entire organization (all funds), or per mini organization (i.e. individual funds). Essentially there are two levels of reporting – 1) using the funds and 2) using the accounts. This two-level categorization, unlike for-profit accounting systems, can then report on a fund or an account, or both at the same time.

To learn more about the differences between for-profit and nonprofit accounting systems go here to check it out.

How Do Church Revenue Accounts Work In Fund Accounting?

The church’s revenue account should remain generic even when using multiple funds.

- Revenue

- Donation Revenue

- Rental Revenue

- Fundraising Revenue

How can we use a generic naming convention for revenue accounts when using multiple funds in the church’s accounting books? Because the funds are used in conjunction with the accounts, it allows a categorization at both levels. The best way to describe this is that the transactions are tagged with the fund name and the revenue account. Using tagging, a report is created first by looking at all the transactions that are tagged with the desired fund category and pulling those transactions out. Then the report organizes the accounts in the order needed for the profit and loss report, which is revenues first then expenses. For the balance report, it would be assets, then liabilities.

To further explain how the transaction might look with the tagging let’s review the six transactions below.

| Date | Revenue Account | Fund | Amount |

|---|---|---|---|

| 07/01/2021 | Donation Revenue | General Fund | $125.00 |

| 07/05/2021 | Donation Revenue | Mission Fund | $30.00 |

| 07/06/2021 | Rental Income | Building Fund | $500.00 |

| 07/10/2021 | Donation Revenue | General Fund | $1,000.00 |

| 07/15/2021 | Donation Revenue | Mission Fund | $35.00 |

| 07/20/2021 | Donation Revenue | General Fund | $550.00 |

In a for-profit system, note the fund column wouldn’t be present, hence why the organization couldn’t separate the revenue by that category. But a good church accounting system would have this category. Let’s see how this extra category helps in regards to the revenue piece of profit and loss report. Here’s the profit and loss report for the General Fund.

Statement of Activities (P&L) for the General Fund

- Donation Revenue ———————————————- $1,675.00

- Expenses would follow here …..

Note: The church software will look through the transactions and pull out the $125.00, $1,000.00, and the $550.00 and add them up which totals $1,675.00. Note the other revenue accounts, such as Rental Income, do not show up because that is a Building Fund category.

Statement of Activities (P&L) for the Mission Fund

- Donation Revenue ———————————————- $65.00

- Expenses would follow here …..

Note: The church software will look through the transactions and pull out the $30.00 and $35.00 and add them up which totals $65.00. In this case, some Donations and the Rental Income are not included. Again it’s because this report is for the Mission Fund only and not the General or Building Fund.

Statement of Activities (P&L) for the Building Fund

- Rental Revenue ———————————————- $500.00

- Expenses would follow here…..

Note: The church software will look through the transactions and pull out the $500.00. There is only one transaction that is coded to the Building Fund.

nly one transaction that is tagged to the Building Fund.

Funds work together with the accounts to separate the revenue account totals into three different reports as seen above. Fund accounting and the church’s chart of accounts work together to provide the data on the reports in multiple ways. Keep in mind the church can still run a report to combine all of these revenues (or expenses) into one report to get a grand total.

How Do Church Expenses Work In Fund Accounting?

Expenses work the same way revenue accounts do when it comes to reporting. Just like revenues, each expense account would have a fund attached to the transaction as seen below. We can then pull out each expense transaction and create the profit and loss reports in regards to the expense side of the report.

| Date | Expense Account | Fund | Amount |

|---|---|---|---|

| 07/01/2021 | Utilities Expense | General Fund | $125.00 |

| 07/05/2021 | Haiti Missionary Expense | Mission Fund | $30.00 |

| 07/06/2021 | Building Repairs | Building Fund | $500.00 |

| 07/10/2021 | Water Expense | General Fund | $100.00 |

| 07/15/2021 | Bolivia Missionary Expense | Mission Fund | $35.00 |

| 07/20/2021 | Van Repair | General Fund | $500.00 |

As we could do with revenues, we can now pull out the expenses for each fund and create three different reports based on the fund (i.e. the ministry focus).

Statement of Activities (P&L) for the General Fund

- Donation Revenue —–

- Expenses —————————————- $725.00

Note: The church software will look through the transactions and pull out the $125.00, $100.00, and the $500.00 and add them up which totals $725.00. All three of these transactions are tagged with the General Fund.

Statement of Activities (P&L) for the Mission Fund

- Donation Revenue ———–

- Expenses ————————————— $65.00

Note: The church software will look through the transactions and pull out the $30.00 and $35.00 and add them up which totals $65.00.

Statement of Activities (P&L) for the Building Fund

- Rental Revenue —————

- Expenses would follow ——————— $500.00

Note: The church software will look through the transactions and pull out the $500.00. There is only one transaction tagged with the Building Fund.

Summary

In this third part, we see how funds work with the accounts within the chart of accounts to produce reports that are mission-focused. The common name for this is fund accounting. It allows the church to break out the financial data information into what we call mini-organizations, such as, General Fund, Building Fund, and Mission Fund. These mini-organizations allow separate reporting so the church can review each mission-focused area and its financial health.

Leave a Reply