This post was last updated on July 30th, 2024 at 08:57 am.

Charitable giving and church software go hand in hand. When a charitable donation is received, the nonprofit organization must record the entry to provide a tax statement to the donor. These tax statements are an important element to the donation process in that they provide proof to the IRS of what the donor has contributed. Of course, this tax statement is not the only reason people give. We will discuss donations in-depth and the reasons why churches need good software. Quality donation software does a lot more than provide the donors end-of-year statements. What other things should the software do?

Communication For Charitable Giving

Aside from the end-of-year statements, good software will provide a way to communicate with your donors. As an organization, you should have your donors segmented into proper groups. For example, when a big project comes up, the church knows who to rely on for sizable gifts to kick start the project. Communicating with this group of people is vastly different than communicating with say, the faithful, weekly givers. Yet, another group where the communication is different is the donors who aren’t giving at their full potential.

Each church’s criteria on how they break these groups out will be different. Some donors may be in multiple groups, which is okay. In marketing, we call this marketing segmentation. The main consideration is that whichever group they are in, the marketing messages relate to that group.

To illustrate, let’s use a clothing company that sells women’s, men’s, and children’s clothing. When they communicate to their customers or email list, they communicate (market) very differently to men vs. women. Additionally, they would probably break down these two main groups into various ages as well. Why? Because they know marketing to 15 – 20 year old men is different than marketing to 40 – 50 year old men. The clothing company creates different marketing messages for these groups because of their demographics. Shouldn’t the church do the same?

Membership Capability For Donor Giving

Having donor information like mailing addresses, phone numbers, emails, and birthdays, is essential to know your audience. This demographical data is just part of what a nonprofit needs, to engage effectively with its donors. Retaining the demographical information about donors coupled with communication, creates a strong software package. It enables effective marketing to the church’s donors, based on demographics, their previous donation history, and more.

The membership capabilities extend into donation recording as well. It’s basically the start and end of the entire process. First, you gather names, email addresses, and other data about the donor and their family. For example, they may have donated to your organization via check so you have some of their information. Or maybe the information came from a contact form on your website they filled out.

After the initial data is entered from the contact form, the church secretary may place them into a group such as ‘possible new donors’. Whereas, if they already gave once, the group may be called ‘new donors’. From here, the church starts to market to them with automated emails, or maybe a phone call here and there. The marketing messages would be different for these two groups.

When church marketing pays off!

When the marketing effort pays off via a received donation from the family, the church enters it into their charitable giving software. This keeps a record of their giving, so the church can provide the donor with an end-of-year statement. It is also tied to the membership software.

At this point, the church may change how they market to that family. Should they be moved out of the ‘possible new donors’ group into another group like ‘new donors?’ This would allow the church to keep the marketing message relevant to the family. When your charitable giving and membership are in one system, it’s easy to move donors to other marketing segments as their giving changes.

Accounting Capability – Spending Charitable Donations Correctly

When the accounting books are a part of the all-in-one package it makes a big difference. Churches must spend their donations, not only wisely, but within the legal requirements. Spending the donations must follow fund accounting principles. When donations are received and entered into the donation module, the accounting software needs a similar entry. Packages, like IconCMO, automatically post donations to the accounting module, reducing entry errors and saving time.

Nonprofits, like churches, must use a fund accounting system to stay compliant. What a fund accounting system gives you, is the ability to keep funds separate. In other words, it helps the church avoid spending money out of a donor-advised fund such as ‘Haiti Mission’ on something that the General Fund should be paying for. Because the ‘Haiti Mission’ is what they call a donor-advised (ie: restricted) fund, the money spent out of it can only be used for that area of operation. A good accounting package linked to the donation package helps track this and keeps the church on the straight and narrow.

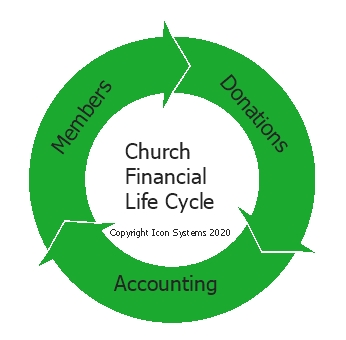

Church’s Financial Life Cycle

We have illustrated below, what the church’s financial life cycle looks like visually. The church starts with the members area where they communicate with them and foster relationships. These members (or visitors) give money — aka donations. Those donations post to the person’s account for tax statements at the end of the year. Additionally, the donations post to the church’s accounting books. Then the church spends the money as instructed by their donors or via the General fund which the church controls. The church reports back to the donors their mission’s progress throughout the year. When donors see progress or other mission needs, the cycle starts all over with donors giving donations in the future.

Shouldn’t your church software replicate what happens in real life? Having separate software that handles each of these areas is a bad idea. They work together and should be in one package.

Charitable Giving Conclusion

Charitable giving is not easy. There is a lot to think about from the time of first contact with the donor to their first donation, all the way through to say thank you for each received donation. A good charitable giving solution will help you with each of these tasks:

- automating emails,

- recording the donations,

- preparing donor year-end statements,

- tracking pledges,

- posting to the accounting books automatically,

- saying thank you to your donors,

- marketing to various different donor segments with relevant messages,

- preparing financial reports to your congregation on how the church spent the money throughout the year,

- and so on.

As you can see a good charitable software will have a lot of moving parts. Each of which is important to ensure the donations entrusted to the church are not only used wisely, but accounted for, donors are given credit, and the church reports back to the donors their progress in fulfilling the church’s mission.

Contact Us for a 1-on-1 Guided Tour!

Thanks for scheduling a time with us!

Looking forward to talking with you,

Carrie at Icon Systems, Inc.

Nice post, thanks a lot for sharing as it comes with a lot of useful details.