This post was last updated on May 26th, 2022 at 09:31 am.

The year is 2007 and the iPhone was just released and churches are still getting use to their online church finances programs. Thirteen years later, online is the only way to go. So what does the church look for in getting the best church finance software in 2020? To have the best church finance software in the industry, it must check off a lot of boxes. Let’s go over what church finance software should have at a bare minimum.

Rule #1 Staying Compliant — Don’t Use Quickbooks

The legal mumbo gumbo

Let’s start with the legal mumbo gumbo. Churches operate as not for profits, which dictates they must use fund accounting as their accounting method. That method of accounting is governed by FASB, which produces the GAAP and the fund accounting principles. These principles state how the not-for-profit must — without exception, handle their books or suffer consequences. These consequences can include losing the church’s tax exemption status.

Staying compliant with FASB and GAAP

Now that legal mumbo jumbo is out of the way, let’s focus on what’s needed to stay compliant. Because FASB states churches must use fund accounting, this dictates the programs you can use. A lot of churches will try to use Quickbooks. Unfortunately, Quickbooks is not a fund accounting system. There is a lot of great fund accounting software that was built specifically for churches, unlike Quickbooks and other for-profit systems.

Some well-known church software companies that lack a fund accounting package will often advise churches to use Quickbooks plus their church software. This ill-advised advice further steers churches from doing their books correctly and staying compliant. Why would they give bad advice? Simply put because their system does not have fund accounting and they want to make a sale. They are not looking to keep the church’s costs low because now the church needs to purchase Quickbooks in addition to this company’s software for membership and donations.

When looking for church software, and they tell you that the church can just use Quickbooks for your accounting, run like the wind! Likewise, if a council member or treasurer says you can use Quickbooks, then we suggest the church educate themselves about fund accounting. In both scenarios, these well-intentioned people have not reviewed the rules or possible ramifications for the church in regard to fund accounting. In both cases, they are steering the church in a very bad direction. Why? Because if the church chooses an improper accounting system, it could lose its tax exemption status.

Rule #2 Separation Of Donor Restricted Funds

The separation of restricted funds is one of the primary goals of fund accounting. The church needs the ability to see how each mission in their organization is doing financially. Fund accounting provides accountability of donations for churches, unlike a for-profit system. A proper fund accounting software accomplishes this with very little effort. Without this capability, the church would spend enormous amounts of time deciphering its numbers and then separating them into various reports to show accountability and financial stability.

How does the fund accounting method keep donor-restricted funds separate? Fund accounting in its simplest terms allows the bookkeeper to enter transactions using the typical debit and credit like any other system, but tag the transaction with a fund. This extra piece of information allows a fund accounting system to group transactions by the fund and create all the necessary reports, by each fund. This tagging allows the reports to show restricted versus unrestricted funds. This separation of restricted versus unrestricted funds is based on the FASB rules which all churches must follow.

Rule #3 Flexible Chart Of Accounts

An accounting system must have a flexible chart of accounts (COA). It should have the ability to use numbers with names or just names. For example, a COA should be able to have the ability to name an expense account like this.

- 6000 Car Expense ~~OR~~

- Car Expense

As more people switch to computerized accounting systems the trend we see is they just use names for their accounts as humans are better with names than remembering numbers. Numbered accounts were used historically when accounting systems were mostly paper ledgers as it was easier to record transactions, using a 3 or 4-digit number than writing out the name each time.

Rule # 4 Self Balancing Funds

An important part of a fund accounting system is the ability of the funds to self-balance. On each transaction in the accounting system, the self-balancing aspect is what makes a “for-profit system” work differently than a “not for profit system”. This difference affects everything from entering transactions to the generated reports. Unlike for-profit systems, the self-balancing ability allows the required not-for-profit reports. To be considered the best church finance software, it must have self-balancing funds.

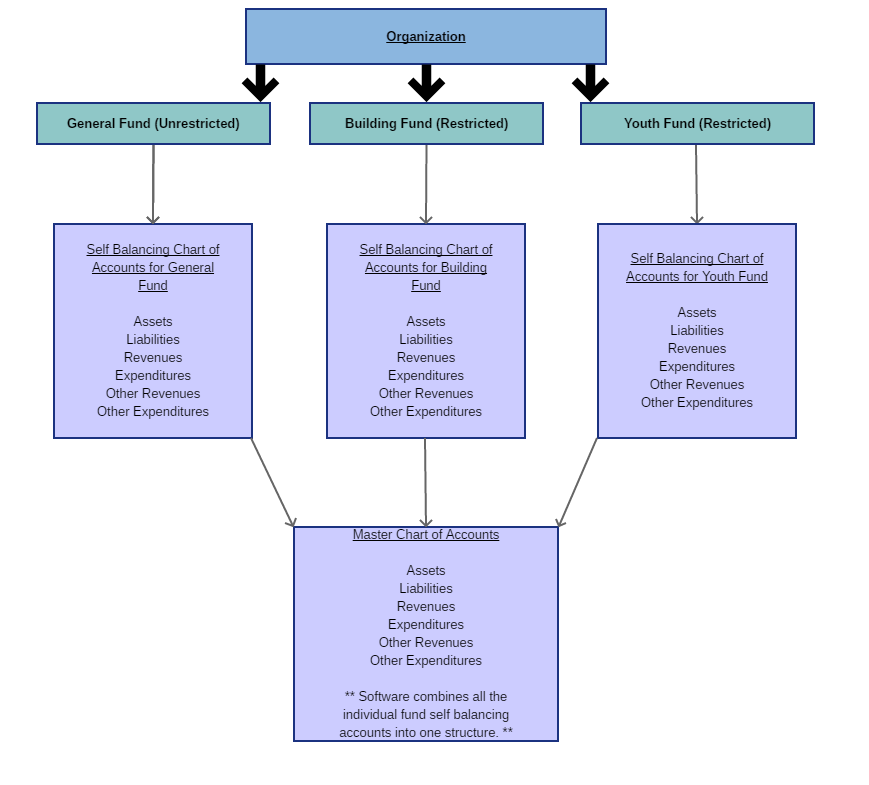

Below is a picture representation of self-balancing funds and their relation to the Chart of Accounts (CoA).

The self-balancing structure keeps the resources for the General fund separate from the Youth fund. The churches can report specifically on how certain missions, community outreach, and so on are doing by using funds. In the above picture representation, the Youth, Building, and General fund would all have their own reports. In other words, they can print a report for the Youth fund and only see the transaction(s) that affected the Youth fund. All other General and Building fund transaction(s) are ignored. This capability allows churches to see how their Youth program is financially.

Here’s a simplified explanation using a purchase of food for the youth camp. The transaction would have a debit and credit using the accounts under the Youth fund, only. So there would be a debit to a “food” expense and then a credit to the checkbook. These credits and debits are encapsulated with the tag of ‘Youth Fund’. This tagging, allows an accounting system to prepare reports, give balances, track expenses/revenues, and so on by fund without including information from the other funds in the report. By doing this, the fund stays in balance with itself. Remember that old accounting equation from college — assets minus liabilities equal equity.

Rule # 5 Must Use Double Entry For Accounts

We briefly discussed in rule #4 that credit(s) and debit(s) are needed for each transaction. This is commonly called double-entry accounting. This simply means that for anyone transaction there are always two entries. There can be more, but the minimum is two. So if you pay an expense from the checkbook you have a credit that goes against the checkbook. This subtracts money from the checkbook. But you must also record a debit which in this instance would go against an expense. This debit would add the amount to the running total in the expense account. This credit and debit would be the two sides to the transaction — thus the double entry.

In our personal finances, we don’t do this double-entry accounting so it can be confusing. We just deduct an expense from the checkbook and go about our day. But the double-entry method allows us to record the expense in a ledger so we can go back and know how much we spent on gas, food, lawn maintenance, and so on. This double-entry method is an absolute ‘must have’ in any accounting system.

An in-depth look how double-entry accounting and funds work together

When it comes to fund accounting, these debits and credits have funds associated with them for every transaction. Let’s use the food example from before. You would have one expense for Food in the CoA, but all the funds that you have can use that one account to apply transactions for their ‘food’ needs, when needed. So the General fund buys food for a staff meeting, the Youth fund buys food for a youth camping event, and the Building fund buys food for a project committee planning session. Some questions come to mind.

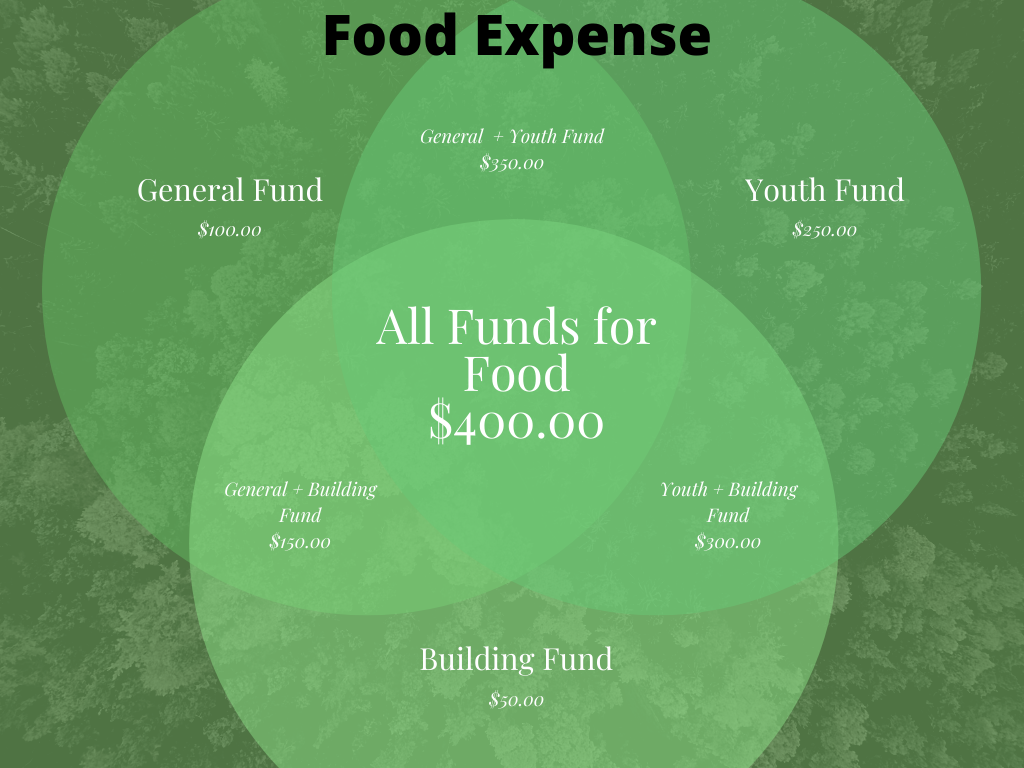

How would you know how much the Youth paid for food for their camping event? Or how much was the staff lunch? If everything was put into one expense account called “Food Expense” all three of these would be lumped together with no way of breaking them out. Another question is how much did the organization pay for food altogether? A fund accounting system can answer all these questions plus more. Let’s illustrate this using a Venn diagram.

The above illustration shows the CoA food expense. In fund accounting every account would have a similar break out like this depending on the number of funds. Above we are using three funds, thus 3 circles. The assets, liabilities, revenues, and expenses would all have a similar representation. How does this help? It answers a lot of questions while keeping the CoA simplified.

Questions are answered when funds and accounts are used together

So what questions are answered when funds and accounts work together? A lot more than when a for-profit system was used like Quickbooks. Let’s review them.

- Using the picture illustration above we can see that the total for the “food” expense was $400.00. This would include all three funds’ food expenses. This is the number you would get out if using a for-profit system.

- Next, we can see how much each ministry area spent on food. For example, the General fund spent $100.00 while the Youth fund spent $250.00. The Building fund spent $50.00.

- Next, we can report the money spent on food between restricted and unrestricted funds. This reporting is required by FASB. Let’s suppose the organization has two restricted funds – the Building and the Youth fund. Furthermore, they have an unrestricted fund which is the General fund. What questions can we answer?

- First, the restricted funds spent $300.00 on food.

- While the unrestricted, as it only has one fund — the General fund, spent $100.00 on food.

As you can see this fund and CoA structure gives answers to all the church’s questions about their areas of ministry, restricted vs unrestricted, and so on. A for-profit system, like Quickbooks even when tailored for a church, simply fails in this regard and does not pass FASB guidelines.

CoA is simplified when funds and accounts work together

Without the funds working in conjunction with the accounts, the church would need three expense accounts just for food. They may be named something like this.

- General Food

- Youth Food

- Building Food

Now imagine that structure for the entire chart of accounts. This is only for three funds. What happens if you have 20 -30 funds? The CoA would have tens of thousands of accounts. Using the structure shown in the illustration you have one account called “food” and the funds own their part within that account.

Rule # 6 It Doesn’t Use Liabilities or Classes For Funds

Many systems that were created for the for-profit industry, use workarounds to adapt their system to work in a church. Some of these workarounds are using liabilities or Quickbook’s classes. This is wrong on so many levels, so we will tackle the liabilities method first. Then we’ll tackle using classes like Quickbooks recommends. Both of these workarounds don’t make for having the best church finance software for your organization.

The problem with using liabilities for funds

First liabilities are defined as money you owe someone, right? So how can funds which have your available resources (ie cash on hand), suddenly become liabilities where you owe money? Simply put that is craziness. You are swapping your on-hand resources into a loan. A loan has to be paid back to someone. Does that make any sense?

Let’s illustrate this a little more plainly using our own personal finances. This is like taking money you have in your household to the bank and handing it over to them. But instead of them putting it into a checking account, they open a loan account in your name where you pay them a monthly installment. Hold on… you gave them money – ie an asset. But they turned it into a liability via a loan that you have to pay back. Ludicrous right? You are paying the bank on a loan, and the money from the loan is your own money.

But this method of using liabilities for funds is exactly what Quickbooks advises churches to do. It is a workaround because of their software’s shortcomings. Why this workaround? Simply put there are inherent flaws in Quickbooks which limit its capabilities in fund accounting and they can’t be fixed without a rewrite of the Quickbooks program structure.

The problem with using classes for funds

The issue with using classes is this only allows a two-dimensional reporting structure. You have the accounts (ie expenses, assets, liabilities, and so on), and the classes. But not for profits need to have more than two-dimensional reporting.

Not for profits need to report in more than two dimensions (ie. accounts and classes). Their reporting is more complex than that of a for-profit system. They need to report at the account and fund level. Next, they need to report by restricted and unrestricted funds. And finally, all levels must roll up to an organizational level. If that wasn’t tricky enough, each level must stay in balance. What does that mean? By using the account equation — assets minus liabilities equals net assets each level must obey this equation.

So what happens when Quickbooks can’t do the complex reporting needed? Most of the time the church creates some spreadsheets outside of the accounting system. At Icon Systems we love innovation, but this is probably where churches should avoid internal innovation and creativity. Because of these Quickbook workarounds, it should not ever be on the list of best finance church software.

Accounting is one area where we would stress that innovating your own spreadsheets lead to inaccuracies and inconsistencies, deficient internal controls, and mistrust. Creating a spreadsheet from scratch, that handles complex accounting scenarios isn’t in most churches’ repertoire of tools. Spreadsheets, as good as they are, can’t account for every single accounting scenario. When one formula is incorrect in a spreadsheet, then the entire report is wrong. True fund accounting systems have checks and balances to avoid this that are built over time — many decades to get it right.

Rule # 7 The Financial Reports Must Calculate Correctly

There are three primary financial reports for any not-for-profit organization required by FASB. They are the balance sheet, profit and loss, and cash flow statement. And all three work together when giving a financial picture of the organization. In other words, they should calculate correctly between each one, by fund and account. If you do not know how these financial statements relate to each other we recommend watching this Khan video before moving on.

Note: In the not-for-profit world these are called Statement of Financial Position for the Balance Sheet and Statement of Financial Activities for the Profit and Loss Report (P&L). To simplify this blog post, we will refer to them by the common names everyone knows — balance sheet and profit and loss (P&L).

P&L and balance sheet characteristics

The profit and loss statement (P&L) and the balance sheet work together to give a full financial picture of the organization. Let’s first go over a few basics. A P&L goes by a date range and shows all revenues and expenses that were received or spent within that date range. There is no carry-over for any of the accounts from one year to the next. A balance sheet goes by an end date and is a snapshot of assets and liabilities on that date. There is no date range for this report. There are carryover balances from one year to the next in these accounts.

Additionally in the following example, we will use the cash-based method. When the organization is using accrual-based accounting, things get more complex and you need to look at another statement called the cash flow report.

How do the P&L and Balance sheets relate to each other?

Let’s review how the P&L and Balance sheet work together. The net income from the P&L is applied to the Balance sheet which either increases or decreases the equity of the organization. The P&L’s “net revenue” is after all revenues and expenses are accounted for. Thus the Balance sheet can take the net revenue and apply it to the appropriate Balance sheet accounts. Then the Balance sheet subtracts the liabilities, to finally give the organization’s equity. Essentially the numbers flow from the P&L into the Balance sheet, which in return shows the outstanding liabilities, if any, and what is on hand for resources.

Very Important Note: In the section above when discussing the balance sheet’s equity, keep in mind that in a fund accounting system this is broken out across multiple funds. It’s not lumped together as one number like a for-profit accounting system or the above section alludes to. This is a very important distinction to understand because it does add a level (or two) of complexity to the various financial statements that are not shown in this section. We kept the above section very basic on purpose, to explain the financial statements’ relationship.

Cash flow report

We recommend reviewing this quick Khan video on how the cash flow report relates to the other two financial statements before moving on.

For an accrual-based system, the Cash Flow report will help the organization reconcile cash differences. Why would there be cash differences between balance sheets for various months? As the video showed it comes down to how we account for Accounts Payable (AP) and Accounts Receivable (AR). It’s possible to not have enough cash in the checkbook even though the organization took in enough revenue to pay all expenses. These AP and AR scenarios are beyond the scope of this blog post and aren’t discussed in the previous example.

Best Church Finance Software Summary

These seven rules are essential and the bare minimum for having the best church finance software for your organization. It must be compliant with FASB to avoid getting audited by the IRS and allows the organization to keep its tax-exempt status. The church finance software must allow the separation of restricted and unrestricted funds by providing financial statements for each category that self-balance. Lastly, the organization’s financial statements must correlate with each other. As you can see, having the best church finance software must check off a lot of boxes to get just the bare minimum in one package. And yet, we haven’t even touched on things like ease of use, monthly reconciliations, and other financial reporting- like budgets, and so on.

But rest assured, Icon Systems can provide all of these requirements in IconCMO plus budgeting, ease of use, reconciliation, and more. Test drive IconCMO for 30 days, no credit card required. We have you covered and can keep you from losing your tax-exempt status.

I appreciate the information provided on this blog, this has certainly helped open up with a new mindset.