This post was last updated on July 24th, 2024 at 09:44 am.

Introduction to Accounting Software for Churches

In this post, we are going to discuss the seven sins of accounting software for churches. We will uncover the reasons for when church accounting goes wrong and discuss some possibilities of why it happens. Spoiler alert — it typically starts from inside the church. Next, we’ll go over some areas the IRS reviews closely that may trigger an audit and explain them in a little more detail.

The 7 Sins of Accounting Software for Churches

The church’s theology oftentimes references the seven deadly sins or cardinal sins. In case you’ve forgotten, these sins are from our early bible school days. Let’s review; they are pride, envy, gluttony, lust, anger, greed, and sloth. In church accounting there are seven sins churches should avoid at all costs. Why? Given the IRS’s broad auditing power, they can make life on earth miserable for the church.

Sin # 1 — Ill-informed understanding of financial statements

Churches put a great emphasis on operational budgeting. However, budgets are not financial statements. Seeing and understanding the complete financial picture of an organization requires using all the financial statements. Operational budgeting is a tiny sliver of the overall picture, but churches spend 90% of their time on it.

How can church accounting software help with financial statements? Good software produces accurate financial reports. While software can’t tell you how to read them, it does the heavy lifting. It produces the reports accurately for the organization. It’s up to the church and its leadership to educate themselves on how to read these financial statements. Why not just review the easier budget reports? Because budgets have many flaws discussed below.

The problems with budgets

Operational budgeting doesn’t answer questions like capital replacement costs or how to pay for them. Budgets don’t show accumulated assets over time. Also, budgets don’t account for things the organization spent resources on until after the fact. Budgets only show revenue and expenses — not how much you owe someone as in a liability. While budgets are a nice tool, they do not tell the organization how financially healthy they are.

Financial statements, NOT budgets, tell the whole story

When you don’t review and understand financial statements, it can hurt the church. One example is when a major item (expense) is needed right away. Think about your capital expenses like a new roof that cost tens of thousands of dollars. Or the heating system goes down and needs to be replaced. Financial statements, not budgets, tell you how well you’re positioned financially to take care of it. When you only budget on the operations of the church without considering these items, something eventually goes bad when you least expect it. Budgets only work with operating expenses. They do not plan for capital expenses.

What happens when churches don’t review their financial statements? Their luck runs out, eventually. A big-ticket item goes bad and they need a lot of money to replace it. The problem is they don’t have it in their budget. Remember budgets aren’t financial statements so they can’t help you with this. So the church says we’ll just do another ‘special appeal’ to the congregation. These repeated requests wear thin with a lot of donors.

Sin # 2 — Internal control problems lead to fraud

Internal control problems can come in many forms. Some examples include:

- Short-term volunteer turnover.

- Not enough signatures are required on checks.

- A volunteer treasurer who is related to someone within the church’s leadership.

- Treasurers many times aren’t professional accountants and aren’t bound by the appropriate codes of conduct which leads to lax day-to-day accounting functions.

- There are very few checks and balances, like having an invoice for every expense, accountability of petty cash, and spending on items that aren’t in the budget.

- Dissuade electronic giving.

Some of the above items are self-explanatory but there are a few that need some explaining. Short-term volunteer turnover leads to an issue called corporate amnesia. This is when a trained person leaves the job, and the majority of the knowledge leaves with them. This happens even if they train someone else before they leave. And it’s worse if they don’t train anyone and the incoming person has to figure everything out. This process plays out in churches every day because many positions change each year.

Use non-professional or volunteers accountants

Treasurers many times aren’t professional accountants thus there is no code of conduct. There are some churches that are fortunate enough to have a CPA or Enrolled Agent as their church’s treasurer. They are bound by a code of conduct or risk losing their license. But most churches rely on a paid person or an unqualified volunteer to maintain the accounting records. They are not bound by any code of conduct.

Churches rely heavily on their volunteers to fulfill their mission(s). Without them, the church would struggle financially. All bookkeepers, volunteer, or salaried employees need appropriate training. The bookkeeper position changes frequently in some organizations because of bylaws. This has its own set of challenges like ‘corporate amnesia’, discussed earlier. Over time this becomes a huge deficit. One way to help with this is by training people consistently.

The church’s accounting books should be in the hands of people that want to do the job. They also have excellent record keeping and organizational skills. They should not be related to the church’s leadership nor be the only person that signs checks. It is up to the church leaders to put in place internal processes to prevent fraud. The bookkeeper’s job is to follow those processes. You typically do not want the bookkeeper to create the processes for themselves.

Background checks protect the organization’s resources

Background checks are great tools. The church should require background checks for any accounting position. But relying solely on them is unwise! Why? Because 96% of fraud perpetrators are first-time offenders. In other words, 96% of perpetrators have never been charged or convicted of a fraud offense. Their background is clean. This is according to the MN AFP (Minnesota Association For Financial Professionals) page 18.

Many organizations including churches think or say ‘This could never happen to us because we are a church’. Think again! Over the course of seven years, Anita Collins stole one million dollars. Who did she rip off? The New York Archdiocese. What is astonishing is she had a criminal background record for theft before they hired her in 2003. They admitted they did not conduct a background check before hiring her. How did she do it? She issued checks under the $2500.00 threshold which required dual signatures. She fabricated 450 invoices for accounts she controlled.

How does accounting software for churches help with internal controls?

First reviewing the monthly expenses using the statement of activities is a start. Most church boards know the common expenses and their cost each month. A quick review of the statement of activities will show these and if they are in line with ‘normal’. If so they can probably move on. Next, you zero in on items that don’t appear normal. These might be expenses you have never seen before. Or possibly they are expenses that repeat each month or so just under the dual check signature threshold.

Reviewing supporting documentation for expense accounts each month is crucial. The size of your chart of accounts will dictate how many you can do each month. If you can’t review all accounts each month, then select just a few. The next month pick ones that weren’t reviewed in the previous months. You keep doing this throughout the year. What are you looking for? Discrepancies! The bookkeeper should have supporting documents such as invoices for each expense account. Likewise, the revenue account should have deposit slips and other supporting documents. Filing the supporting documents is crucial so if they suddenly become lost, it is a bad sign.

What do the fraud experts says?

As Steven J. Durham from the Fraud and Public Corruption Section United States Attorney Office, Washington D.C. says — “Employee embezzlement schemes are often the product of an absence of proper internal controls OR a breakdown of those controls. Regular audits and control testing can help to mitigate exposure.” Matching invoices to expense accounts on the financial statement is one way to audit. By reviewing checks written — you are doing a regular audit and testing the controls you have in place. Not only that but you are letting the people in the accounting area know, that it will be pretty hard to get away with fraud. By doing regular checks, it psychologically tells people you are staying on top of things.

Sin # 3 — Donor fatigue when financial goals aren’t communicated

In short donor fatigue is asking donors over and over to support the ‘next’ cause, but the donor received no update from the previous cause. Donors like to see progress when donations are sought. In fact, when progress is shared with donors, donations increase. Many would say donors should give out of obligation or duty. But that tired argument falls on deaf ears for the majority of the population.

Seems like a lot of work to update our donors some churches may say. Maybe, but churches should exude transparency in every way possible. By summarizing what donations came in, and linking them to the church’s financial activities error is eliminated. This is why having donations and your finances in one accounting software helps a lot. Having the ability to track the money coming in through the donors, into the church’s revenue accounts and checkbooks, then finally leaving via an expense account gives the church the most details to share with their donors. It gets donors emotionally tied to the mission and motivates them to give.

Sin # 4 — Lack of ownership of financial resources

When an organization places ownership on one or two people for the church’s finances, there is no buy-in. Church accounting and reporting should have an organization-wide interest and responsibility. Oftentimes, churches don’t discuss finances as a whole. Church finances should bring the issues out in the open and create the organization’s mission.

How does accounting software help in getting the organization to realize its financial potential? Using accounting financials for transparency is a good start. The church’s leaders must break up the numbers from the financial statements into smaller chunks. Sharing the financials with the congregation creates a personal connection between the church and their donations. By linking the financials and the fulfilled missions back to the donations, member’s donated more consistently. This helps during slower periods such as summer.

Sin # 5 — Avoid robbing Peter to pay Paul

Accounting software produces statements that clearly show robbing Peter to pay Paul. Some examples of this are when a church is in decline, and they sell an asset such as land, buildings, or something of value. There are times when selling an asset makes sense because you do not need it anymore. But if the only reason you are selling is that you can’t make salaries this month, then that is a problem.

This is when the church needs to decide, sooner rather than later, what to do. When selling off assets to meet monthly obligations, most would say it is time to make some serious decisions about the church’s finances. Good fund accounting software could give you indications of cash shortages. Let’s look at a few.

Ways to determine cash shortages early

The Statement of Activities shows the net revenue which is the revenue minus the expenses for the month. If your net revenue is negative for any period of time, it is a huge red flag that the organization did not take in enough money to cover expenses. A more subtle indicator is if you see a gradual decline in net revenue month over month or year over year. The easiest way to see this is to review the Statement of Activities monthly and watch the trend.

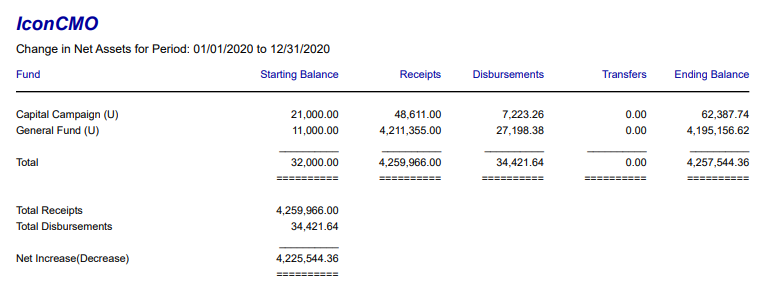

Another way is to review the Change in Net Assets report. A good church accounting system can give you the report, seen below. This report breaks things down by the fund and its starting balance, on the date you choose. The user also chooses an end date in which the report will show the ending balance for each fund. Between those two dates, the report will show the income, expenses, and any transfers that occurred. The income and expenses will either increase or decrease the Net Assets overall and for each fund. The overall amount labeled ‘Net Increase(Decrease)’ in the example below, is what the net assets increased or decreased.

Sin # 6 — Using the wrong accounting system for the church

When evaluating a church’s accounting system the leaders must ensure it follows proper guidelines. The majority of software today, can’t do church accounting as it requires a fund-based methodology as the software’s foundation. Quickbooks is one such package that can’t do fund accounting. They use what we call “creative workarounds” to complete the task(s). These workarounds can get the churches into trouble. We discuss what makes a software fund based extensively in this church accounting blog.

Churches – like all organizations – must follow tax laws. Churches hold themselves to higher standards than the bare minimum tax laws. In fact, the tax laws for churches emphasize accountability, not profitability. Churches must follow the FASB Topic 958, primarily. This is the minimum standard, most nonprofits strive to do better in their reporting. They want to be above reproach and transparent with their donors and the public.

Hint: Quickbooks and other sub-standard software do not follow the FASB 958 guidelines.

It isn’t always the software that is the problem. Underinvesting in technology by the organization can lead to many issues. The typical scenario is the church bought an accounting package ten years ago. But never updated it or reviewed it to ensure it’s still in compliance. In other words, they have not invested in a software solution recently, and their old software is not up to par.

Sin # 7 — Allowing the wrong people to make software decisions

When making an organizational decision, it’s best to use the strengths of the entire team. Most ‘for profit’ businesses understand this important concept. They strike a balance between CEO-made decisions versus a team-led decisions. Churches tend to struggle with making proper decisions for their accounting system. Why? Church boards typically don’t play to a person’s strengths. For example, allowing one person to make an organizational change like replacing the accounting system – is a terrible idea. There’s a time and place to replace the software, but only after an adequate review of the current system and the new replacement. The review committee should have one person in charge that has intimate accounting knowledge. Better yet, one that understands church accounting.

For example, a new seasoned pastor starts at a church. This church has used proper fund accounting software for over a decade. However, the pastor used Quickbooks for 20 years in his previous positions. He tells the church we are going to start using Quickbooks. He may or may not have reviewed the current software. A snap decision almost always ends poorly. A pastor without the knowledge of the ramifications moves the church to Quickbooks for convenience. This example shows when a person in authority doesn’t have the knowledge. A person in a position, like a pastor with broad decision-making capability, doesn’t always translate to knowledge.

Why do people in leadership positions make poor decisions?

There are multiple reasons this happens. One is, that the person doesn’t want to learn anything new. Or they haven’t kept up with the times and don’t know there are better solutions that follow the law. However, that isn’t an excuse when the church ends up losing its tax exemption status. It all comes down to using accounting software that failed them.

Unfortunately, this is the one area where having good software can’t help. Leaders make a decision, many times, to go to a software that doesn’t do the job because they don’t understand the ramification. Software that can’t give the right reports for an audit is basically worthless. It doesn’t matter if you spent a few hundred or thousands of dollars. While the right software can save you a lot of pains and aches, it can’t keep people from making poor decisions.

Summary of The 7 Sins

There are many ways accounting software for churches can save the organization a lot of headaches. It can help the organization to keep its tax exemption status. Church accounting software can prepare financial statements with ease. But the church’s leaders have to understand and interpret them. Making ill-informed decisions because leaders don’t understand the financial statements, can be perilous. Whatever the case is, churches must still obey the rules and laws set forth in the FASB guidelines and by the IRS. To risk the tax-exempt status, because the church used the wrong accounting software, is terribly unfortunate.

Other Points to Ponder for Accounting Software for Churches

Proper software alone can’t keep the church out of trouble with an audit, but it can help. Let’s shift focus to how recording correctly helps the organizations stay on the right side of the law. Having proper accounting software can ensure subtle processes don’t turn into a pitfall. In the following section, accounting software plays more of a supporting role. It helps to give data – like unrelated business income and payroll taxes. The church is still responsible to know what to do with the information and how it is filed and reported.

Common Pitfalls for Accounting Software for Churches

There are many pitfalls a church can entangle itself in such as:

- Recordkeeping.

- UBIT (Unrelated Business Income Tax) and the filing of Form 990-T for anything over $1,000.00.

- Employee vs Independent Contractor.

- Staying current on payroll filing and IRS payments like the 941’s.

General Internal Record-Keeping for Churches

Accounting software for churches can provide records of money spent and for what. An all-in-one package can show how many donors there are, what their average monthly donation is, and more. There are items that are recorded outside of accounting software that we should discuss. Here’s a shortlist to start from but every organization will be a little different.

- W4’s,

- submitted resume or application,

- state income forms,

- job description,

- employee handbook received the signature form,

- vacation accumulation form,

- minister status with the congregation,

- copy of the ordination,

- licensing or commissioning documents, and

- new employee checklist.

Why is record keeping so important?

Why is record keeping so important? Because if the church gets audited, the IRS likes everything spelled out. Let’s use an example with a pastor. The church should have documentation on how they classified the pastor’s employment status. Why do they believe he is an independent contractor? The church needs to have this documentation on how they arrived at that decision.

Employee records are probably the hardest and most complex to keep up to date. Understanding how to keep employee records can help with organizing various other records. Take extreme care when handling employee records. The majority of the time they have personal protected information referred to as PPI.

Churches and UBIT Triggering Audits

What is UBIT (Unrelated Business Income Tax)? UBIT is any income that is outside the normal everyday operation of the organization. The IRS requires Form 990-T filed for any UBIT totaling over $1,000.00, combined from all sources.

Not reporting UBIT to the IRS is a quick way to get audited

Not reporting UBIT is a quick way to start an IRS audit. When initiated, an IRS audit can look at everything and anything. Some other UBIT areas are church coffee shops, parking lot fees, and church stores. Here’s a three-point list to test each income-producing activity to see if it’s taxable.

- The activity constitutes a trade or business,

- The trade or business is regularly carried on, and

- The trade or business is not substantially related to the organization’s tax-exempt purpose. (The fact that the organization uses the income to further its charitable or religious purposes does not make the activity substantially related to its exempt purposes.)

Good accounting software can’t make the decision on the three items above. But it can provide totals for each revenue account that is from an unrelated business. Good software can total donations separately from the unrelated business income. Then the church can see if collectively the income(s) are over the $1,000.00 threshold. There are many guidelines on what income is taxed versus which ones are not, as explained in this fact sheet.

Employees vs Independent Contractors

Accounting software for churches doesn’t decide if an individual is an employee or an independent contractor. The decision requires knowing the individual’s performed duties. Once the decision is made, the accounting software comes into play. Paying the employees through the payroll module further solidifies the employee/employer relationship. For independent contractors, always pay them like you would pay the monthly utility bills.

Note: The IRS believes all individuals are employees until the organization can prove otherwise.

Ministers’ employment classifications are tricky

Ministers are a little more tricky. When in doubt, pastors are employees. What if the church misclassified them as independent contractors and not employees? The church is on the hook to pay back all Social Security and FICA for at least three years. As of 2020, it is 15.3% of gross wages plus civil penalties and interest. They cannot take it out of the pastor’s current salary after the fact, as it was not the pastor’s mistake. A painful lesson for the church. The church should seek tax advice on the independent contractor status of ministers.

Here are some guidelines.

- A pastor performs infrequent ceremonies or sermons in multiple settings, then they might be an independent contractor. If he is serving as your congregational pastor – he’s an employee, period.

- If they are doing the majority of their work in the church, they are an employee.

- Does the pastor put their own assets at risk like their own money, which could give them a greater opportunity for gain in the future? If not, they are an employee.

- Does the church have the right to discharge the pastor? If so, they are an employee.

- Length of time for engagement. Independent contractors are short term engagements.

Accounting Software for Churches Help File IRS Forms

Filing the appropriate forms to the IRS is a task that a good church accounting system can help in a big way. It can give you the numbers for your payroll to file to the IRS and state taxing authorities. It can show you how much is in your liabilities for various government entities.

Missing a deadline for a 941 (or any other form) is another way to invite the IRS to your doorstep for an audit. The same goes for any other mandatory state and federal forms. Any tax payment missed or forms not filed, will end in a strong rebuke from the IRS or state taxing authorities. The best thing to do here is never to be late and ensure your payroll accounting system is correctly set up for each employee.

Accounting Software for Churches Summary

Church accounting software is a necessary function in the church. It is one of the few areas that can make a church’s mission a nightmare via an IRS audit. Avoiding the seven sins will keep the organization on the right side of laws and policies. Reviewing monthly transaction activity will help deter fraud. Having strong internal controls and processes helps prevent theft from the most determined individual. Keeping in mind the average loss per incident is about $120,000.00 and growing every year. Additionally, 12% of not-for-profit organizations fall victim to fraud every year. So if you are serious about church accounting software and doing things right, then the only answer is IconCMO as your accounting software.

Great insights on the critical pitfalls in church accounting! The comparison between theological sins and financial missteps is clever and eye-opening.

This is an excellent breakdown of accounting tools for churches—clarity and compliance are so important. Alongside financial transparency, it’s equally vital to run background checks before hiring any staff or volunteers. Peace of mind is priceless!