This post was last updated on May 26th, 2022 at 08:29 am.

Financial software comes in many shapes and sizes for various industries. Each industry requires unique financial transactions to be carried out by its software. Financial software packages that are rooted in the for-profit world have one major devastating flaw. They fail miserably when used in churches or governmental accounting.

Then, why are these packages sold to churches? Good question. We scratch our heads on this as well. We are not sure of the answer, except to say the software company is trying to widen its client base to the detriment of the church. Most of these software companies think a church’s accounting system is the same as a for-profit system. This couldn’t be further from the truth and we will go into some of the reasons why.

Let’s review a few reasons why generic financial software companies aren’t capable of handling church accounting.

Reason #1 Assuming For-profit and Nonprofit Accounting is the Same

Many financial software companies make this mistake and it cost their clients dearly. These financial software companies assume what works in the for-profit area will work in the nonprofit area. Wrong!

The software company is rarely held accountable when churches use the wrong software for their organization. The church is on the hook. It’s not the software’s fault that the church chose the wrong software to manage their accounting books.

What is the difference between for-profit and nonprofit accounting? The difference comes down to the underlying structure of the software. The easiest way to explain the underlying architecture is that the software needs the ability to split any account into various funds. These accounts include checking, liability, revenue, and expenses accounts. In other words, we should see separate balances corresponding to each fund within the same checkbook (or other accounts).

Note: All churches must conform to certain policies and regulations. These regulations are governed by the church’s bylaws, IRS, Financial Accounting Standards Board (FASB), GAAP, and other federal and state laws.

So why do financial software companies ignore the accounting principles that churches are required to follow? Well, these companies —

- simply don’t know the difference

- have never researched it

- don’t care about the differences because they see an opportunity to make a bigger profit, or

- they don’t want to invest the money to make the changes

Seeing the vast number of financial packages being marketed to churches that don’t obey fund accounting is astonishing. Here is a list of some of the companies that ignore the rules, WaveApps, ZipBooks, AccountEdge, Freshbooks, and so on. Always ensure the financial software follows fund accounting principles.

Reason #2 Not Built From the Ground Up for Church Use

When software companies release an accounting package, they typically market to all businesses in need of accounting. Why? Because they are often unaware of the significant differences between for-profit and nonprofit accounting. This is a big mistake.

The big mistake

When software companies assume nonprofit and for-profits work the same way, it’s an epic failure. This failure impacts everything from the database design, user interface, and programming logic of the software. Even successful companies, like QuickBooks with lots of resources, have failed to create a successful nonprofit fund accounting system.

It’s not an easy change because of the underlying software architecture that enables all accounts in the chart of accounts to be split among funds. It’s this secondary level of reporting (by fund) that eludes even the best software systems. In other words, the system must be able to report by each account in the chart of accounts and by the fund. An example is having a checkbook where the balance is split across multiple funds, without having sub-accounts within the checkbook.

Software companies failed to plan ahead

The software company didn’t plan ahead for the differences in the accounting principles (and legal regulations) between the two different types of accounting. Let’s use an analogy to explain how this might look like.

The analogy

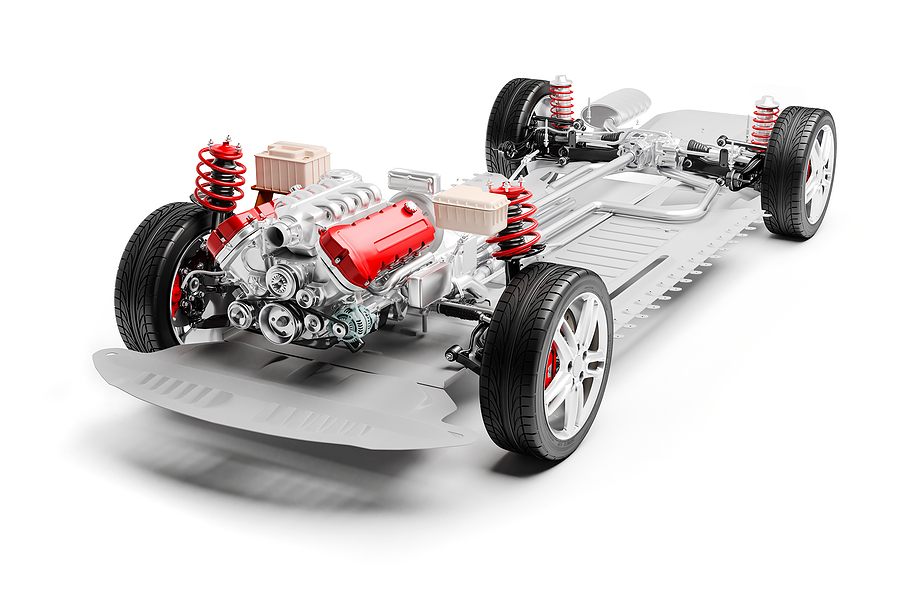

Let’s say you are a Chevy engineer. You design and build a new truck for the upcoming year that is approved by upper management. Now, the Chevy factory changes all their tooling and production lines based on the new design so they can maintain an output of 1,000 trucks/day.

A week later a nightmare unfolds…

The company’s president makes an announcement stating, Chevy purchased the Jeep company down the road. Worse yet, Chevy’s new trucks will use the more rugged Jeep engines and transmissions over the approved original engine and transmission design.

In building any automobile, the first step is what they call the ‘marriage’ — which is attaching the engine and transmission to the chassis. Changing this ‘marriage’ has devastating effects on everything that comes afterward like the engine wiring, the components that attach to the engine, fluid lines, steering components, the onboard computer, the outer body panels like fenders, and so on.

In other words, you can’t simply change the chassis piece to accommodate the engine. The new marriage of the Jeep engine to the Chevy chassis must be rebuilt from the ground up, and not just ‘retrofitted’ to work. This is true for accounting software that wasn’t built with the fund concept in mind.

Software retrofitted later is not the answer

Just like putting a Jeep engine onto a Chevy chassis quite literally takes you back to the drawing board for a full redesign of everything, financial software built with a for-profit goal in mind can’t be retrofitted to suddenly work in the nonprofit world. Retrofitted software simply doesn’t work. Many software companies have tried retrofitting a for-profit system to only give up in defeat.

One of three things typically happens when the financial software company figures out retrofitting doesn’t work.

- The company sells the software anyway, leading the churches to believe it will work for them when it doesn’t.

- They stop selling an inferior product that doesn’t fit the market.

- They build a new product from the ground up that does work for churches and other nonprofits.

We would hope the software company would either remove themselves from selling an inferior product or create a new product from the ground up that works the right way. But these two scenarios are rarely followed. The financial software company typically keeps selling their inferior product to unsuspecting clients. After all the clients won’t know in most cases until after an IRS audit and at that point, the damage is done.

Reason #3 Budgeting by Fund isn’t Available

Any organization has a budget including churches. Church budgets work quite differently. Let’s first describe how a for-profit company does its budget so we can understand the church budget differences later on.

For-profit companies budget on the revenues and expenses in their chart of accounts. These accounts will either be parent accounts or sub-accounts. Let’s look at a very small section of the expenses below.

| 7000 – Travel |

| 7025 – Utilities |

| 7026 – Electricity |

| 7027 – Garbage |

| 7028 – Gas |

| 7029 – Water |

Note: Every organization is different in how they number their accounts. Some may not use numbers at all.

So how does the budget work in the for-profit scenario? The organization assigns an annual amount to each of the line items that we see above — Travel, Electricity, Gas, Water, and Garbage. Why not budget on the Utility account? Because that is a parent account thus it summarizes everything under it.

A for-profit budget might look like something below.

For-profit budget example

| 7000 – Travel | $ 5,000.00 |

| 7025 – Utilities | Parent Account |

| 7026 – Electricity | $ 1,200.00 |

| 7027 – Garbage | $ 200.00 |

| 7028 – Gas | $ 1,500.00 |

| 7029 – Water | $ 1,100.00 |

The above table shows a for-profit budget with totals listed for each individual account. Now let’s look at how a nonprofit budget is set up. We will use the same numbers as above and keep the chart of accounts similar. What changes is the fund assignment. We will add two fund columns to the table below.

Nonprofit budget example

| Chart of Accounts | General Fund (added) | Youth Fund (added) | Total All Funds | |

| 7000 – Travel | $3,000.00 | $2,000.00 | = | $ 5,000.00 |

| 7025 – Utilities | Parent Account | |||

| 7026 – Electricity | $ 1,200.00 | $0.00 | = | $ 1,200.00 |

| 7027 – Garbage | $ 200.00 | $0.00 | = | $ 200.00 |

| 7028 – Gas | $ 1,500.00 | $0.00 | = | $ 1,500.00 |

| 7029 – Water | $ 1,100.00 | $0.00 | = | $ 1,100.00 |

As you can see from the table above, the line item, 7000 Travel, is budgeted across 2 funds. The nonprofit software allows you to divide the budget into categories. (ie. the two fund columns). This allows the church to look at the budget for just the Youth fund which shows only the travel account for $2,000.00.

Below is what it would look like for the Youth fund budget. Essentially the Youth fund column above becomes the report you see below.

| Youth Fund Budget Report | |

| 7000 – Travel | $ 2,000.00 |

| 7025 – Utilities | $ 0.00 |

What about the budget report for the General fund? It would show only the numbers for the General fund column. So for example, the $2,000.00 designated for the Youth fund’s travel expense would be removed from the report. This distinction is what for-profit systems can’t do, and then later be retrofitted to accomplish. They can’t break these expenses (or revenues, assets, and liabilities) into different categories, such as General and Youth funds.

Let’s take a look at the General fund budget report below.

| General Fund Budget Report | |

| 7000 – Travel | $ 3,000.00 |

| 7025 – Utilities | |

| 7026 – Electricity | $ 1,200.00 |

| 7027 – Garbage | $ 200.00 |

| 7028 – Gas | $ 1,500.00 |

| 7029 – Water | $ 1,100.00 |

The above table shows the General fund budget only. It basically comes down to the travel expense being shown with either $ 3,000.00 for the General fund, or $ 2,000.00 for the Youth fund. The other notable difference is the Youth fund had no values for the Utility sub-accounts, thus those sub-accounts are removed from the Youth fund reporting.

This category of budgeting by fund is what for-profit financial software lacks. It isn’t created from the ground up to track funds and workarounds all short. These packages fail in every way for the nonprofit organizations because they need to drill down into the areas of ministry, like the Youth fund. The church also needs to be able to see how the General fund is doing financially. Essentially a two-level categorization is needed for nonprofits, the accounts in the chart of accounts, and the funds.

A Final Thought

The final thought about for-profit vs nonprofit is that there are legal ramifications for the church when they don’t follow IRS and FASB standards.

Financial Software Summary

Churches use categories (ie. funds) to budget, receive donations, and pay bills. This kind of accounting is typically called fund accounting. It is closely related to governmental accounting. However, for-profit accounting and nonprofit accounting are only similar in that they both have a chart of accounts. That is where the similarities end. When proper fund accounting isn’t used in churches they jeopardize their 501 (c)(3) tax-exempt status.

I had some questions about this topic and your post has answered them. Thanks a lot for sharing this useful post on your website. I look forward to more educative posts from this website.